A decentralized finance (DeFi) initiative with ties to Donald Trump, World Liberty Financial (WLFI), has addressed concerns surrounding $60 million in Ethereum transfers. The company clarified that these movements are routine treasury management operations, dismissing rumors of asset liquidation.

Routine Operations, Not Liquidation

In a statement released on January 15, 2025, the WLFI team refuted claims of Ethereum sales, asserting that these actions are standard business operations:

“To be clear, we are not selling tokens—this is merely a reallocation of assets to maintain ordinary business operations. These actions are part of a robust, secure, and efficient treasury management process. Speculation is unnecessary; these are entirely standard practices.”

Blockchain Analysis Reveals Details

Blockchain analytics platform Lookonchain shed light on WLFI’s high-value transfers. According to their report, WLFI converted 103 Wrapped Bitcoin (WBTC) to Ethereum, generating approximately $9.89 million. Following this, 18,536 ETH (valued at $59.8 million) were transferred to Coinbase. Subsequently, WLFI used $1.7 million in USDT to acquire 17.62 WBTC.

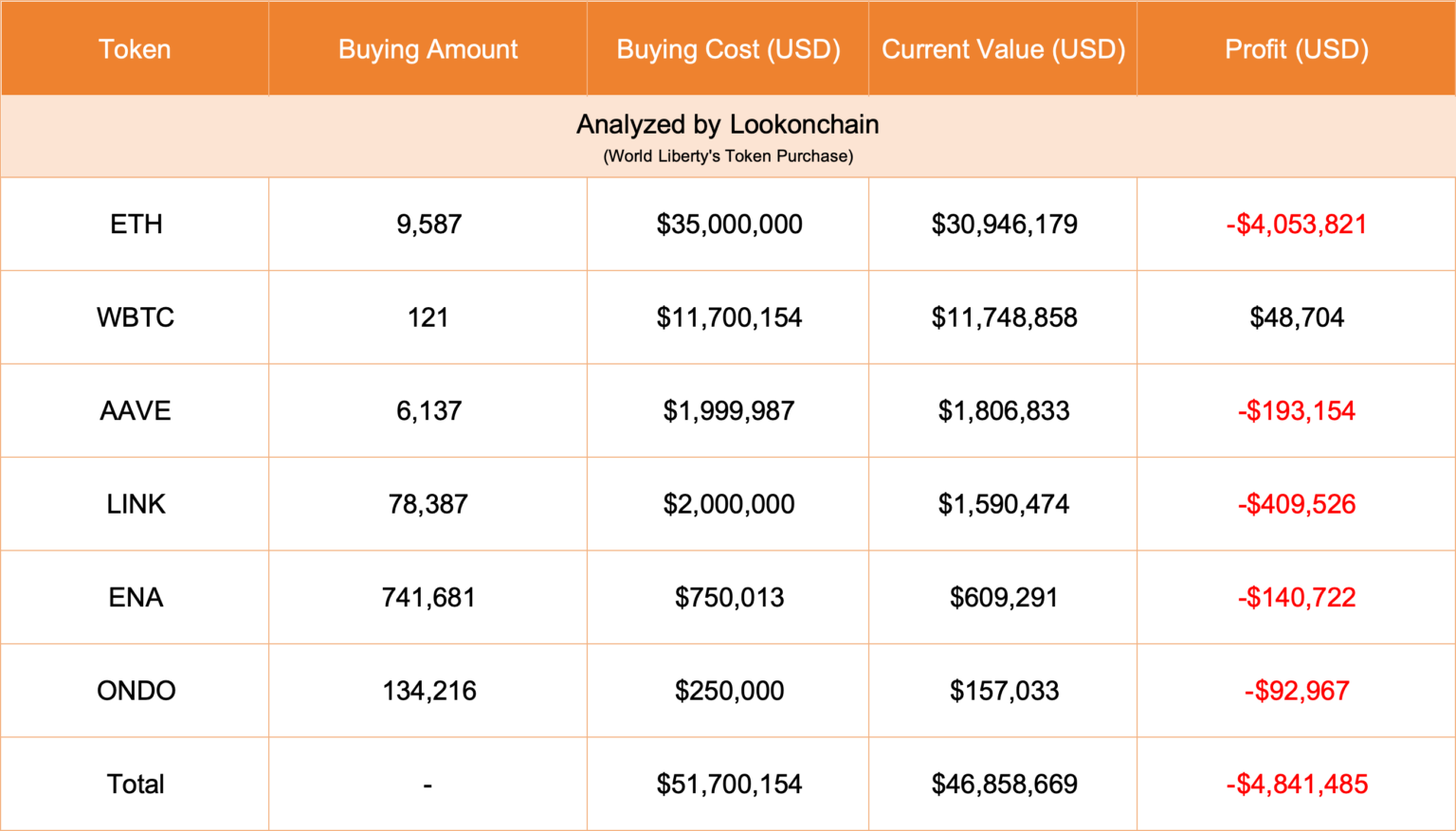

These transactions come after WLFI’s recent accumulation of DeFi tokens, including Aave, Chainlink, and Ondo. However, Lookonchain’s analysis suggests that these allocations resulted in a $5 million loss for the project.

WLFI’s Current Financial Position

Data from Arkham Intelligence indicates that WLFI’s wallet currently holds approximately $16.7 million in various assets. This marks the first major transaction since December. The activity aligns with the community’s approval of a proposal to launch a custom Aave v3 version for the platform.

Challenges and Adjusted Goals

Initially targeting $300 million in funding, WLFI revised its goal to $30 million due to unforeseen challenges. Despite the setback, the project met its target with backing from prominent crypto investor Justin Sun. Following Trump’s November election victory, WLFI token profits surged by 81%, with total profits now standing at $80.2 million, according to Dune Analytics.

WLFI’s Road Ahead

While World Liberty Financial continues to pursue ambitious plans within the decentralized finance ecosystem, recent losses and heightened speculation have placed its future moves under scrutiny. Enhancing transparency and increasing social media engagement will be crucial for regaining community trust and sustaining growth.

Key Takeaways

The Bit Journal will continue to monitor developments surrounding WLFI and other significant players in the DeFi space. Stay tuned for updates on projects shaping the crypto world.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!