Toncoin (TON) currently trades around $3.40 after Pavel Durov obtained legal freedom in France, triggering a Toncoin price increase. TON experienced an initial surge after Durov’s permission to travel was approved yet it has now cooled down before observers question its ability to sustain positive price movement. Toncoin price faces scrutiny about long-running performance even though on-chain data indicates ongoing strength as its founder Pavel Durov moves to Dubai.

Toncoin’s Rally Slows After a Weekend Surge

Crowd interest in Toncoin price diminished after its market surge during the weekend. The travel approval granted to Durov caused Toncoin prices to skyrocket by more than 40% from $2.59 to $3.66. The original excitement surrounding this news seems to diminish. TON continues trading at $3.41 during the present market session yet show an overall decrease of 1.25% during the last day.

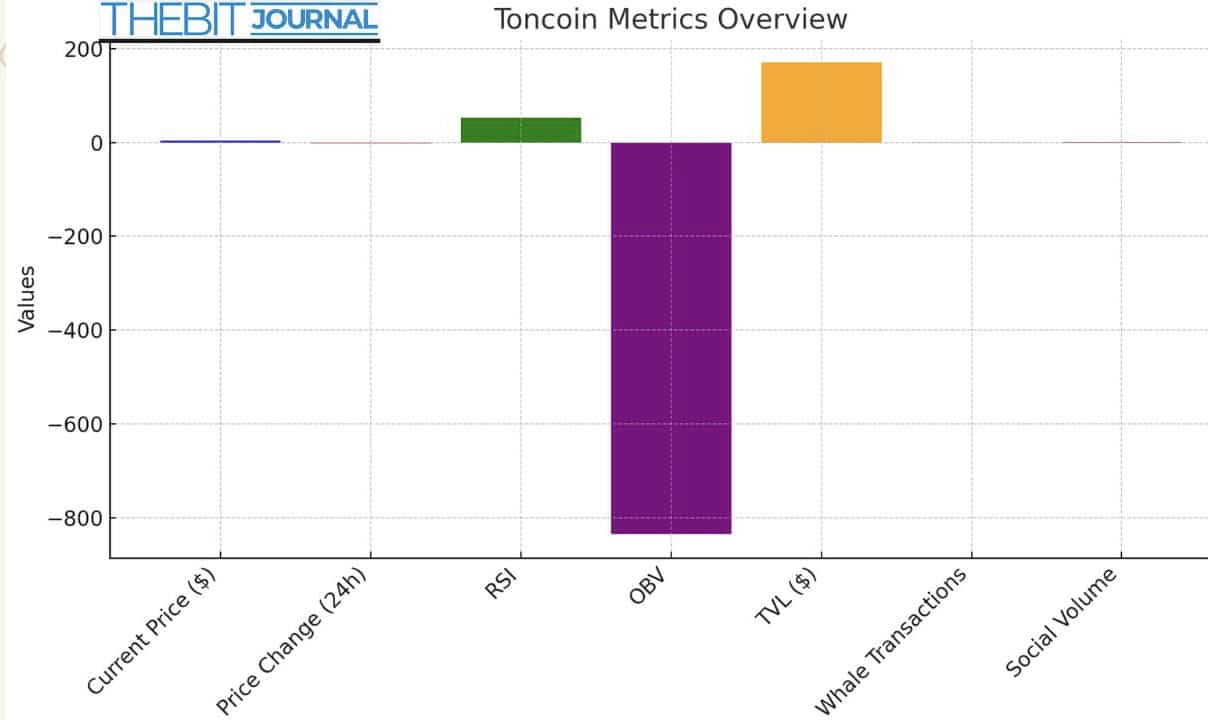

| Metric | Value |

| Current Price ($) | 3.41 |

| Price Change (24h) | -1.25% |

| RSI | 53.31 |

| OBV | -835K |

| Total Value Locked (TVL) | $170M |

| Whale Transactions | High |

| Social Volume | High |

RSI currently stands at 53.31 which signifies declining buying pressure since it fell from overbought territory. A negative indicator value of -835K on the OBV reveals a weak build-up of investor accumulation during recent price appreciation. Over the weekend there was an initial volume surge that has now faded suggesting traders are becoming cautious about their decisions.

“While the short-term outlook might include consolidation or a retracement, the bigger picture still suggests that Toncoin has potential for sustained growth,” said John Doe, a crypto market analyst at CryptoTrend.

Toncoin Price Profitability Metrics Show Strength

The Toncoin price market keeps advancing even though its price growth rate has slowed down as investor faith stays strong according to profitability indicators. Information from IntoTheBlock shows TON tokens are in an advantageous position for 73.82% of their holders given their purchase cost remains below the current value of $3.41. MOST holders acquired Toncoin at prices below the current market value which is only 12.25% of all addresses as per IntoTheBlock data.

Recent NVT ratio variations led to a drop during early March before Toncoin received its price breakout. The price reduction of Toncoin indicated its value was below its market potential right before its price increase. The current rise in NVT ratio shows that Toncoin needs large transaction volumes to maintain an upward price trajectory.

Mark Johnson from ChainMetrics believes “TON will benefit in the long-term due to growing transaction volumes combined with strong supporter confidence.”

Toncoin’s Total Value Locked (TVL) Sees Growth

Toncoin price witnessed an expansion of its Total Value Locked (TVL) indicator during this period. The Total Value Locked statistic serves as a fundamental performance signal for future Toncoin developments since it measures decentralized finance protocol capital investment levels. DeFiLlama records show that TON TVL grew substantially from $140 million to nearly $170 million during the period from March 15 to March 17, 2025. The rising investment sentiment reflects growing confidence from investors toward the DeFi ecosystem of Toncoin.

A substantial rise in whale transactions together with substantial social content created a marked effect on price just before the price breakout according to Santiment data. Large-scale Whale activities on the network indicate impending market growth for the asset. Market interest and potential price rising movements are indicated by high social trading activity.

The market trends indicate Toncoin might sustain its upward momentum as long as social engagement and whale activity result in consistent investor engagement.

Will Toncoin’s Bullish Trend Persist?

The recent Toncoin price decline does not prevent the token from following an upward trajectory based on its basic metrics. The rising TVL, strong profitability metrics, and sustained social and whale activity point toward a healthy market structure.

Multiple elements define the price direction that Toncoin will take moving forward. Market sentiment fluctuations together with general market declines might trigger instantaneous price drops. The crypto market performance of Toncoin faces potential risks from both external macroeconomic factors and new market regulations that might affect its operations.

Conclusion: Toncoin’s Future Remains Positive, but Risks Exist

The positive trajectory for Toncoin price exists despite known risks in its future development path. The gradual pace of Toncoin’s price growth does not affect the fundamental operational strength it offers to investors. Future growth for Toncoin remains strong due to rising treasury value locked combined with robust holder belief and favorable blockchain statistics.

Toncoin has the potential to stay positive in the short term provided market sentiment remains high and whale activities and social volume continue at their present levels. Toncoin shares the typical market risks that all cryptocurrency assets encounter alongside price fluctuations which depend on overall market stability. Keep following The Bit Journal and keep an eye on Toncoin price.

FAQs

What caused Toncoin price surge recently?

Toncoin price rose substantially when Telegram founder Pavel Durov obtained release as he won authorization to travel. The news led investors to become more interested which resulted in the token price increasing beyond 40%.

What has caused Toncoin’s price to slow down?

The market’s decreasing energy has caused Toncoin prices to decelerate. An RSI reading drop from overbought territory matched a negative OBV trend which demonstrates reduction in market buying power.

The total value locked in Toncoin represents what specific metric?

The rise in Toncoin’s Total Value Locked demonstrates growing investor belief in all DeFi protocols whose foundation rests upon Toncoin. The stable market framework of the token indicates ongoing potential development considering its current position.

Is Toncoin still a good investment?

The fundamental aspect of Toncoin stands strong because it shows high profitability metrics and strong holder confidence along with growing TVL. The explosive nature of the cryptocurrency market has risks which all potential investors must acknowledge.

Glossary of Key Terms

- Toncoin (TON): works as the exclusive cryptocurrency within the Telegram ecosystem.

- RSI: performs as a momentum indicator through technical analysis to determine asset overbought positions against oversold status.

- On Balance Volume: The technical analysis indicator On-Balance Volume (OBV) determines stock price variations through volume flow evaluation.

- TVL (Total Value Locked): represents the combined capital investments which users put into DeFi platforms.

- Whale transactions: The term whale transaction refers to big-scale trades conducted by persons or organizations controlling large amounts of cryptocurrency holdings.

References

- IntoTheBlock: Toncoin Profitability Metrics

- DeFiLlama: Toncoin’s TVL Growth

- Santiment: Whale Transactions and Social Volume

- TradingView: Technical Analysis of Toncoin Price Trends

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!