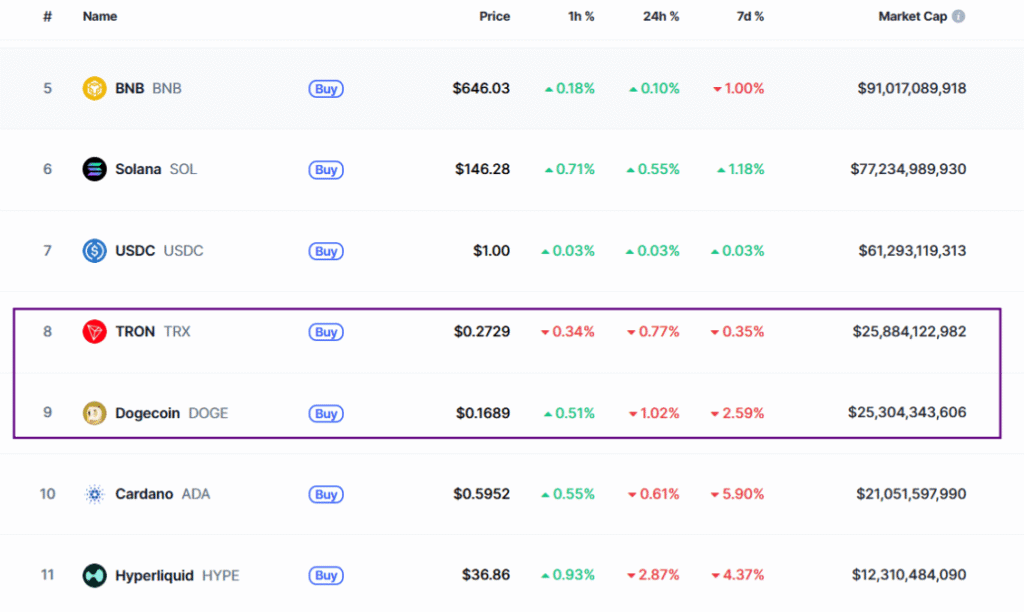

Tron growth has become one of the most significant trends in the cryptocurrency market over the past year. TRON (TRX), a leading blockchain network, has surpassed Dogecoin (DOGE) in market capitalization, securing its position as the 8th largest cryptocurrency.

The growth of TRON comes amid major news regarding its upcoming Initial Public Offering (IPO). This has caught the attention of both investors and the broader financial community.

Key Factors Behind Tron Growth

The dramatic rise of TRON has come with a series of significant developments. One of the most notable is TRON’s strategic move to go public through a reverse merger with Nasdaq-listed SRM Entertainment. The news of the IPO has caused waves within the cryptocurrency world, sparking speculation and positioning TRON as a key player in the financial markets.

At the time of writing, TRX is trading around $0.2746, with a market cap of $25.88 billion. Over the past year, TRX has surged by more than 134%, peaking at $0.4407 on December 4, 2024.

In comparison, Dogecoin has seen a significant decline. The price of DOGE has fallen by over 24.48% in the past month, with its market capitalization now at $25.30 billion, about $500 million behind TRON.

Tron IPO: A Game-Changer for the Crypto Industry

The impending IPO is expected to be a game-changer for the cryptocurrency market. The merger with SRM Entertainment, facilitated by Dominari Securities, an investment bank with connections to Eric Trump and Donald Trump Jr., has injected political capital into TRON’s growth. Speculation surrounds the involvement of Eric Trump, who may join the board of TRON Inc., adding further weight to the IPO.

The deal is set to infuse up to $210 million in token assets into the entity, positioning TRON growth to follow a strategy similar to that of MicroStrategy, holding TRX as a core reserve asset. This could elevate TRON’s status to an institutional-grade financial instrument, a significant leap for the platform.

Tron Growth: Surge in USDT Transactions

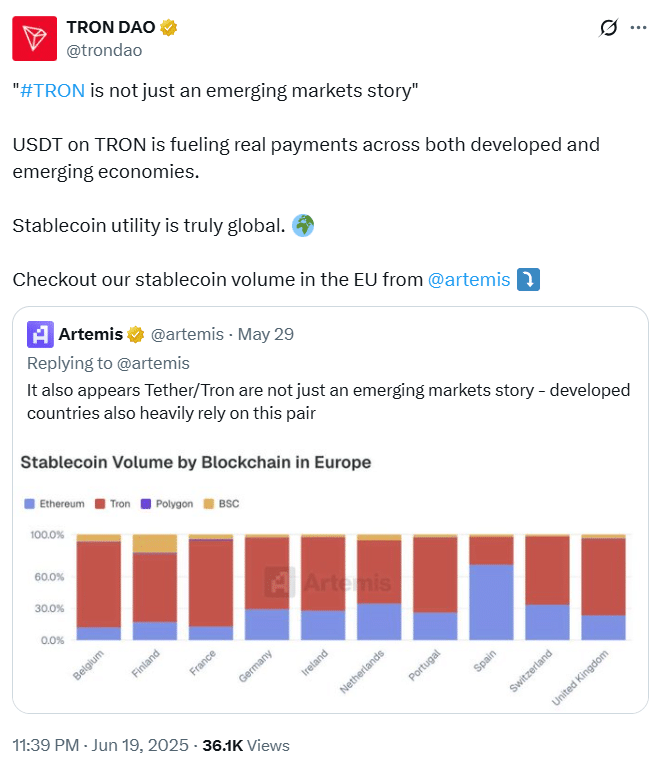

In addition to its IPO, TRON’s network has seen a surge in USDT transactions across both emerging and developed markets. This increase has cemented TRON growth as a critical global payments infrastructure. As highlighted by Tron DAO, USDT on the TRON network is now fueling real-world payments, with stablecoin utility being recognized globally.

The network’s low fees and rapid settlement times have made it the preferred choice for stablecoin transfers, especially on large scales. Binance, one of the leading cryptocurrency exchanges, processes between $2 billion and $3 billion in USDT transfers on the TRON network daily, representing more than 65% of total on-chain USDT activity.

Global Payment Infrastructure: TRON’s Rising Influence

TRON’s increasing usage in Latin America and other emerging markets has not gone unnoticed. Analysts have drawn comparisons between TRON and traditional payment giants like Visa and Mastercard. One industry expert remarked that TRON plus USDT could become as important a payment rail in South America as Visa or Alipay is in other regions.

As TRON continues to expand, its adoption rate has increased steadily, attracting both retail and institutional investors. TRX’s rise contrasts with the struggles of meme coins like Dogecoin, which have lost traction in recent months. This shift underscores the growing preference for cryptocurrencies that offer practical utility, scalability, and liquidity, rather than those driven by speculative hype.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $0.273 | $0.311 | $0.348 | 27.3% |

| July | $0.287 | $0.316 | $0.344 | 25.9% |

| August | $0.265 | $0.289 | $0.313 | 14.5% |

| September | $0.250 | $0.261 | $0.271 | -0.8% |

| October | $0.241 | $0.279 | $0.317 | 16% |

| November | $0.255 | $0.286 | $0.317 | 16% |

| December | $0.213 | $0.256 | $0.299 | 9.4% |

The Path Ahead: TRON’s Potential Post-IPO

As TRON heads toward its public listing, the network’s growing market cap and its integral role in stablecoin liquidity position it for continued success. Analysts believe that the ongoing adoption of TRX, combined with the IPO and the rise of USDT transactions, could propel the network even further, making it a critical piece of the global financial ecosystem.

Conclusion

Tron growth has been marked by rapid expansion, strategic partnerships, and an increasing presence in key sectors like DeFi, gaming, and global payments. The future of Tron growth looks bright, with the upcoming IPO and continued adoption positioning it as a dominant force in the cryptocurrency and blockchain market.

Frequently Asked Questions (FAQ)

1: What caused TRON to surpass Dogecoin in market cap?

TRON’s focus on utility-driven blockchain solutions, coupled with the announcement of its IPO, has led to increased investor interest, pushing its market cap above Dogecoin.

2: How does TRON’s IPO affect its future?

TRON’s IPO positions it to enter the US capital markets, which could increase its visibility and attract institutional investors, accelerating Tron growth.

3: What role does USDT play in TRON growth?

USDT transactions on TRON’s blockchain have surged, making the network a critical part of global payments.

4: How is Dogecoin performing compared to TRON Growth?

While TRON has seen a surge in market value, Dogecoin has faced significant declines in price and trading volume, reflecting waning interest in meme coins.

Appendix Glossary of Key Terms

Tron (TRX): A blockchain-based decentralized platform focused on enabling content sharing and entertainment applications.

Stablecoin: A type of cryptocurrency designed to maintain a stable value, often pegged to a fiat currency like the US Dollar.

Tether (USDT): A widely used stablecoin that is pegged to the US Dollar, primarily used for digital transactions.

Decentralized Finance (DeFi): Financial services built on blockchain technology, offering decentralized alternatives to traditional banking.

Non-Fungible Token (NFT): A unique digital asset representing ownership or proof of authenticity of a specific item or piece of content on the blockchain.

Initial Public Offering (IPO): A process where a private company offers its shares to the public for the first time to raise capital.

Reverse Merger: A method by which a private company merges with a public company to become publicly traded without going through the traditional IPO process.

References

Cryptotimes – cryptotimes.io

BeInCrypto – beincrypto.com