According to the official source, the Trump Bitcoin policy is no longer just a topic in campaign speeches; it’s a growing part of U.S. economic decisions. From building a national Bitcoin reserve to shaping new crypto laws, Trump is turning digital assets into a serious financial tool.

White House Moves Bitcoin Into National Reserve

In March 2025, President Trump signed an executive order to launch the Strategic Bitcoin Reserve. The goal is to build a government-backed stockpile of Bitcoin to strengthen national digital assets. This is the first time the U.S. has officially recognized Bitcoin as part of the federal reserves.

Shortly after, over $90 million worth of TRUMP memecoins were unlocked. These tokens added about $930 million to the circulating supply. The connection between personal branding and public policy drew attention, while also boosting investor interest.

Reports indicate that the value of Bitcoin increased following these events. Investors now closely monitor policy updates as they do price charts.

Trump Bitcoin Policy Gains Structure With the Genius Act

In July 2025, Trump signed the Genius Act into law. This new regulation creates a federal framework for stablecoins and digital asset licenses. Instead of state-by-state rules, the U.S. now follows a single path for crypto compliance.

“This law supports safe innovation in crypto while giving the government tools to prevent abuse,” said a White House spokesperson during the signing ceremony.

This law plays a significant role in the Trump Bitcoin policy. It gives legitimacy to digital assets while setting clear rules for developers and exchanges.

Crypto Adds Billions to Trump Family Wealth

Trump and his close officials hold at least $193 million in crypto. His net worth jumped by over $620 million, according to an official source. Much of this growth is attributed to token holdings, crypto-backed fundraising events, and the hype surrounding meme coins.

A private dinner held on May 22 provided major investors with early access to $TRUMP tokens. That dinner sparked debates about ethics in Congress.

Still, the numbers speak for themselves. Bitcoin, Ethereum, and Solana all saw gains in response to policy moves and public endorsements.

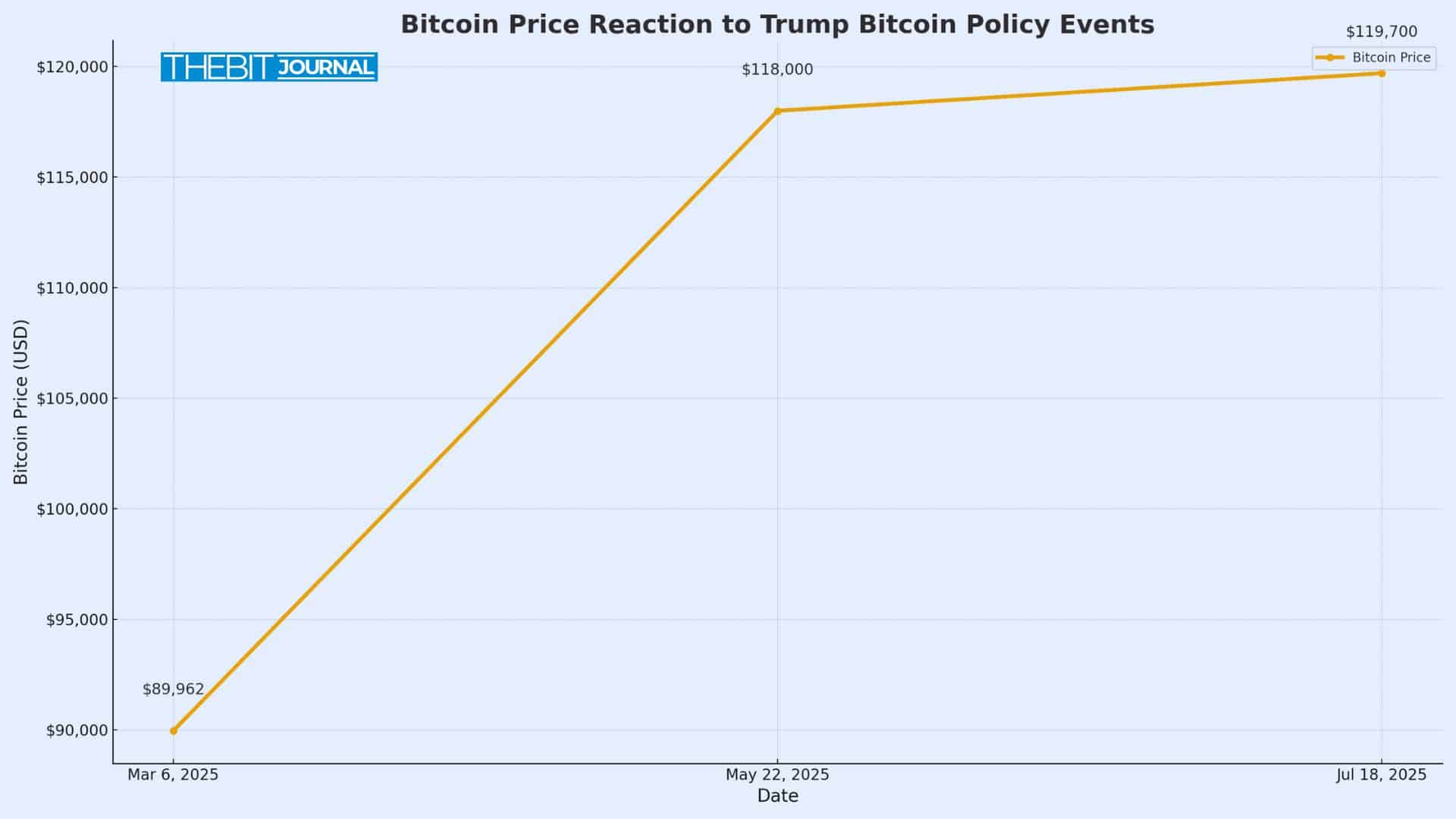

Price Reactions: Bitcoin’s Climb After Policy Shifts

Here’s a look at how Bitcoin responded to Trump’s key crypto announcements:

| Date | Event | Bitcoin Price (Approx.) |

|---|---|---|

| Mar 6, 2025 | Strategic Reserve Order Signed | $89,962 |

| May 22, 2025 | $TRUMP Token Dinner | $118,000 |

| Jul 18, 2025 | Genius Act Signed Into Law | $119,700 |

Crypto investors now use political calendars along with trading charts. In the current cycle, Trump Bitcoin policy is driving more than just headlines; it’s driving trades.

Source: CoinMarketCap, Yahoo Finance, TradingView

Conclusion

Based on the latest research, Trump Bitcoin policy is no longer a side note in crypto discussions; it’s a driving force shaping U.S. market direction, regulation, and investor sentiment. With initiatives like the Strategic Reserve and the Genius Act, the policy presents both opportunities and scrutiny. As crypto becomes a bigger part of government strategy, investors will need to watch not just the charts but the policies shaping them.

Summary

Trump Bitcoin policy is reshaping the U.S. crypto landscape through new laws, a national Bitcoin reserve, and strong market influence. The Genius Act sets clear rules for stablecoins, while Trump’s crypto holdings raise both interest and ethical questions. Bitcoin prices have responded to these shifts, gaining over 30%. As policy and crypto continue to overlap, investors are paying close attention to every move from the White House.

For more expert reviews and crypto insights, visit our dedicated platform for the latest news and predictions

FAQs

Q: What is Trump Bitcoin policy?

Trump’s Bitcoin policy includes creating a national reserve, signing the Genius Act, and supporting wider use of digital assets.

Q: What is the Genius Act?

It’s a new law that sets federal rules for stablecoins and crypto firms in the U.S.

Q: How much crypto does Trump hold?

Trump and his top officials hold at least $193 million in crypto, according to public reports.

Q: Has Bitcoin’s price changed due to policy?

Yes. Bitcoin has gained nearly 32% since Trump’s executive order on the Strategic Reserve.

Glossary of Key Terms

Bitcoin Reserve: Bitcoin held by the U.S. government for strategic use.

Stablecoin: A crypto token tied to the value of the U.S. dollar or other stable assets.

Executive Order: A legal order issued by the President of the U.S.

Memecoin: A digital token driven by community interest or pop culture.

Genius Act: A federal U.S. law for regulating stablecoins and digital assets.