Trump Media & Technology Group (TMTG), the corporate parent of Truth Social, is making moves in traditional finance as well as in the cryptocurrency space.

The company recently announced a $400 million stock buyback while also affirming that its massive $2.3 billion Bitcoin plan is still very much underway. And the buyback shares have seen a massive pump after the purchase.

These two releases demonstrate that Trump Media is serious about returning value to its shareholders and that it’s not giving up on its intent in the crypto arena.

$400 Million Stock Buyback

On June 23, the board of directors at Trump Media authorized a plan to buy back as much as $400 million in stock. The repurchase includes common stock as well as warrants, and all repurchased shares will be retired.

The repurchases will occur through open market transactions and comply with all of the regulations by the U.S. Securities and Exchange Commission (SEC).

CEO Devin Nunes described the action as a “vote of confidence” in the company’s long-term vision and financial health. As it has $3 billion in cash reserves, Trump Media claims that it can still make this buyback and have some space to expand.

Bitcoin Strategy Still Going Strong

As Trump Media made the announcement of the stock repurchase, it also comforted investors with the fact that its Bitcoin strategy is progressing. In May, the company raised $2.44 billion in an institutional investor private placement.

The funds were received from a combination of stock and zero-coupon convertible notes and were allocated primarily to construct a Bitcoin treasury, similar to what MicroStrategy has been doing.

This indicates that Trump Media desires to hold Bitcoin as part of its long-term budget, considering it a fundamental asset in its treasury.

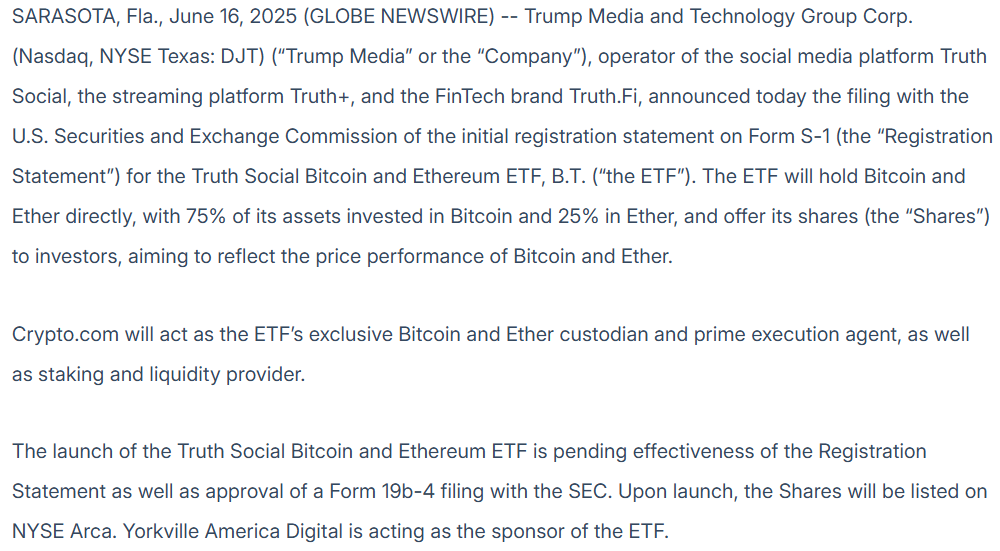

Filing for a Bitcoin and Ethereum ETF

June 16, weeks only after the funding news, Trump Media submitted documents with the SEC to initiate a Bitcoin and Ethereum ETF. The ETF would consist of 75% Bitcoin and 25% Ethereum and list on NYSE Arca. The custodian and trading agent would be Crypto.com.

The ETF would provide individual investors with an opportunity to invest in crypto via conventional markets, without the necessity of purchasing or holding digital coins themselves.

SEC Process After Gary Gensler

The SEC, led by Chairman Gary Gensler, has now opened up more to crypto products. Following decades of being put off and rejected, the SEC has finally approved some Bitcoin spot ETFs, including those from BlackRock and Fidelity. This shift has led more companies to apply for crypto ETFs with increased confidence.

For Trump Media, this more streamlined and accelerated approval process may accelerate its launch of an ETF, facilitating it to provide investors with exposure to digital assets via Truth.Fi, its fintech brand.

Trump Media’s Impact on Crypto Users

In the short run, Trump Media’s crypto has caused much publicity, particularly among political backers and individual investors. By pushing Bitcoin and seeking an ETF approval, the firm has raised visibility for cryptocurrency as a mainstream component of finance.

Certain users who earlier dismissed crypto have begun studying Bitcoin due to Trump Media’s publicly visible position. Its actions could also nudge more conservative or cautious audiences towards digital asset adoption.

Trump Media is not merely a social media platform anymore. It now has:

With these platforms and billions of dollars in backing, TMTG claims it has space to invest in both crypto and legacy finance. The company also dropped hints about potential future initiatives, such as repurchasing convertible notes or growing ETF offerings into other markets.

- Truth Social – Its centerpiece social media platform

- Truth+ – A streaming platform

- Truth.Fi – A fintech website venturing into crypto-based products

Summary

As Trump Media announced a $400 million stock buyback and reaffirmed its $2.3 billion Bitcoin strategy, indicating its commitment to conventional and digital finance. Trump Media has made a filing to introduce a Bitcoin and Ethereum ETF. Its intentions would pave the way for crypto to further enter mainstream finance.

Trump Media’s public steps in the short term have impacted crypto awareness and adoption among new user bases. As it expands through Truth Social, Truth+, and Truth.Fi, the company appears set to play a growing role in the evolving digital economy.

FAQs

1. What is Trump Media’s Bitcoin strategy?

Trump Media raised $2.3 billion to hold Bitcoin in its treasury. It wishes to hold Bitcoin as a long-term financial asset, just like MicroStrategy.

2. Will stock buyback impact Bitcoin plans?

No. The company stated that the two initiatives are self-funding. The $400 million buyback and the Bitcoin plan will proceed independently.

3. What is the SEC’s role in crypto ETF approval?

The SEC needs to approve any cryptocurrency ETF prior to launch. Since Chairman Gary Gensler took office, the process has been streamlined and transparent, allowing companies such as Trump Media to go faster.

Glossary

ETF (Exchange-Traded Fund):

An investment fund listed on stock exchanges, which can hold assets such as Bitcoin or Ethereum.

Buyback:

When a business buys back its own shares from the market, decreasing the overall number of shares and frequently raising the value of the remaining ones.

Treasury Strategy:

How a business holds its reserves or holdings—such as when a business has decided to hold Bitcoin rather than merely cash.

Sources