Toncoin (TON) has faced a continued downward trend, slipping below the $6 mark in recent Toncoin price projection and evaluations. This decline reflects broader market challenges as the cryptocurrency grapples with significant selling pressure. As traders and investors look for signs of recovery, the technical analysis points to critical levels of support and resistance that could determine the next movement for Toncoin.

Currently, Bitcoin (BTC) is trading around $60,000, but this does not provide the positive momentum needed for altcoins like Toncoin to thrive. The overall crypto market sentiment remains cautious, with prices potentially rising temporarily as traders look for short-term liquidation points. However, experts anticipate that this minor uptick will be short-lived and that the broader Toncoin price projection decline may resume. Amid this uncertainty, investors are keenly watching Toncoin price projections to guide their trading decisions.

Technical Analysis: Potential Downside for Toncoin

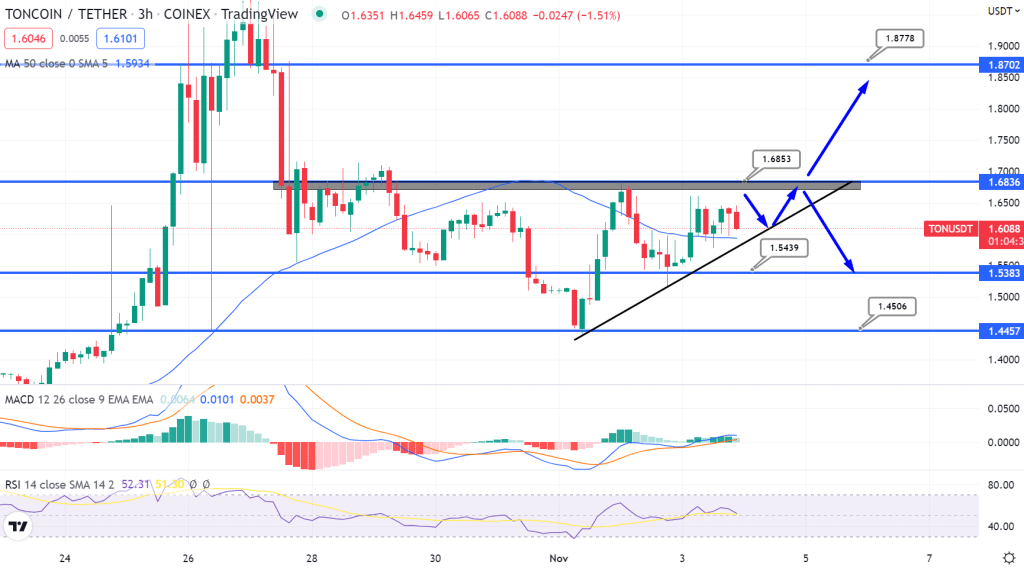

The technical outlook for Toncoin suggests a possible further decline in the coming weeks. The persistent negative market structure for TON, coupled with recent price movements, indicates that the cryptocurrency could test lower support levels. A significant area of concern is the fair value gap around $6.5, which may act as a formidable resistance if Toncoin attempts to recover from its current lows.

Toncoin price projection and Technical indicators reinforce the bearish sentiment surrounding Toncoin. The Moving Average Convergence Divergence (MACD) has shown a consistently downward trend throughout July, highlighting ongoing negative momentum. Additionally, the Chaikin Money Flow (CMF) has dropped to a four-month low, underscoring the intense selling pressure since Toncoin’s rejection at the $7.7 level. This Toncoin price projection place the bulls in a challenging position, suggesting that a further decline could be on the horizon.

The 78.6% Fibonacci retracement level at $5.36 is emerging as a potential target for Toncoin, given the current technical situation. This projection suggests a significant drop from current levels, yet it also presents a potential entry point for traders anticipating a trend reversal. The general market sentiment remains negative, however, so investors should exercise caution when considering positions at these lower levels.

On-Chain Metrics: Mixed Signals for Toncoin’s Future

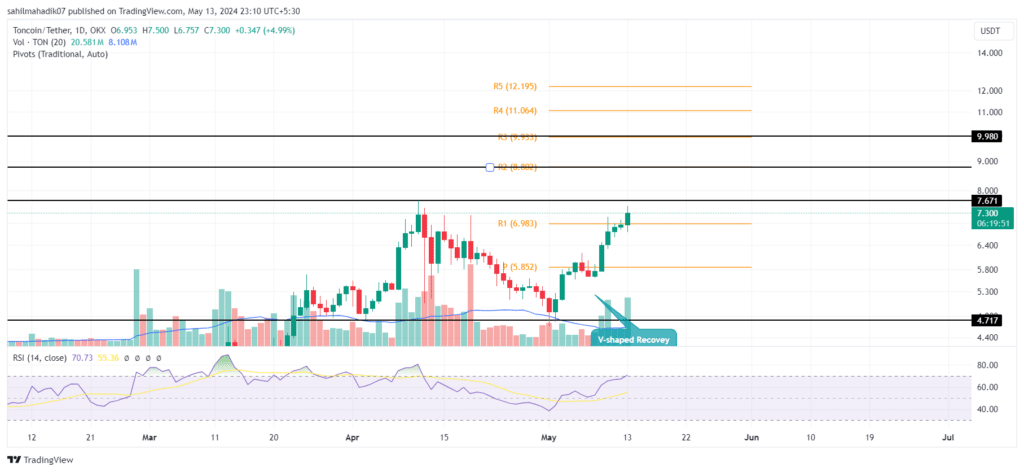

While technical analysis points to a negative short-term outlook for Toncoin, on-chain metrics present a more nuanced perspective. Despite the recent price decline, the average age of coins has been increasing, indicating ongoing accumulation across the network. This trend suggests that Toncoin holders may be confident about the cryptocurrency’s long-term prospects.

Another positive on-chain indicator is the Market Value to Realized Value (MVRV) ratio, which has fallen to levels not seen since early May. This Toncoin price projection decline indicates substantial losses for short-term holders and suggests that Toncoin may be undervalued. Historically, such events have preceded significant price rallies, offering some hope for a medium-term recovery.

However, the weighted social sentiment for Toncoin, which had been favourable, has recently turned negative. This shift in sentiment may reflect a loss of confidence among retail investors, potentially leading to increased selling pressure. Investors considering entry points at support levels, such as the $5.86 mark (61.8% Fibonacci retracement level), should be aware of the heightened risk associated with purchasing during a market downturn.

Toncoin Price Projection: Navigating Uncertainty

As we analyze the various factors influencing Toncoin price projection, the cryptocurrency finds itself at a crucial juncture. Key support levels at $5.86 and $5.36 are likely to be tested in the near term, based on current technical analysis which suggests a negative short-term trend. Meanwhile, on-chain data indicating accumulation could signal potential for future recovery.

Investors and traders should approach the Toncoin market with a strategy that balances the mixed signals from technical indicators and on-chain metrics. The cryptocurrency landscape remains highly dynamic, and factors specific to Toncoin could alter the prevailing narrative. While a potential rally could shift the current outlook, further declines are still a possibility.

In navigating this uncertain terrain, staying informed and adaptable is crucial. The interplay between technical analysis, on-chain data, and broader market conditions will continue to shape Toncoin’s price trajectory. Traders should remain vigilant and prepared for a range of outcomes, whether the price reaches the projected $5.36 or experiences an unexpected turnaround. TheBITJournal is committed to keeping you updated on the latest trends and developments in the digital asset world. As Toncoin’s journey unfolds, we will provide ongoing analysis and insights to help you make informed decisions in this ever-evolving market.