Cryptocurrency whales, investors holding substantial amounts of digital assets, play a critical role in shaping market trends. Their transactions often signal upcoming price movements, making them an essential metric for traders and analysts. This week, whale activities have driven significant shifts in Bitcoin, Ethereum, and altcoin markets, influencing both bullish and bearish sentiment.

Bitcoin Whales Trigger Volatility

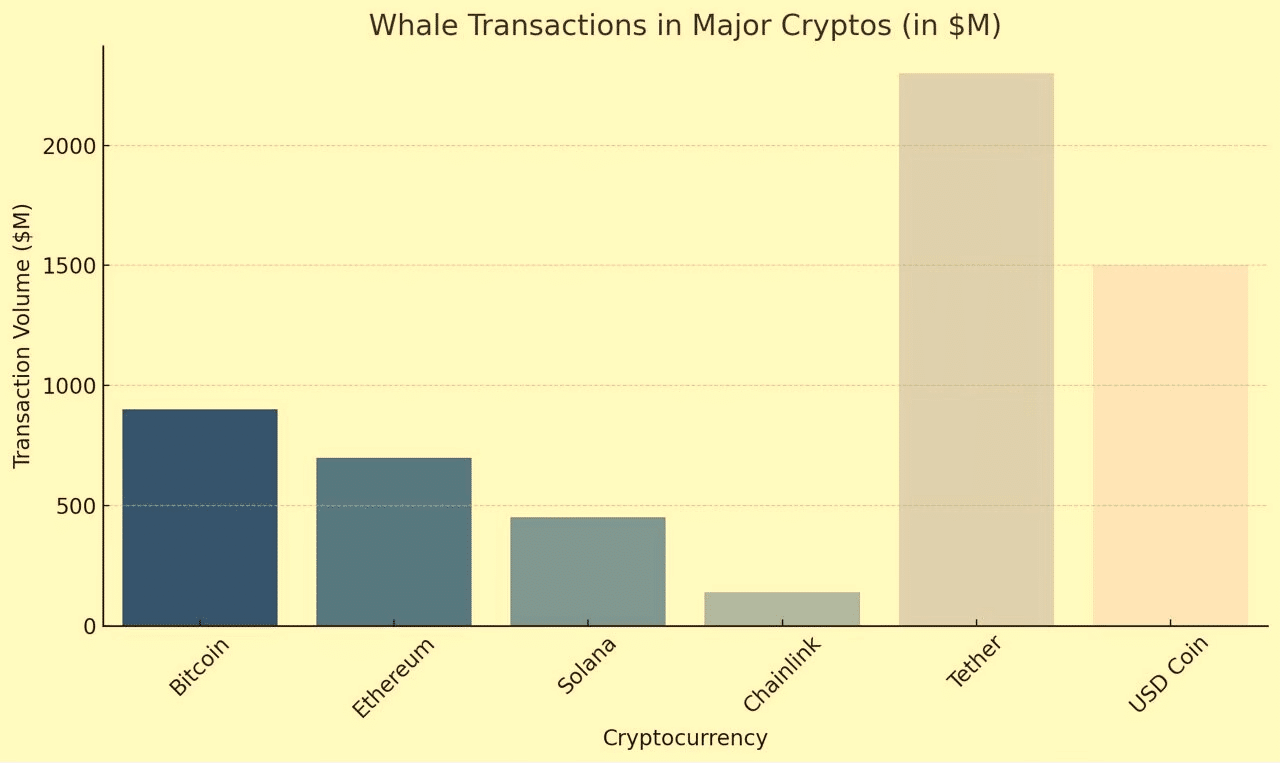

Bitcoin ($BTC) saw a surge in whale transactions exceeding $100 million, leading to heightened market speculation. According to on-chain data from Santiment, over 350 large BTC transactions were recorded in the past seven days. A single entity transferred 12,500 BTC (~$900 million) to an undisclosed wallet.

Exchange outflows from whale wallets increased by 15%, indicating potential long-term holding sentiment. Meanwhile, a notable whale dumped 5,200 BTC on Binance, sparking a temporary price dip. These activities suggest a tug-of-war between accumulation and sell-offs, making the market highly reactive to whale movements.

Ethereum Whales Intensify Accumulation

Ethereum ($ETH) whales have shown increased accumulation this week, hinting at a potential price breakout. Over 200,000 ETH (~$700 million) moved off centralized exchanges, suggesting reduced sell pressure. A prominent whale wallet added 50,000 ETH ($175 million) to its holdings, capitalizing on recent price dips.

ETH staking deposits surged, with over 100,000 ETH staked in Lido and Rocket Pool, reinforcing confidence in Ethereum’s long-term value. Ethereum’s whale-driven demand signals strong bullish sentiment, especially ahead of major network updates and staking yield enhancements.

| Cryptocurrency | Whale Activity | Amount/Value | Impact on Market | Sentiment |

|---|---|---|---|---|

| Bitcoin ($BTC) | Surge in whale transactions exceeding $100 million. | 350+ large BTC transactions. | Increased volatility due to accumulation and sell-offs. Temporary price dip after whale sold 5,200 BTC. | Mixed (Bullish/Bearish) |

| Ethereum ($ETH) | Increased accumulation and ETH staking. | 200,000 ETH (~$700 million). | Reduced sell pressure and positive market momentum. Large whale added 50,000 ETH (~$175 million). | Bullish |

| Solana ($SOL) | 3 million SOL moved into cold storage; Whale withdrew 500,000 SOL. | 3 million SOL (~$450 million). | 5% price increase after whale withdrawal. | Bullish |

| Chainlink ($LINK) | Whale added 7.2 million LINK to the portfolio. | 7.2 million LINK (~$140 million). | 22% increase in large LINK transactions, institutional interest. | Bullish |

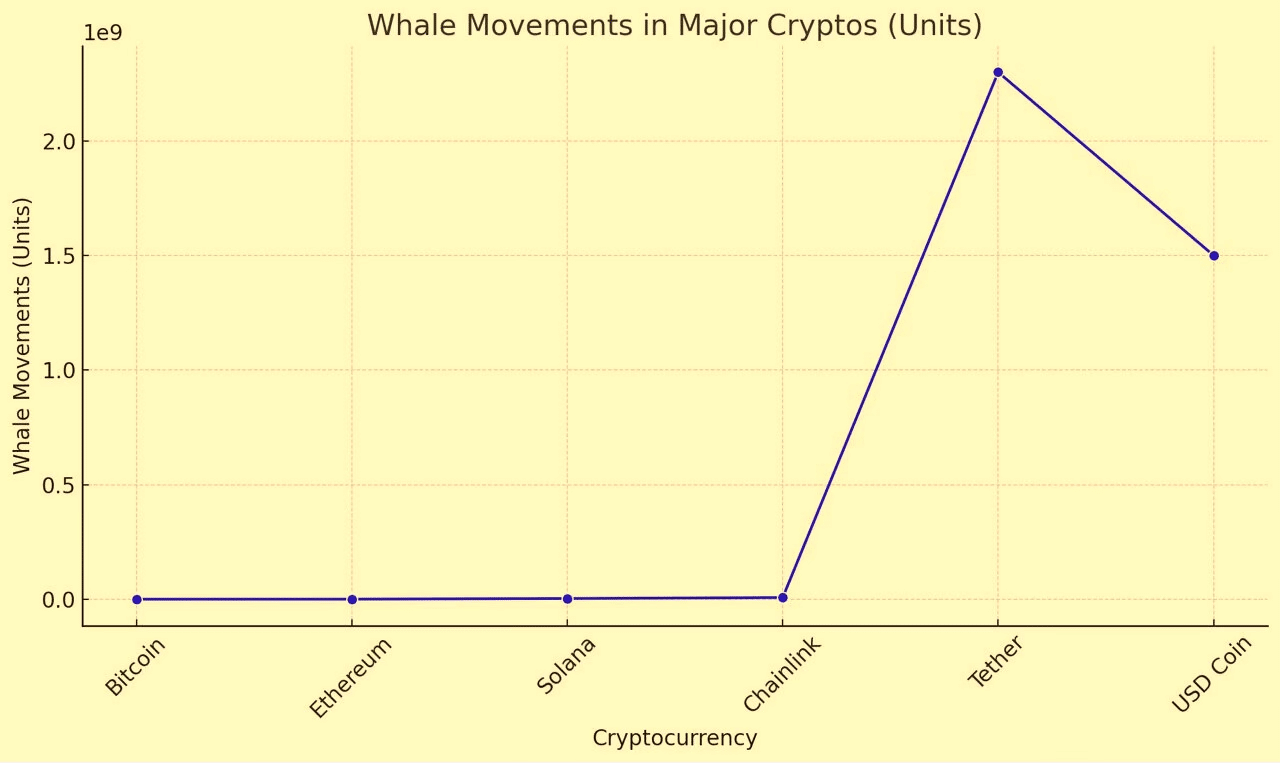

| Stablecoins | USDT inflows and USDC outflows. | $2.3 billion USDT, $1.5 billion USDC. | USDT inflows indicate upcoming large-scale purchases, USDC outflows suggest anticipation of volatility. | Mixed (Liquidity Increase) |

Altcoins: Whales Bet Big on Solana and Chainlink

Beyond BTC and ETH, whale activities in altcoins have drawn significant attention. The most notable movements occurred in Solana ($SOL) and Chainlink ($LINK). Whales moved 3 million SOL ($450 million) into cold storage, signaling long-term confidence.

A single whale address withdrew 500,000 SOL ($75 million) from Binance, leading to a 5% price jump. Similarly, a whale added 7.2 million LINK ($140 million) to their portfolio, fueling speculation of an impending rally. On-chain data shows a 22% increase in large LINK transactions, indicating rising interest from institutional investors.

Stablecoins: USDT and USDC Flows Reveal Market Sentiment

Stablecoins play a crucial role in crypto liquidity, and this week, whale movements in Tether ($USDT) and USD Coin ($USDC) provided insight into market sentiment. About $2.3 billion USDT was deployed into exchanges, suggesting upcoming large-scale purchases. Conversely, $1.5 billion USDC was withdrawn, hinting at a move toward off-exchange holdings, possibly in anticipation of volatility.

Whale Activities Impact on the Market

Whale activities influence market liquidity, volatility, and investor sentiment. Large-scale transactions often lead to price swings, as significant buy or sell orders can drive short-term price fluctuations. Accumulation trends signal bullish momentum, while whale sell-offs may lead to corrections. Increased whale movements may also indicate institutional strategies, affecting retail investor confidence.

| Activity | Assets Involved | Market Impact | Market Sentiment |

|---|---|---|---|

| Bitcoin Whale Transactions | Bitcoin ($BTC) | Heightened volatility and increased market speculation. | Mixed (Tug-of-war between accumulation and sell-offs) |

| Ethereum Whale Accumulation | Ethereum ($ETH) | Increased staking, long-term bullish sentiment. | Bullish |

| Solana Whale Cold Storage | Solana ($SOL) | Long-term confidence, price surge after whale withdrawal. | Bullish |

| Chainlink Whale Addition | Chainlink ($LINK) | Institutional interest, speculation of a price rally. | Bullish |

| Stablecoin Movements | Tether ($USDT), USD Coin ($USDC) | USDT deployed into exchanges, USDC withdrawn, volatility expected. | Mixed (Liquidity increase, potential market surge) |

Expert Opinions

Expert opinions provide valuable insights into the impact of whale activities on the market. Analysts suggest that increased Bitcoin outflows indicate strong accumulation, which may trigger a potential breakout. Ethereum’s staking growth further reinforces a bullish outlook.

Meanwhile, stablecoin inflows point to rising liquidity, but analysts caution that whale sell-offs could introduce short-term volatility. Here’s what leading experts are saying about this week’s whale activity.

Michael van de Poppe, a leading crypto strategist, stated,

“The increased Bitcoin outflows indicate a strong accumulation phase, which could lead to a significant price breakout in the coming weeks.”

Santiment analysts emphasized that “Ethereum whales are positioning themselves for long-term gains, with the growing staking deposits hinting at a potential uptrend in the near future.”

Glassnode reports highlighted that “Stablecoin inflows into exchanges signal increased liquidity, which could support further bullish momentum across the market. However, whale sell-offs should be closely monitored as they may trigger short-term corrections.”

What This Means for Traders

Whale activities this week indicate a mix of accumulation and strategic sell-offs. Traders should keep an eye on Bitcoin whale inflows and outflows as they continue to dictate market sentiment. Ethereum staking trends could push ETH into a bullish phase.

Altcoin whale movements may present short-term trading opportunities, particularly in Solana and Chainlink. Stablecoin deployment is also a key metric to watch, as high inflows into exchanges may precede market surges.

Conclusion

Whale transactions remain a powerful indicator of market movements. This week’s activities suggest cautious optimism, with major players accumulating key assets while still exhibiting short-term profit-taking strategies. As institutional interest continues to grow, staying informed on whale movements can provide traders and investors with an edge in navigating the crypto landscape.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why do whale transactions matter in crypto trading?

Whale transactions impact liquidity, price action, and overall market sentiment. Large buy or sell orders can trigger volatility.

How can traders track whale movements?

On-chain analytics platforms like Santiment, Whale Alert, and Glassnode provide real-time insights into large crypto transactions.

Are whale activities a bullish or bearish signal?

It depends. Accumulation often indicates bullish sentiment, while large sell-offs can signal impending corrections.

Which altcoins are seeing the most whale activity?

This week, Solana and Chainlink witnessed significant whale accumulation, suggesting potential short-term rallies.

Glossary

Whale: An investor holding a significant amount of cryptocurrency, capable of influencing market movements.

On-chain Data: Information derived from blockchain transactions that provide insights into market behavior.

Exchange Outflow: The movement of crypto assets from centralized exchanges to private wallets, often indicating long-term holding sentiment.

Staking: The process of locking up cryptocurrency to support blockchain network operations in exchange for rewards.

Stablecoin: A cryptocurrency designed to maintain a stable value by being pegged to a fiat currency like the US dollar.