Toncoin (TON) entered the spotlight this week, fuelled by renewed investor interest following the confirmed integration of Grok AI into the Telegram platform. The partnership, which received public acknowledgment from Elon Musk, has positioned the TON ecosystem for potential growth. This development is not just a technical enhancement; it opens a pathway for TON-based applications to leverage AI tools for improved functionality and engagement.

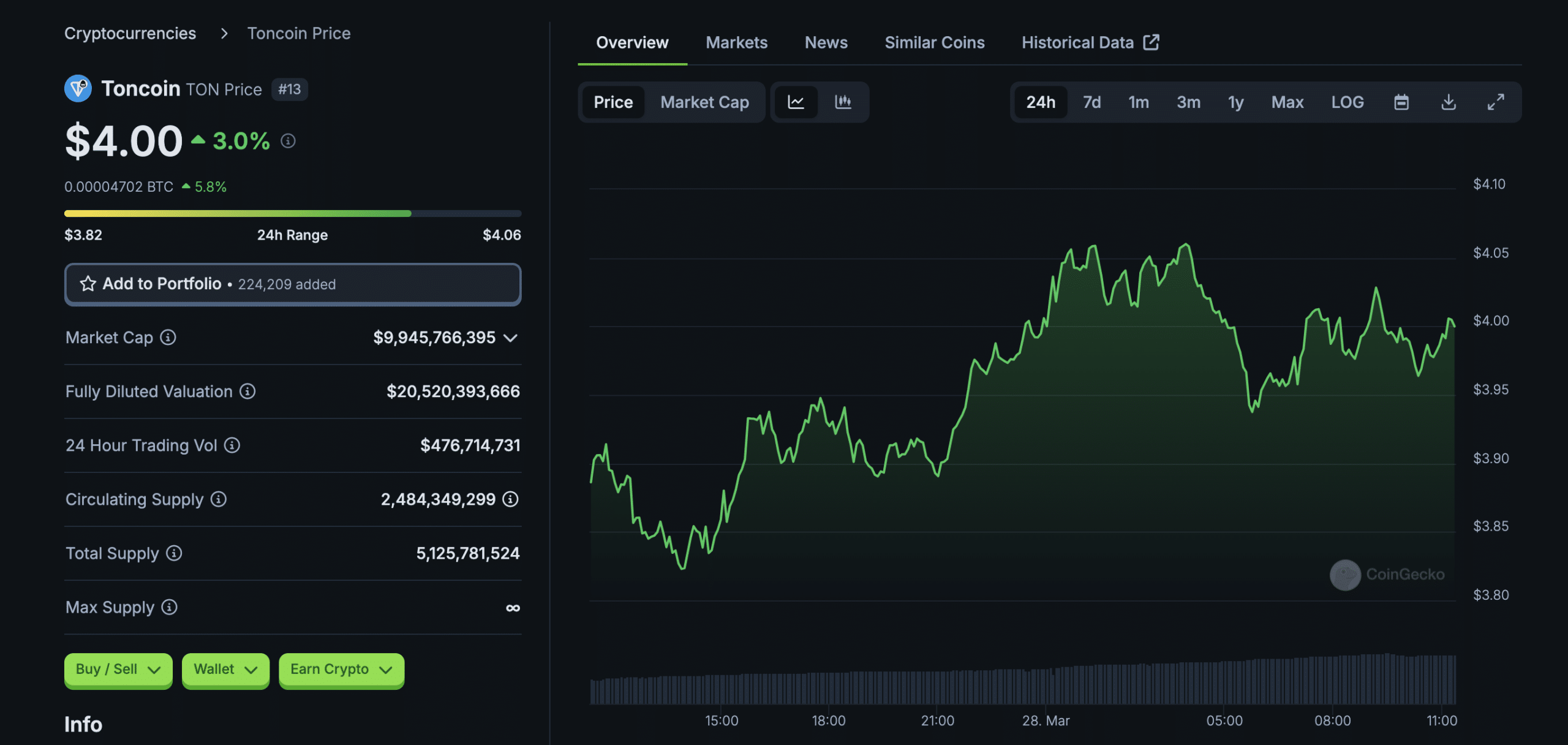

With Toncoin trading around $3.9 – $4, the ecosystem has shown notable signs of traction. Its total value locked (TVL) currently stands at $163 million, reflecting growing confidence among users and developers. Moreover, a 14.66% increase in Open Interest, now totaling $176.23 million, suggests heightened speculative activity in the derivatives market. These metrics together hint at an increasingly active Toncoin ecosystem that could be on the cusp of a major move.

Grok AI Integration with Telegram: A Turning Point for TON’s Ecosystem

Elon Musk’s involvement in integrating Grok AI into Telegram has served as a confidence booster across the TON community. Grok, a conversational AI project backed by xAI, is expected to add real-time utility for Telegram users by enhancing in-app interactions. Since TON is the underlying blockchain for Telegram’s ecosystem, this development directly benefits Toncoin’s demand profile.

The integration presents a strategic edge: it introduces smart AI tools to TON-powered decentralized applications, making them more interactive and accessible. Enhanced user experiences, driven by Grok’s AI capabilities, could entice developers to build more Telegram-native dApps, ultimately fuelling long-term demand for Toncoin. Analysts speculate that this evolution could serve as a catalyst for an upward price trajectory, particularly if adoption follows at scale.

Technical Momentum Builds: Can Toncoin Break Past $4?

Toncoin’s recent breakout from a falling wedge pattern signals potential bullish momentum in the short term. The price currently sits just below a psychological and technical resistance level at $4. Historically, this zone has served as a barrier for sustained rallies, but the recent market dynamics suggest TON may be gearing up for a shift in direction.

Market analysts note that a confirmed breakout above $4 could open the door for TON to test higher targets, possibly extending to $5.55 in subsequent weeks. However, this outcome depends heavily on the asset’s ability to attract continued inflows and fend off market volatility. Any failure to maintain its current trajectory might trigger a correction back toward the $3.60–$3.70 support range.

Derivatives Market Shows Mixed Sentiment Amid Price Gains

Despite bullish sentiment across spot markets, derivatives data paints a more cautious picture. According to Coinglass, Toncoin’s Open Interest hit $176.23 million, a sign of increased speculation. However, liquidation data tells a more nuanced story: long positions are being liquidated at a higher rate than shorts.

This imbalance suggests that while traders are hopeful, volatility remains a threat. Long liquidation spikes imply that upward momentum could be unstable, particularly if whales or institutions use this rally as an opportunity to exit. Traders are advised to watch for further liquidation imbalances and monitor funding rates, which could hint at the sustainability of the bullish setup.

On-Chain Activity Reflects Gradual Adoption Growth

While not explosive, Toncoin’s on-chain activity has been inching upward. At the time of analysis, the network reported 219 daily active addresses, a mild but notable improvement. Transaction volumes also registered a bump, with 156 transactions processed within the last 24 hours.

Although these numbers may appear modest compared to larger blockchain networks, they represent growing interest in TON’s capabilities. The AI-driven integration may be encouraging developers and users alike to explore Toncoin more deeply, particularly as Telegram’s 800+ million user base becomes more engaged through Grok’s presence.

According to data from Santiment, gradual increases in wallet activity and smart contract interactions could signal the start of an adoption curve. If this trend holds, on-chain fundamentals could provide the needed support to stabilize Toncoin’s price and set the stage for long-term ecosystem expansion.

Expert Insight: What Analysts Are Saying

Speaking with CryptoMarketReview, blockchain analyst Lydia Tran commented on TON’s positioning:

“The integration of Grok AI into Telegram creates a use-case narrative that Toncoin hasn’t had in a long time. If user engagement with Telegram-native applications increases, the demand for TON could see a structural uptick.”

Meanwhile, derivatives strategist Marco Velasquez of DeltaTrade Analytics emphasized caution:

“Despite the short-term upside, we’re seeing long liquidations climb. That suggests traders are overleveraging in hopes of breakout momentum. A sustained move above $4 would need volume confirmation and reduced volatility.”

These insights reflect the prevailing uncertainty as TON teeters near a critical price level.

Conclusion

Toncoin is navigating a high-potential phase, backed by technical breakouts, AI integration, and rising market participation. The Grok AI partnership with Telegram offers more than just hype—it introduces real infrastructure that could redefine how users interact with TON applications. Open Interest and TVL growth support the bullish case, yet liquidation patterns and cautious trading behavior hint at underlying volatility.

Whether TON can decisively break past the $4 resistance remains to be seen. If it does, the path toward $5.55 becomes far more plausible. Until then, traders should tread carefully, watching on-chain data and broader sentiment as the market digests the implications of Grok’s entry into the TON ecosystem.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What is Toncoin’s current price outlook?

Toncoin is hovering near $3.90–$4.00, and a breakout above the $4 mark could initiate a new rally toward $5.55, depending on volume and sentiment.

How does Grok AI integration benefit Toncoin?

Grok AI adds advanced user engagement features to Telegram, indirectly boosting TON’s utility and developer appeal through more interactive decentralized applications.

Why are long liquidations concerning?

Higher long liquidations suggest traders are aggressively betting on the upside, which can backfire during volatility, triggering sharp pullbacks if resistance levels hold.

What should traders watch in the near term?

Key resistance at $4, Open Interest fluctuations, and liquidation patterns are crucial. Also, monitor on-chain metrics and Grok AI adoption rates within Telegram.

Glossary

Toncoin (TON): Native cryptocurrency of the TON blockchain, tied to Telegram-based applications.

Open Interest: Total number of outstanding derivative contracts (futures or options), often used to gauge speculative interest.

Grok AI: An AI chatbot developed by xAI (Elon Musk’s firm), now being integrated into Telegram for enhanced user interaction.

Total Value Locked (TVL): The total amount of assets deposited in DeFi protocols on a given blockchain.

Liquidation: A process where leveraged positions are automatically closed when margin requirements are no longer met.