TRON is getting crushed under bearish pressure as indicators show weakening bullish momentum. The bigger picture hits have TRX going down and now $0.22 is the last line of defense for Bulls to hold on. With active addresses growing and World Liberty Financial buying, analysts say TRX doesn’t look good.

TRON Bearish Trend and Key Indicators

TRX daily chart is not encouraging. Technical analysis shows weak momentum and less buying pressure. Bitcoin’s price drop in the last 24 hours has brought all bearish signs and pulled TRX down from $0.247, which is critical mid-range support. This puts TRX on track to retest $0.22, which is the range low and key support for the short term.

Crypto analyst Burak Kesmeci pointed out some key moving averages to watch in the next few days. On CryptoQuant Insights, Kesmeci mentioned daily moving averages at $0.26 and $0.15 as the levels to watch. TRX failing to break above $0.26 means bulls are not in control yet.

1-day chart shows TRX has been oscillating between $0.274 and $0.22 for the last month, with the midpoint at $0.247. If the price stays below this mid-range support, TRX is in for more pain as 78.6% Fibonacci retracement level is close to the range low at $0.22. Failing to hold this key level will lead to a deeper correction in TRX.

On-balance Volume and Accumulation/Distribution Trends

On-balance volume – the important indicator of buying vs selling pressure – is also bearish. On-Balance Volume has made higher lows within this range so far but it’s a distribution and not an accumulation. This is another sign of low buying pressure in this market and lowers the chances of any positive response in the near future.

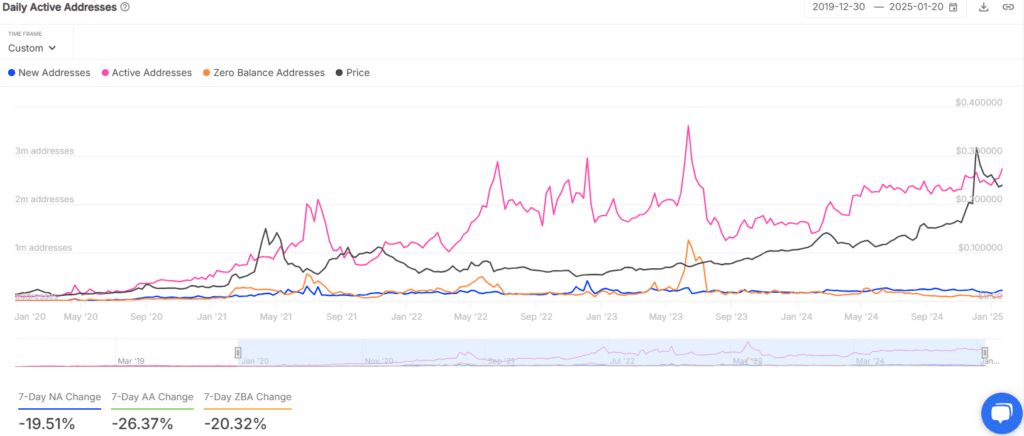

To add to the bearishness, sources show short-term active addresses are retreating. Daily active addresses have been going up since April 2024 but 7 day active address change has dropped -26.37%. This sudden drop means less investor activity and makes it harder for bulls to hold key support areas.

World Liberty Financial’s TRON Buying

Despite the bearish TRON, the market’s attention fell on one key news: World Liberty Financial, an organization connected to former President Donald Trump, had just bought an additional $2.6 million TRX. Institutional-level buys are usually bullish catalysts but they haven’t been able to counter the market conditions.

This is a bigger problem for TRON: to sustain investor confidence amidst external market volatility and waning bullish momentum. For now, the TRX price decline means institutional buying alone may not be enough to turn things around without broader market support.

TRON can’t be looked at in isolation. The broader crypto market is bearish and Bitcoin’s recent drop is putting pressure on Altcoins to sell. Crypto market is highly correlated and TRON’s fortunes are tied to the big ones like Bitcoin and Ethereum.

The market-wide issues from liquidity to regulatory to macroeconomic are setting the stage for the bearish trend to move fast. Technical analysis for TRON says unless bulls come in to defend the $0.22 support, a bigger drop is imminent.

What’s Next for TRX?

TRON’s future is on whether it can hold the $0.22 support. If bulls can regain lost ground and push TRX back above the mid-range at $0.247, that could be a sign of a new push to $0.26 resistance. However, given the metrics showing sustained selling pressure, analysts say it might be unlikely to happen without a broader market recovery.

For now, more active addresses is a long-term hope for long-term investors. If this community of TRON developers and their institutional partner World Liberty Financial, can keep the momentum, these signs might eventually turn into a bounce. The focus now is on the levels for nearby support and changes in market sentiment.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is TRON bearish?

TRON is bearish due to weak buying power, market volatility, and low investor activity as shown by OBV and 7-day active address change.

2. What does $0.22 support mean for TRX?

$0.22 is the short-term support for TRON. If it breaks, then more drop is expected; if it holds, then it could be the start of a reversal.

3. How does Bitcoin affect TRON?

Bitcoin’s price move has a big impact on the whole crypto market, including TRON. A drop in BTC, as seen recently, usually triggers selling across altcoins, including TRX.

4. Can institutional buying like World Liberty Financial support TRON’s price?

Large institutional buying is a sign of long-term confidence in TRON but usually does not move the short-term price, especially if the overall market is bearish.