Bitcoin analyst PlanB has relocated the complete contents of his Bitcoin portfolio into spot Bitcoin ETF exchange-traded funds which he now self-directs.

On February 15 he published via X that his transfer was aimed at letting him manage Bitcoin like authorities handle stocks and bonds.

“I guess I am not a maxi anymore,” PlanB remarked, referring to Bitcoin maximalists who advocate for full self-custody of BTC.

According to him, ETFs represent an easy solution that removes the risks and difficulties connected to managing private wallet keys.

Security Concerns Drive Move Away from Self-Custody

PlanB chose this strategy because private key management poses safety issues.

“Not having to hassle with keys gives me peace of mind,” he stated.

The principles of Bitcoin support user ownership of assets yet self-custody demands continuous protection of private keys from thieves or hackers and accidental losses.

The blockchain security firm Cyvers documented that crypto-related hacking incidents rose dramatically in 2024 completely stripping $2.3 billion from victims through 165 documented cases beyond the totals from 2023.

Because of the security risks several investors now consider Bitcoin ETFs as safer alternatives to Bitcoin itself.

Investor Reactions: Pragmatic or Against Bitcoin’s Core Principle?

The choice made by PlanB received conflicting comments from his 2 million follower base.

A part of his followers approved of his business strategy yet several others believed ETFs go against Bitcoin’s decentralized nature which represents both self-sovereignty and decentralization.

“In my view, ETFs are a logical step in Bitcoin adoption, next to holding your own keys,” PlanB wrote in response to criticism.

He also posed a question: “Would it be different in your opinion if I had bought [Micro]Strategy instead of an ETF, or would that be equally evil?”

Some of PlanB’s followers wondered if his move to exchange Bitcoin for ETFs might cause taxable consequences. The advisor explained how Bitcoin transactions in the Netherlands tax system neither create capital gains nor require payment of tax under such circumstances. Dutch residents face unrealized capital gains taxation better known as wealth taxes through which a presumed 6% yield from total assets results in taxation at 30% amounts to 2% tax on yearly net value.

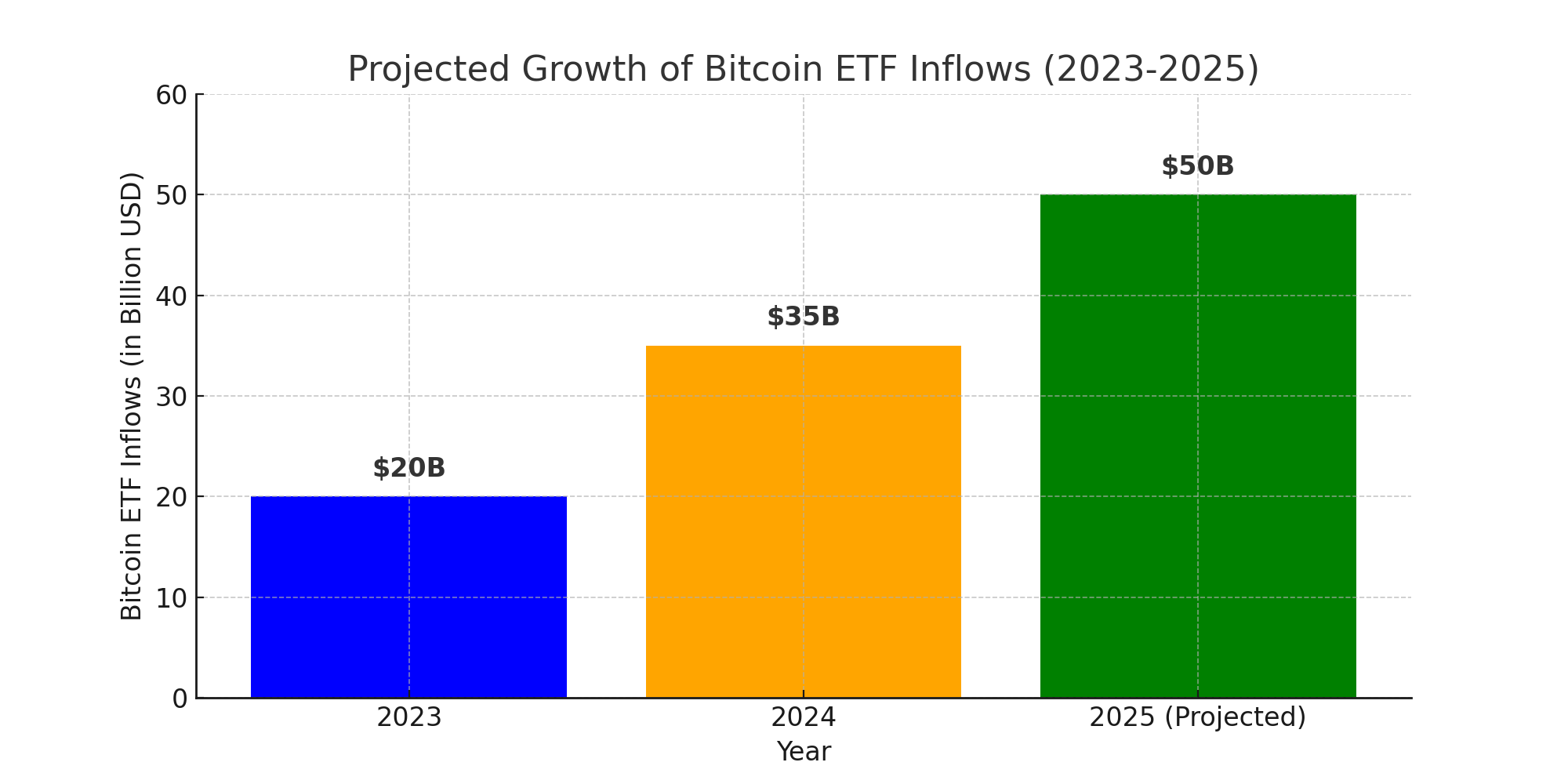

Bitcoin ETFs Expected to See $50 Billion in 2025 Inflows

The demand for spot Bitcoin ETFs remains robust throughout the market.

According to Matt Hougan from Bitwise Investment, about 50 billion dollars in inflows will come to U.S. spot Bitcoin ETFs during 2025.

“So far, so good: Spot Bitcoin ETFs pulled in $4.94 billion in January, which annualizes to ~$59 billion,” Hougan wrote on February 11.

Research from Bitwise has confirmed that ETF inflows during 2025 will rise beyond 2024 levels, according to Ryan Rasmussen.

Bitcoin continues trading at $97,500 following a stable market performance throughout the previous day. The cryptocurrency market experts predict BTC will advance to $103,900 if it succeeds in breaking above $98,700-$100,000 with sustaining trading volume. Continued upward momentum could result in a revaluation attempt at $110,000.

Conclusion

PlanB began focusing on Bitcoin ETFs because investors now want financial products that combine regulatory control with digital asset management convenience.

The success of spot ETFs will impact Bitcoin adoption rates since they offer investors new ways to participate in the cryptocurrency market. Investor interest in regulated financial products, including Bitcoin ETFs, continues to rise because of the growing acceptance of these products based on proper oversight. Keep following The Bit Journal and keep an eye on Crypto market updates.

FAQs

Why did PlanB move his Bitcoin holdings to ETFs?

PlanB transferred his Bitcoin funds to ETFs due to what security concerns and convenience benefits.

PlanB mentioned security needs combined with convenience aspects as his main motivations. Private key management becomes safer through the use of ETFs because the funds help protect against theft and accidental losses.

How do Bitcoin ETFs work?

Investors using Bitcoin ETFs can experience Bitcoin price growth while avoiding the responsibility of actual Bitcoin ownership. Bitcoin ETFs can be traded through regulated stock market platforms much like conventional financial instruments.

Is the security of Bitcoin ETFs higher than the solution of managing Bitcoin independently?

While Bitcoin ETFs minimize private key management problems they introduce risks involving their issuers as well as regulatory supervision requirements.

What impact do Bitcoin ETFs have on the crypto market?

The introduction of Bitcoin ETFs produces specific impacts throughout the crypto market.

Through Bitcoin ETFs financial institutions enter the market to purchase Bitcoin securities which boosts market liquidity and helps Bitcoin gain wider adoption.

What are the anticipated market projection forecasts for Bitcoin ETFs until 2025?

The prediction that exceeds $50 billion from upcoming ETF inflows in 2025 demonstrates Bitcoin will dominate traditional finance operations.

Glossary of Key Terms

Bitcoin analyst: A financial specialist who analyzes Bitcoin market trends to make predictions functions as a Bitcoin Analyst.

Spot Bitcoin ETF: represents a fund that keeps Bitcoin directly within the fund structure along with its ability to trade on stock exchanges.

Self–Custody: A private wallet under self-custody enables the owner to control their Bitcoin through their exclusive access to private keys.

Wealth Tax: Under this tax legislation, assets’ total worth becomes subject to taxation, but earnings from sources other than capital gains and income remain untaxed.

Bitcoin Maximalist: Someone practicing Bitcoin Maximalism holds only Bitcoin yet rejects using ETFs or similar intermediaries to manage it.

References

- Cyvers Security Report (2024). “Crypto-Related Hacks Surge 40% in 2024.” Retrieved from [cyvers.com]

- Bitwise Investment Analysis (2025). “Bitcoin ETFs Expected to See $50B in 2025 Inflows.” Retrieved from [bitwiseinvestments.com]

- PlanB’s Official X (Twitter) Account. “Bitcoin ETF Announcement.” Retrieved from [twitter.com/100trillionUSD]

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!