What seemed like a golden opportunity quickly turned into a regulatory mirage. The Open Network’s native cryptocurrency, Toncoin (TON), surged this weekend after an announcement suggested that staking $100,000 worth of TON could grant holders a UAE Golden Visa. But within days, the offer was publicly refuted by Emirati authorities, triggering a sharp reversal in TON coin drops and raising eyebrows across the crypto world.

How the Buzz Began

The rally began when TON Foundation rolled out a staking program pitched as a fast-track path to the UAE’s coveted 10-year Golden Visa. According to promotional material, participants were required to stake $100,000 in TON for three years and pay a $35,000 fee to access long-term residency in the Emirates for themselves and family members.

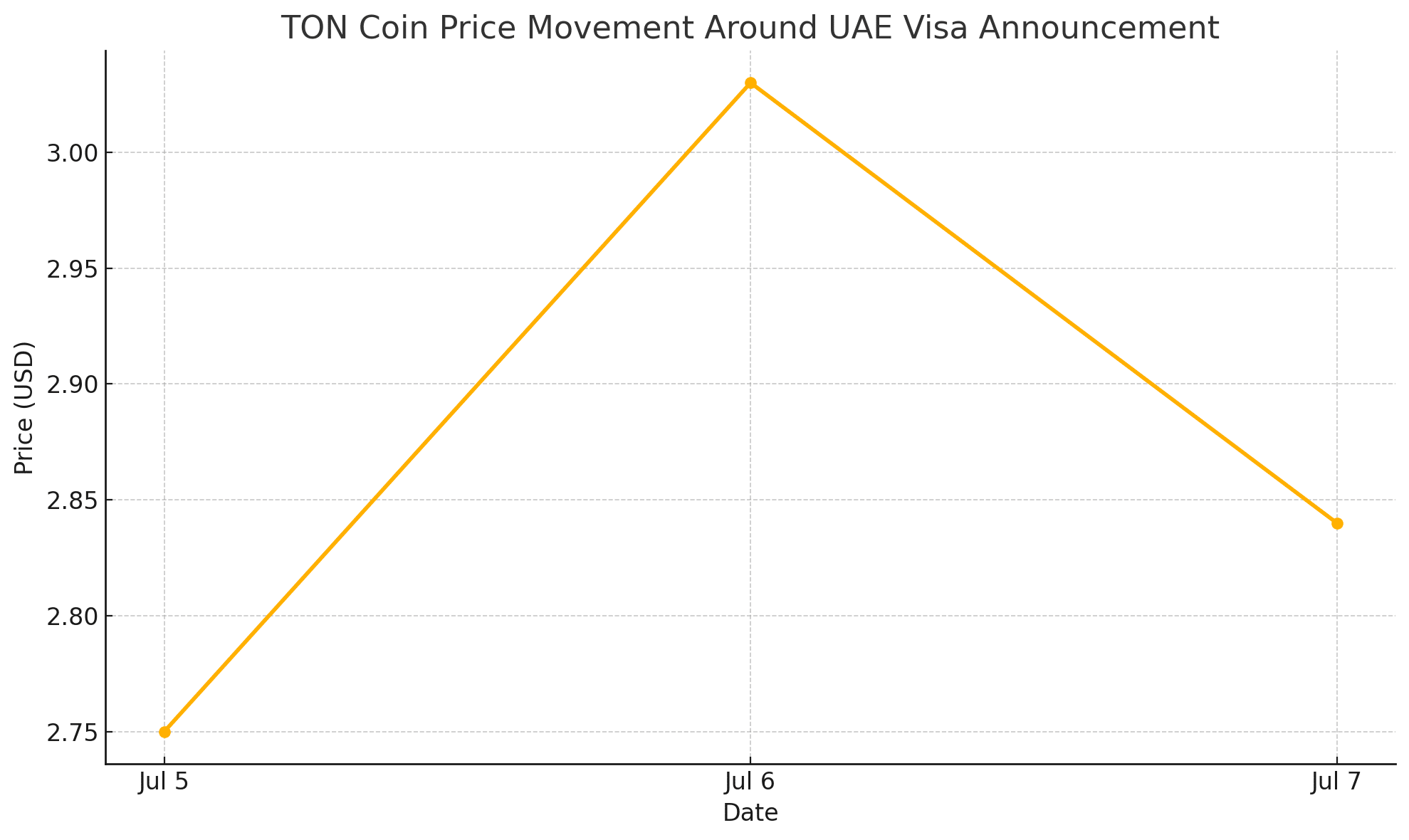

The news sent Toncoin soaring over 10%, climbing from around $2.75 to over $3.03 in a matter of hours. For a network that’s seen significant growth lately, particularly following its Telegram-based ecosystem integrations, the Golden Visa narrative added a fresh layer of legitimacy and long-term appeal. But it didn’t last as TON coin drops again.

TON Coin Drops: Regulatory Rejection and Market Fallout

Within 48 hours, the excitement unraveled. A joint statement from several UAE government bodies, including the Federal Authority for Identity, Citizenship, Customs & Port Security (ICP), the Securities and Commodities Authority (SCA), and Dubai’s Virtual Assets Regulatory Authority (VARA), disputed the offer outright.

They stated unequivocally that staking Toncoin does not qualify anyone for the Golden Visa and added that TON is not a licensed or recognized financial product within the Emirates. The fallout was immediate: Toncoin’s price dropped nearly 6% following the clarification, settling near $2.84.

Toncoin Price Movement: Before and After the Clarification

| Date | Price (USD) | Price Action |

|---|---|---|

| July 5 | $2.75 | Pre-announcement baseline |

| July 6 | $3.03 | +10.2% post-announcement rally |

| July 7 | $2.84 | −6.3% drop after UAE rejection |

The token’s rapid descent echoed a market correction driven not by fundamentals but by retracted hype, a common theme in the volatile world of crypto.

Expert Views on the Controversy

Industry experts were quick to weigh in. Binance founder Changpeng “CZ” Zhao called the offer

“too good to be true,” noting that no official verification had come from UAE regulators. “If something this significant were legitimate, we’d see clearer government signals,”

he said in a recent post.

Joe HedgeHog, a partner at Sigil Fund, speculated that the program may have been initiated by third-party agents rather than through official government channels.

“It looks like a private marketing scheme rather than a state-backed residency framework,”

he warned.

Impact on TON’s Credibility

The PR misstep could cost TON more than just a few percentage points. The timing of the debacle was particularly sensitive, given that The Open Network has been pushing for broader adoption through Telegram-integrated wallets and a growing number of Telegram-based applications.

This blunder risks denting investor confidence and raising questions about how tightly The Open Network controls its messaging, especially when legal frameworks are involved.

What Traders Should Know

For crypto traders, the TON coin drops and incident is a textbook example of why regulatory clarity matters. While staking incentives and ecosystem upgrades often drive price momentum, unverified claims, especially those involving legal or immigration perks, should be viewed with caution.

At a time when global regulators are tightening their grip on the digital asset sector, offering residency in exchange for tokens was bound to attract scrutiny. And when promises fail to hold up, the price usually does the same.

Conclusion

Toncoin’s brief surge and subsequent retreat following the UAE Golden Visa controversy is a reminder that in crypto, hype can lift a token, but only truth sustains it. Traders and investors are advised to rely on verified announcements, especially when price-sensitive developments involve national governments.

The episode leaves TON coin drops with some reputational cleanup ahead. Still, if it can return focus to its real strengths, Telegram integration, active development, and growing community, then the network may yet reclaim the momentum that speculative drama temporarily stole.

Frequently Asked Questions

What was the TON Golden Visa offer?

It was a staking program that claimed holders could earn a 10-year UAE residency by locking $100,000 worth of Toncoin for three years and paying a processing fee.

Did the UAE government approve the TON visa plan?

No. UAE regulators officially denied any connection between Toncoin staking and eligibility for the Golden Visa program.

Why did TON coin drops?

After the offer was debunked by Emirati authorities, the token lost nearly 6 percent as traders pulled back from hype-driven positions.

Was the offer a scam?

The program appeared to be a third-party initiative and was not recognized or endorsed by any UAE government entity.

What does this mean for TON’s future?

The incident dented short-term sentiment, but TON still maintains strong fundamentals through its integration with Telegram and growing ecosystem.

Glossary of Key Terms

Toncoin

The native cryptocurrency of The Open Network, originally developed by Telegram

Staking

Locking cryptocurrency in a protocol to support operations such as validating transactions or earning rewards

Golden Visa

A long-term residency program offered by the UAE for individuals meeting specific investment or professional criteria

UAE Federal Authority for Identity and Citizenship

One of the official bodies that oversees visa and residency programs in the United Arab Emirates

Virtual Assets Regulatory Authority

Dubai’s regulatory agency responsible for overseeing activities related to cryptocurrencies and digital assets

Telegram Wallet

A crypto wallet service integrated with the Telegram messaging app, used for sending and storing Toncoin and other assets