When Robinhood Markets unveiled 24/5 trading of U.S. tokenized stocks and ETFs for European Union customers, the brokerage positioned the move as a milestone for “friction-free” global investing. The company also dangled limited-time giveaways of tokens linked to high-profile private firms OpenAI and SpaceX, all issued on a custom Layer-2 chain based on Arbitrum.

A Launch Followed Immediately by a Recoil

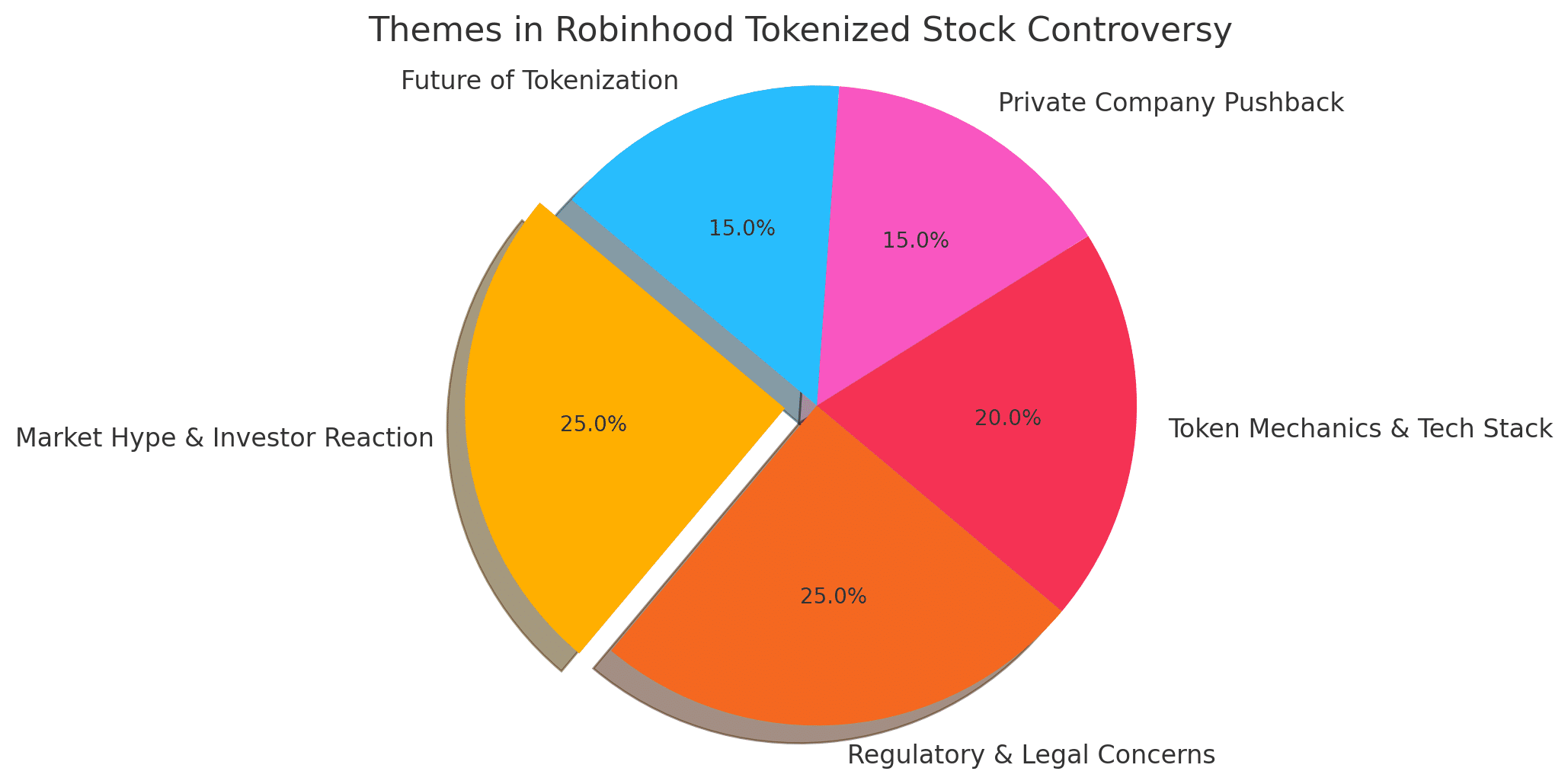

Hours after the promotion went live, OpenAI took to X to declare that the “OpenAI tokens” do not represent authorized equity, stressing that any transfer of its shares requires board approval, a step Robinhood had not taken.

Elon Musk echoed the criticism, calling the tokens “fake” in a separate post. The sharp denials underscored a central tension of on-chain equity products: they promise exposure to hard-to-reach assets but can blur the line between synthetic tracking instruments and true share ownership.

How Robinhood Tokenized Stock Works

Robinhood issues each token through a special-purpose vehicle (SPV) that holds the underlying shares; token holders get price exposure and, in theory, pro-rata dividends, yet no voting rights. The instruments settle on an Arbitrum-derived chain, allowing composability with the rest of decentralized finance while preserving Robinhood’s control over custody. Critics, some of whom are veterans of 2021’s GameStop saga, argue that the structure places transparency obligations on investors who may not read the fine print.

Investor Euphoria Outpaces the Skepticism

Despite the backlash, Robinhood shares jumped more than 6 % to an all-time high after SEC Chair Paul Atkins hailed tokenization as “innovation” during a press briefing. Coinbase, MicroStrategy, and other crypto-exposed equities rallied in sympathy, suggesting that public-market investors see tokenization as a long-term growth driver.

With Robinhood already up 44 % month-to-date, the market reaction indicates that headlines, even contentious ones, can translate into significant capital flows for early movers.

Bigger Than One Broker: A Race to Tokenize Everything

Robinhood tokenized stock is hardly alone. Coinbase, Kraken, Republic, and fintech firm Dinari are all building or piloting tokenized-equity rails, while specialty platforms such as Securitize and Ondo Finance are experimenting with real-world-asset (RWA) tokens ranging from U.S. Treasuries to real estate.

Axios reports that the total addressable market for privately held “unicorn” stocks on-chain could reach $600 billion within five years if regulatory clarity improves.

The Legal Gray Zone

For publicly traded names like Apple or Nvidia, tokenization is structurally simpler: the SPV can purchase shares on an exchange and mint a corresponding number of tokens.

With private companies, the provenance is murkier. CoinDesk notes that founders often embed strict transfer restrictions in shareholder agreements; tokens circumventing those clauses may never convert into actual shares, leaving holders with only a synthetic claim if the issuer of the SPV fails.

Regulators have not yet drawn bright lines. The SEC has hinted that a token mirroring an equity security is itself a security, but questions remain about secondary-market exemptions, cross-border settlement, and whether retail investors understand the limitations on governance rights.

European watchdogs, meanwhile, view SPV-backed tokens as transferable securities under the EU’s Markets in Crypto-Assets (MiCA) framework. This designation triggers prospectus and disclosure rules unfamiliar to many U.S. fintechs.

What Comes Next

Broader Asset Lists: Robinhood says more than 200 U.S. tokenized stock and ETFs will be tokenized by year-end, with fractional units designed to lure traders priced out of giants like Berkshire Hathaway.

Private-Equity Tokens Under Scrutiny: OpenAI’s pushback may force brokers to secure affirmative consent from boards before listing “unicorn” tokens, or risk cease-and-desist orders.

Protocol Interoperability: The choice of an Arbitrum-based chain hints at future bridges to Ethereum mainnet and other L2s, unlocking loan, staking, and options markets around tokenized equities, if compliance hurdles can be cleared.

Bottom Line

Robinhood tokenized stock high-profile debut shows that tokenized stocks can excite retail traders and public-market investors alike, yet meaningful questions remain about shareholder rights, regulatory oversight, and the authenticity of exposure to private-company equity.

Industry momentum suggests tokenization will not fade, but OpenAI’s swift condemnation proves reputation-driven enterprises may insist on explicit control over how their shares, synthetic or otherwise, are marketed. In the short term, the clash offers a textbook stress-test for an emerging asset class; in the long term, it signals that the path to “all assets on-chain” will be paved with as much litigation and policy debate as technological innovation.

FAQs

Q1. What is a tokenized stock?

A tokenized stock is a digital asset representing exposure to a real-world equity, typically backed by an underlying share held by a custodian.

Q2. Did Robinhood get OpenAI’s approval for tokenized shares?

No, OpenAI publicly stated that it did not authorize Robinhood’s token and considers it unrelated to real equity in the company.

Q3. Do tokenized stocks grant voting rights?

No, Robinhood’s tokenized stocks do not grant voting rights; they only provide indirect price exposure and possible dividend distribution.

Glossary of Key Terms

Tokenized Stock: A blockchain-based digital representation of an equity share, offering price exposure without direct ownership.

SPV (Special Purpose Vehicle): A legal entity used to hold actual stocks on behalf of token holders, separating them from the issuer.

Arbitrum: A Layer-2 scaling solution on Ethereum used to reduce transaction costs and speed up token settlements.

Synthetic Asset: A derivative instrument that mimics the value of another asset without requiring direct ownership.

KYC/AML: Know Your Customer and Anti-Money Laundering, regulatory protocols ensuring identity verification and fraud prevention.

Voting Rights: Legal rights granted to shareholders to influence corporate decisions—typically not included in tokenized versions.

MiCA (Markets in Crypto-Assets): A European Union regulatory framework governing crypto-assets and related service providers.