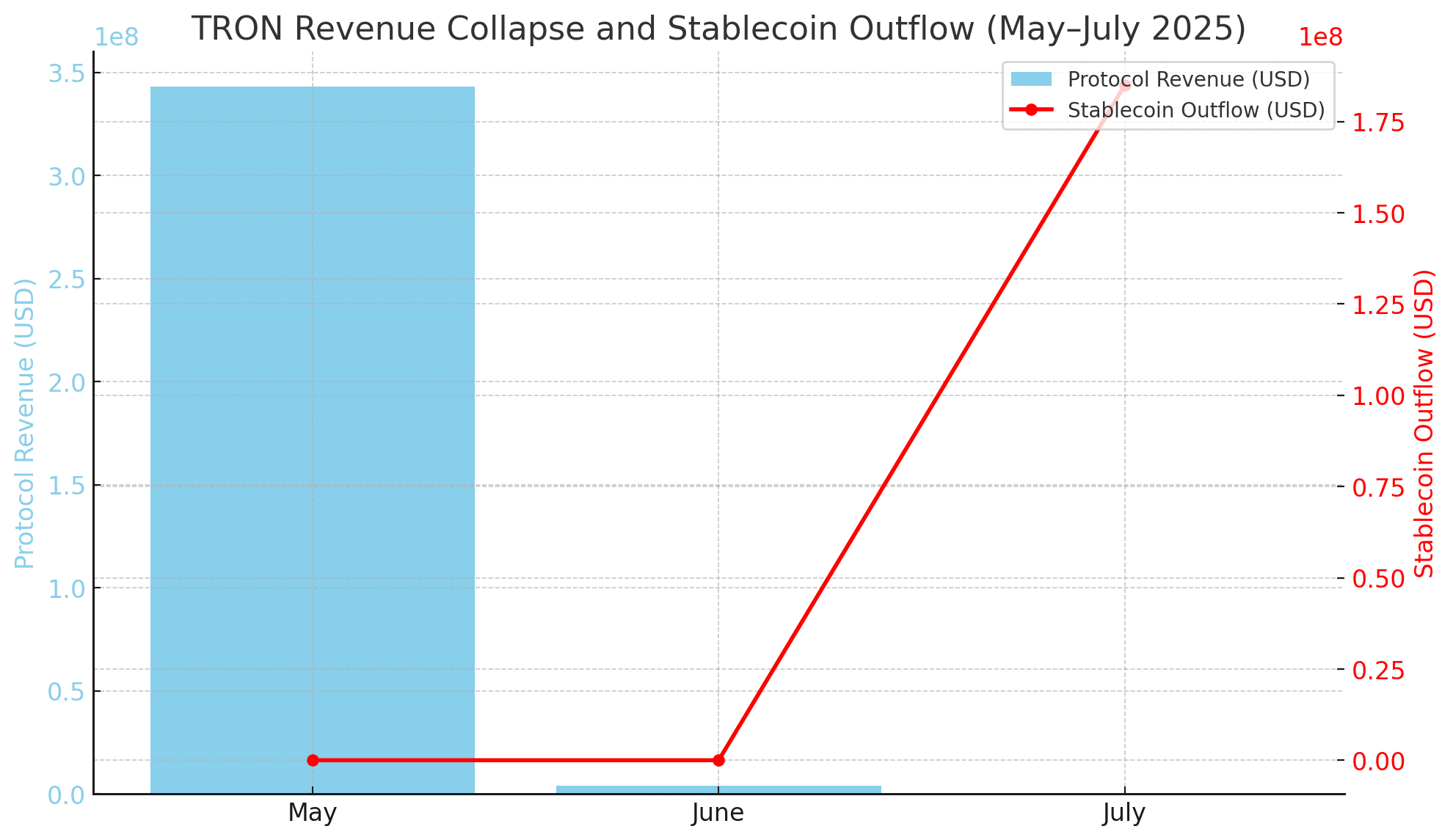

TRON’s fee economy has hit its weakest point in years. Daily protocol TRON revenue fell to just $114 000, its lowest since 2021, while roughly $185 million in stablecoins left the network in a single week. The reversal follows a record-high $80 billion stablecoin supply only one month earlier and has rekindled debate over TRX’s price outlook.

Historical Context: From Boom to Bust

In May, TRON celebrated an all-time-high $343 million in monthly revenue on the back of soaring on-chain activity. That momentum evaporated by early July as fee income collapsed 99 % and capital rotated to other networks. The abrupt u-turn underscores how quickly liquidity can migrate in the multichain era.

Tron Revenue Stablecoin Exodus: Reading the $185 Million Outflow

On-chain data from Artemis show that $185 million in USDT and USDC left TRON during the last seven days, only 0.2 % of supply, yet the first net outflow since February. Analysts at AInvest call it an “early warning” of risk-off sentiment that, if extended, could drag the token toward the $0.27 support zone.

DeFi Still Thrives, but Generates Fewer Fees

Paradoxically, DeFi throughput on TRON remains robust. SunSwap and JustLend cleared more than $3.8 billion in swaps and deposits this year, indicating that user activity is shifting toward low-fee internal protocols rather than fee-rich external transfers. That divergence explains why transactions and active addresses keep rising even as TRON revenue plummets.

TRON’s Turning Point, From Bull Market to Bear Signal?

TRON just hit a dramatic crossroads: daily protocol TRON revenue has crumbled to its lowest level in four years, only $114,000, while a massive $185 million in stablecoins exited the network this week. Despite DeFi platforms like SunSwap and JustLend still processing billions, fresh traction is missing, instead, activity spikes signal fund outflows rather than inflows.

That sharp reversal from May’s historic highs paints a stark picture of cooling investor sentiment and internal liquidity shifts. Now, all eyes are on how TRX holds up above the critical $0.27 support, a dip below could trigger a deeper trend shift, while a bounce might signal resilience under pressure.

Price Action: TRX at a Technical Crossroads

TRX trades near $0.28, flat month-to-date but clinging to a medium-term uptrend. A break below $0.27 would confirm the “deeper dump” thesis; a bounce above $0.30 would invalidate the bear case and reopen the path to last year’s $0.35 peak.

TRX Monthly Price Forecast

| Month 2025 | Min ($) | Avg ($) | Max ($) | Source |

|---|---|---|---|---|

| July | 0.280 | 0.292 | 0.304 | changelly.com |

| August | 0.267 | 0.289 | 0.311 | changelly.com |

| September | 0.258 | 0.269 | 0.279 | changelly.com |

| October | 0.244 | 0.262 | 0.280 | changelly.com |

| November | 0.249 | 0.284 | 0.319 | changelly.com |

| December | 0.217 | 0.266 | 0.314 | changelly.com |

Expert Views

AInvest: Flags falling TRON revenue as “classic slow-bleed distribution,” warning that a daily close under $0.27 could accelerate losses.

CurrencyAnalytics: Notes that rising active addresses stem from exit transactions, not new adoption—a bearish signal for medium-term demand.

TronWeekly: Counters that DeFi volumes above $3 billion per month prove core utility remains intact, suggesting price weakness could be short-lived.

Changelly Research Team: Forecasts a “sideways-to-soft” second half, with December’s average price near $0.266 but a possible spike to $0.314 if sentiment improves.

Takeaway for Traders

TRON’s fundamentals tell two stories: declining fee TRON revenue argues for caution, but sticky DeFi usage and still-dominant USDT volumes hint at resilience. Short-term traders may look to fade rallies into the $0.30 to $0.32 zone, while long-horizon investors could accumulate near or below $0.26, where risk-reward skews positive. Position sizing should respect the 4-year revenue low, which historically precedes spikes in volatility rather than quiet consolidation.

Conclusion

TRON’s network faces its sternest test since 2021: collapsing fee income and the first meaningful stablecoin outflow in months. Whether these cracks widen into a full-blown bear trend will depend on the $0.27 price shelf and the chain’s ability to convert sky-high DeFi throughput into fresh TRON revenue streams. For now, the market appears split—some see a bargain; others brace for a deeper dump.

Frequently Asked Questions

Why did TRON revenue fall so sharply?

Fee income plunged as users migrated to low-fee DeFi swaps and moved stablecoins off-chain, reducing paid transactions.

Is the $185 million stablecoin exit catastrophic?

It represents only 0.2 % of TRON’s stablecoin base but breaks a months-long inflow streak, warranting close monitoring.

What price level invalidates the bearish outlook?

A sustained close above $0.30 would negate near-term downside and shift attention to the $0.35 resistance from 2024 highs.

Glossary

Stablecoin outflow The net movement of dollar-pegged tokens off a blockchain, often interpreted as declining on-chain demand.

Protocol revenue Total fees earned by a blockchain over a given period; a key gauge of economic health.

TVL (Total Value Locked) The dollar value of assets deposited in DeFi protocols on a chain.

Support level A price zone where buying interest historically halts declines.

Resistance level A price area where selling pressure has repeatedly capped rallies.

Sources/References

changelly.com