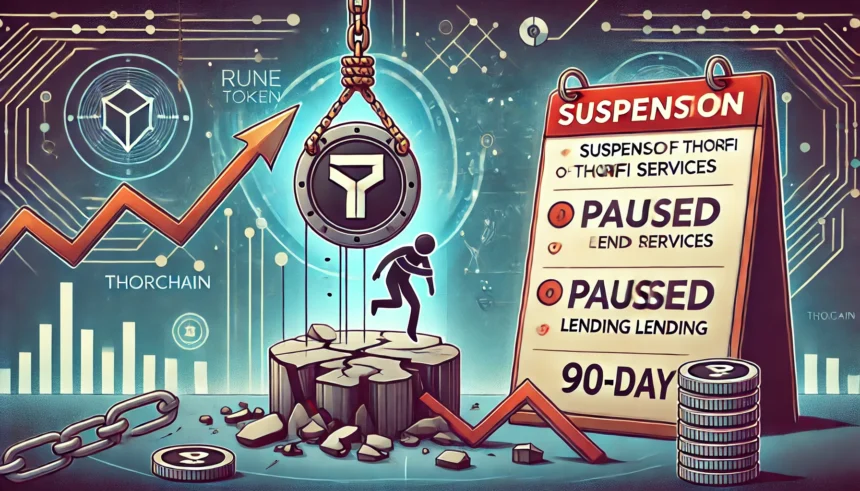

Amid financial uncertainty, THORChain has halted its THORFi services and initiated a 90-day restructuring plan. Following this decision, the price of RUNE experienced a dramatic drop, raising concerns about the protocol’s future.

THORFi Halted: A Crisis for THORChain

Cross-chain swap protocol THORChain (RUNE) has suspended its THORFi operations due to financial challenges and bankruptcy rumors. The pause is part of a 90-day restructuring initiative aimed at addressing issues with its “Savings and Lending” programs. This move seeks to prevent a mass exodus scenario that could destabilize the platform further. Haseeb Qureshi, managing partner at Dragonfly, described the situation as akin to a “bankruptcy freeze,” reflecting a severe liquidity crunch.

Trading functions, including swaps, remain active, but lending services under THORFi have been suspended. The restructuring process is being implemented through validator nodes, with the goal of stabilizing the platform. However, in the wake of this announcement, RUNE’s price plummeted by 30% before staging a minor recovery. Despite this, the token remains deeply in the red.

What’s Behind the RUNE Decline?

Concerns about THORFi’s Bitcoin reserves have fueled doubts about THORChain’s ability to meet creditor obligations. The root of the issue lies in significant Bitcoin borrowing during a period of low prices, coupled with insufficient liquidation mechanisms within the protocol. If large-scale redemptions from lending pools occur, it may necessitate the minting of additional RUNE, further devaluing the token.

This precarious situation has drawn parallels to the 2022 Terra/Luna collapse, with fears that a similar scenario could unfold. A lack of liquidity within the protocol could significantly impact RUNE’s value, eroding THORChain’s purchasing power and investor confidence.

Bankruptcy Speculation Gains Momentum

ThorChain’s synthetic assets, known as synths—derivative tokens tied to the value of cryptocurrencies like Bitcoin and Ethereum—have also come under scrutiny. These assets rely on liquidity pools backed by RUNE and the original assets. However, the reliance on RUNE for collateral exposes the protocol to market volatility, heightening systemic risk.

Community members have raised concerns about the platform’s solvency. One user, TCB, speculated, “In the event of significant redemptions or deleveraging of savings and synths, THORChain may be unable to meet its Bitcoin and Ethereum liabilities.”

Efforts to Stabilize the Network

Despite the challenges, validators and the community are considering proposals for an economic redesign to stabilize the network. THORChain founder John-Paul Thorbjornsen remains optimistic, stating, “The protocol is generating substantial revenue and can service its debt after restructuring.” However, THORChain’s history of multiple protocol hacks adds another layer of concern for stakeholders.

Conclusion

THORChain’s decision to suspend THORFi services underscores the risks inherent in crypto lending protocols. With RUNE’s value under pressure and the protocol’s future uncertain, investors will be watching closely for signs of stability or further distress. The next 90 days will be critical for THORChain to rebuild trust and navigate its financial challenges.

Stay informed with the latest updates on The Bit Journal, your go-to source for cryptocurrency news and analysis.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!