According to the sources, President Donald Trump signed an executive order, establishing a Strategic Bitcoin Reserve for the United States. This initiative positions the U.S. as the first major economy to officially incorporate Bitcoin into its national reserves, signaling a significant shift in the government’s approach to digital assets.

Establishing a ‘Digital Fort Knox’

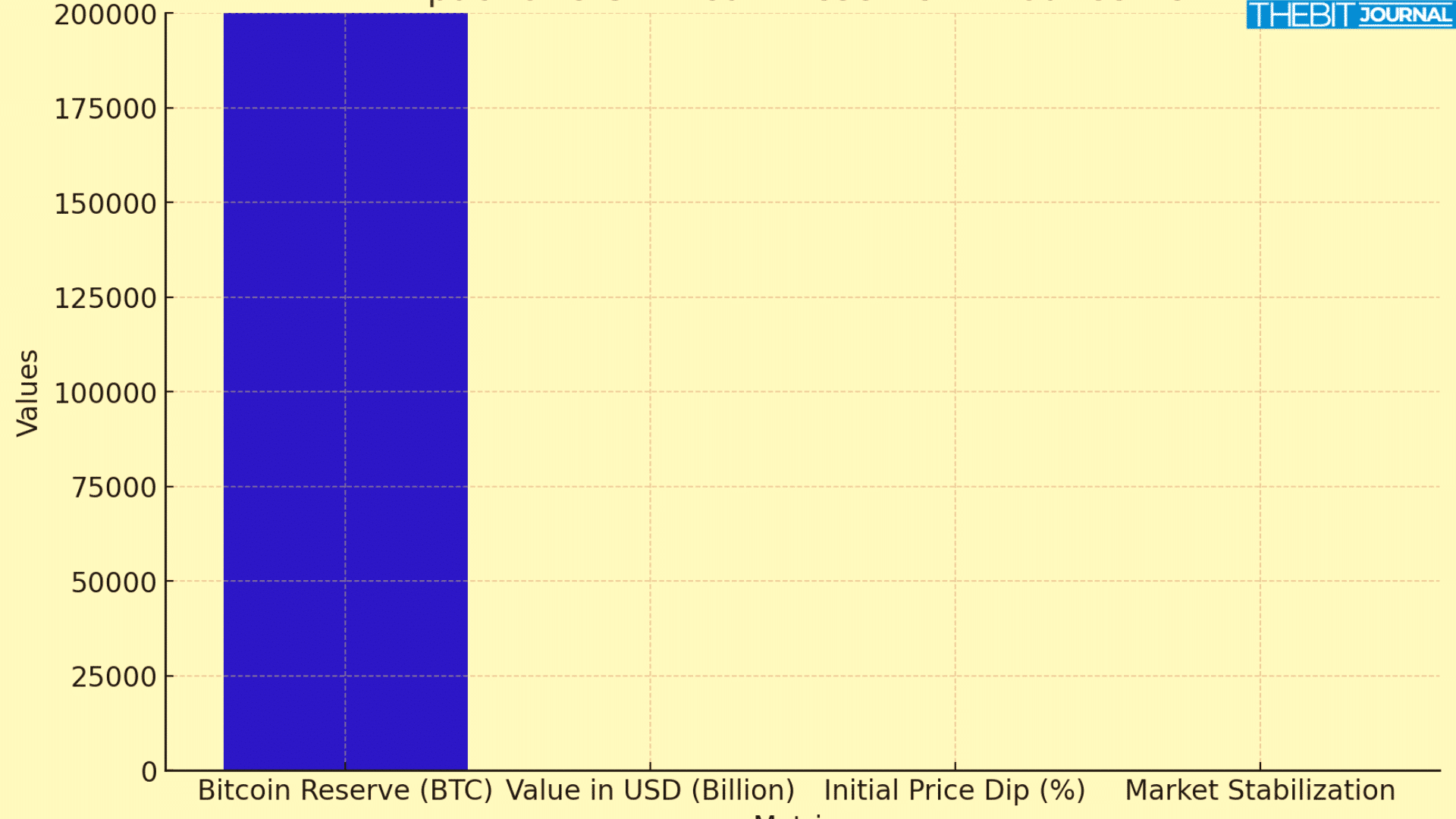

The Strategic Bitcoin Reserve will be initially funded by approximately 200,000 bitcoins, valued at around $17 billion, which were previously seized by U.S. authorities in various criminal and civil proceedings. Venture capitalist David Sacks, appointed as the administration’s “crypto czar,” likened the reserve to a “digital Fort Knox,” underscoring its potential to bolster America’s standing in the burgeoning cryptocurrency industry.

President Trump, who once expressed skepticism about cryptocurrencies, has since embraced their potential. At a recent White House “Crypto Summit,” he declared,

“We are going to ensure that the United States leads the world in digital currency innovation. This Strategic Bitcoin Reserve is a testament to our commitment.”

European Union’s Cautious Stance

Across the Atlantic, the European Union has exhibited a more reserved approach. European Central Bank (ECB) President Christine Lagarde has firmly stated that Bitcoin will not be included in the ECB’s reserves during her tenure, which extends until 2027. She cited concerns over Bitcoin’s volatility and its alignment with the ECB’s monetary policy objectives.

This divergence in policy has raised questions about the future of digital asset integration within traditional financial systems. While the U.S. moves toward embracing cryptocurrencies, the EU’s hesitation reflects broader debates about financial stability and innovation.

Market Reactions and Economic Implications

The announcement of the Strategic Bitcoin Reserve has had a notable impact on cryptocurrency markets. Bitcoin’s price experienced fluctuations, initially dipping by 6% following the news but subsequently stabilizing. Economists are divided on the long-term effects of this policy. Some argue that holding Bitcoin as a reserve asset could expose the U.S. to financial risks due to its price volatility. Others believe it could enhance the nation’s strategic position in the global digital economy.

Kevin O’Leary, a prominent investor and “Shark Tank” star, commented on the development, stating,

“With the establishment of this reserve, cryptocurrency is moving out of its ‘cowboy era’ and into a more regulated and institutionalized phase.”

Domestic Debates

Domestically, creating the Strategic Bitcoin Reserve has sparked debates among policymakers and financial experts. Supporters argue that it positions the U.S. at the forefront of financial innovation, potentially attracting investment and fostering technological advancements. Critics, however, express concerns about the lack of income generation from holding Bitcoin and the potential market implications if the government decides to liquidate its holdings in the future.

As the global financial landscape evolves, the U.S.’s bold move to integrate Bitcoin into its national reserves may prompt other nations to reevaluate their positions on digital assets. The coming years will reveal whether this strategy fortifies America’s economic standing or introduces unforeseen challenges.

Summing Up

In conclusion, the establishment of the Strategic Bitcoin Reserve marks a pivotal moment in the intersection of traditional finance and digital assets. As the U.S. leads this bold venture, the global community watches closely, weighing the benefits of innovation against the imperatives of financial stability.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the Strategic Bitcoin Reserve?

The Strategic Bitcoin Reserve is a U.S. government initiative to hold Bitcoin as part of its national reserves, aiming to strengthen the country’s position in the cryptocurrency industry.

How was the reserve funded?

The reserve was initially funded using approximately 200,000 bitcoins, valued at around $17 billion, which were seized by U.S. authorities in various criminal and civil proceedings.

What are the potential risks of this initiative?

Potential risks include Bitcoin’s price volatility and the lack of income generation from holding the asset, which could impact the financial stability of the reserves.

How has the European Union responded to this move?

The European Union, particularly the European Central Bank, has maintained a cautious stance, with no current plans to include Bitcoin in its reserves.

What could be the long-term implications of this policy?

The long-term implications could range from solidifying the U.S.’s leadership in digital finance to introducing financial risks associated with cryptocurrency volatility.

Glossary of Key Terms

Bitcoin: A decentralized digital currency without a central bank or single administrator, allowing peer-to-peer transactions.

Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of a central authority.

Digital Asset: Any asset that exists in a digital form, including cryptocurrencies, digital documents, and media files.

European Central Bank (ECB): The central bank for the eurozone, responsible for monetary policy affecting member countries.

Volatility: The degree of variation in the price of a financial instrument over time, indicating the level of risk associated with the asset’s price changes.