TRON, founded by crypto billionaire Justin Sun, is going public in the United States. The blockchain company has announced plans to merge with SRM Entertainment, a Nasdaq-listed toy firm, in a bold reverse merger valued at up to $210 million. The objective? To create a publicly traded entity, Tron Inc., modeled on MicroStrategy’s treasury-based crypto strategy, with a key twist: instead of Bitcoin, this entity will hold TRX tokens.

According to reports from Coindesk, The Financial Times, and The Wall Street Journal, the structure allows TRX to bypass a traditional IPO while gaining immediate access to U.S. capital markets. The deal is being brokered by Dominari Securities, a Trump-affiliated financial firm, and aims to position TRX as a treasury reserve asset on Wall Street.

Deal Structure: From Toys to Tokens

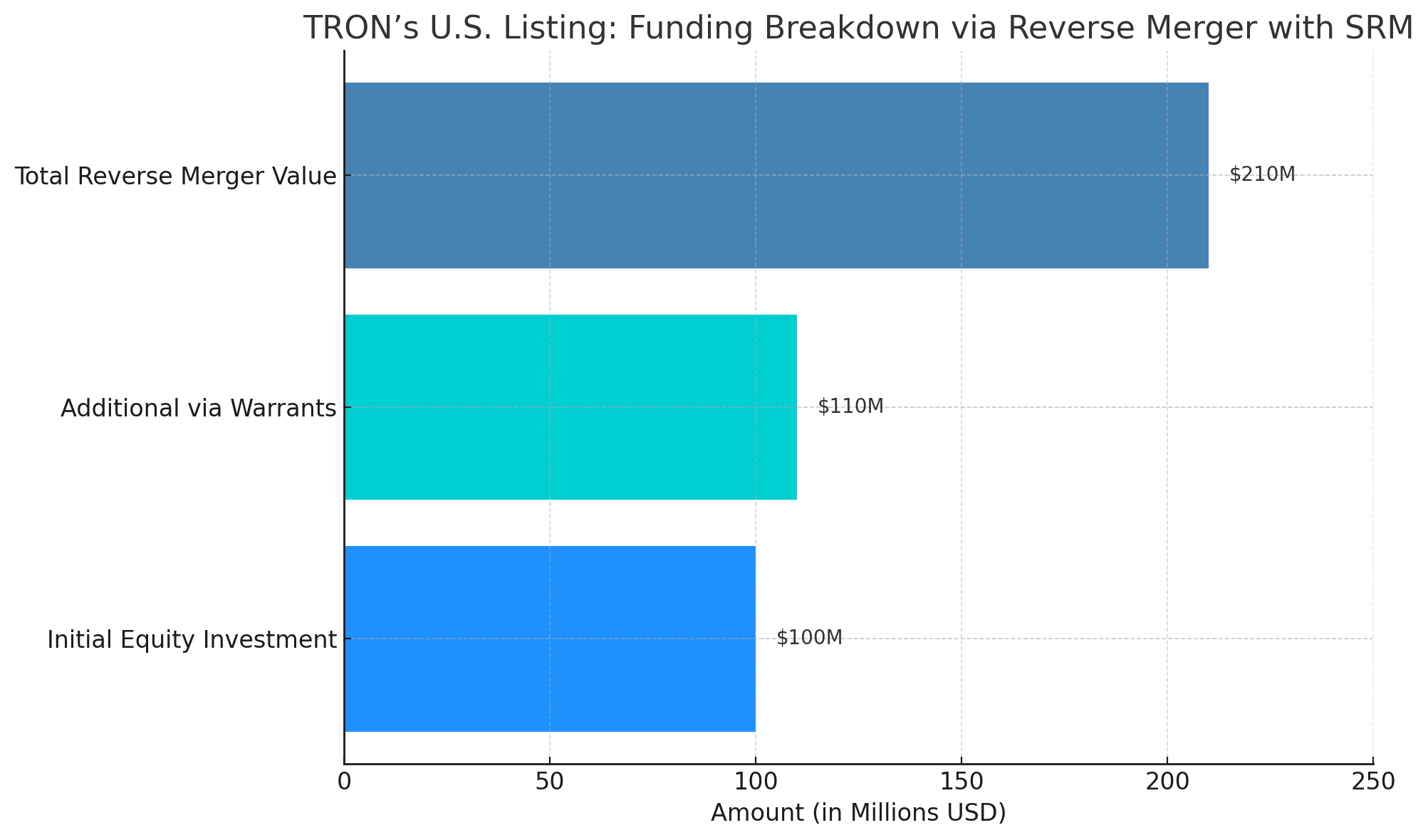

SRM, formerly a children’s entertainment company, is transforming into a full-fledged crypto asset vehicle. Here’s how the deal unfolds:

$100 million in equity is already secured for Tron Inc.

An additional $110 million could be added through warrants and preferred stock conversions.

TRX will use these funds to accumulate TRX tokens, echoing MicroStrategy’s Bitcoin-heavy approach.

The merger is expected to finalize in Q3 2025, pending shareholder and regulatory approvals.

Market Response: Bullish Sentiment, Political Ties

The announcement sent SRM shares skyrocketing by over 600% intraday, reflecting investor enthusiasm for the pivot to crypto. Meanwhile, TRX rose approximately 4%, trading in the $0.28 to $0.29 range, inching closer to key resistance near $0.30.

What’s equally notable is the political angle. Dominari Securities, the advisory firm overseeing the deal, includes Donald Trump Jr. and Eric Trump on its board. Reports also suggest Eric Trump may take on an executive role in the newly formed Tron Inc.

This isn’t Justin Sun’s first brush with MAGA circles. In May 2025, he invested $16 million into the Trump-themed meme coin ($TRUMP) and attended a donor dinner at Mar-a-Lago, suggesting deeper political and strategic alignment.

A New Wave of Crypto Treasuries

TRON’s IPO strategy mirrors a growing trend of blockchain firms embracing publicly traded structures to:

Gain investor legitimacy

Hold crypto assets on balance sheet

Enable institutional exposure to tokens via equity

MicroStrategy made headlines with its Bitcoin reserves, and Circle’s post-IPO growth has further proven the appetite for token-driven treasury plays.

TRON, however, is the first major project to attempt this structure using its own native token (TRX) instead of BTC or ETH, making this a potentially industry-shaping experiment.

Potential Risks

Despite the hype, several risks persist:

SEC Pressure: While the agency has paused its fraud investigation into Justin Sun, it could easily resume scrutiny if the merger draws attention.

Token Volatility: With TRX as the primary treasury asset, Tron Inc. will face valuation swings depending on market sentiment.

Political Backlash: Ties to the Trump family may alienate some institutional investors or provoke further media scrutiny.

On-Chain Strength: TRON’s Foundation is Solid

Beyond the headline deal, TRON’s fundamentals remain strong:

TRON processed $694 billion in USDT transfers over the last year, rivaling Ethereum in stablecoin throughput.

The network generates over $55 million in monthly protocol revenue, showing real adoption and scalability.

TRX remains one of the most active chains in terms of daily user interactions and DeFi TVL, especially in Asia.

These factors give the TRX token intrinsic utility and real-world network value—factors that bolster the case for TRON’s treasury-based strategy.

What This Means for Investors

Exposure to TRX through equity: Investors will soon be able to gain exposure to TRX via a U.S.-listed company.

Shift in crypto funding models: Reverse mergers are becoming an increasingly viable alternative to direct token launches or SPACs.

Wall Street meets Web3: If successful, this model could open the door for other Layer-1 tokens like Avalanche (AVAX), Near Protocol (NEAR), or even Dogecoin (DOGE) to pursue similar strategies.

Final Thoughts: A High-Stakes, High-Reward Move

TRON’s move to go public in the U.S. is bold, disruptive, and politically charged. If successful, it will cement TRX as the first major native token to be treasury-backed at a publicly listed level, offering exposure, credibility, and liquidity in one shot.

But this is also a test of regulatory tolerance, token economics, and market appetite. For TRON, the gamble is massive, but so is the potential reward.

If the SEC stays silent and TRX gains traction through Tron Inc., this could redefine how the next generation of crypto companies enter the public markets.

Frequently Asked Questions (FAQs)

Why is TRON going public in the U.S.?

TRX is using a reverse merger with Nasdaq-listed SRM Entertainment to become a publicly traded company in the U.S. without going through a traditional IPO.

What is the purpose of Tron Inc.?

Tron Inc. will act as a holding company that acquires and holds TRX tokens on its balance sheet, similar to how MicroStrategy holds Bitcoin.

How much is the deal worth?

The reverse merger deal is valued at up to $210 million, with an initial $100 million equity injection and potential expansion via warrants and preferred shares.

Who is backing this deal?

The deal is being managed by Dominari Securities, a Trump-affiliated financial firm with Donald Trump Jr. and Eric Trump involved in executive roles.

Will TRON be offering dividends?

There are early plans for token-backed dividends, but they would depend on TRX’s treasury yields and TRX market performance.

What happens to SRM Entertainment?

SRM will be transformed from a toy company into a crypto asset vehicle as part of the merger and renamed TRX.

Glossary of Key Terms

TRON (TRX) – A Layer-1 blockchain platform created by Justin Sun, known for high-speed, low-fee transactions and large-scale USDT throughput.

IPO (Initial Public Offering) – The traditional process for a private company to become publicly traded by listing its shares on a stock exchange.

Reverse Merger – A faster alternative to an IPO where a private company merges with an already public company to gain a stock market listing.

Tron Inc. – The newly formed public holding company that will manage and accumulate TRX tokens as a core treasury strategy.

SRM Entertainment – A Nasdaq-listed toy firm being acquired by TRX to facilitate the reverse merger and U.S. listing.

Dominari Securities – A Trump-affiliated boutique investment firm facilitating the TRON-SRM merger, with family members of Donald Trump involved.

Treasury Strategy – A financial model where a company allocates its treasury funds into a specific asset—in this case, TRX tokens.

Warrants & Preferred Shares – Financial instruments that may convert into equity in the future, allowing for additional funding without immediate dilution.