President Donald Trump is attempting to resuscitate cryptocurrency legislation in the House of Representatives. His support for the GENIUS Act, a critical law aimed at regulating stablecoins, may have a huge impact on the future of digital assets in the United States. With a pivotal vote looming, Trump’s influence is fueling the legislative effort, indicating a potential shift in the regulatory environment for cryptocurrencies.

What is the GENIUS Act and Why Does It Matter?

The GENIUS Act (Global Economic Network for Innovation and Unifying Standards) aims to regulate stablecoins, which are digital currencies tied to a reserve asset such as the US dollar. The measure mandates stablecoin issuers to keep full reserves and submit monthly transparency reports.

This legislation is intended to maintain stability and confidence in a sector that has grown critical for cross-border payments and decentralized finance (DeFi). The GENIUS Act establishes a legislative framework to guarantee that stablecoins are secure and dependable for users, boosting wider adoption.

Trump’s Role in the Crypto Legislation Debate

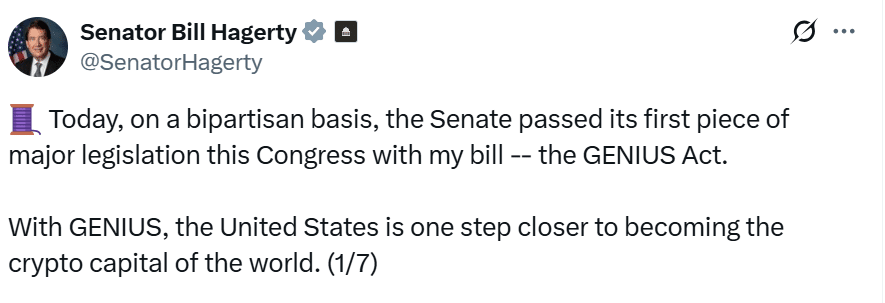

The GENIUS Act passed the Senate with bipartisan support, but it stopped in the House owing to procedural difficulties. Trump’s participation has been vital in resurrecting the legislation. He is asking Republican senators to support the measure as part of his “Make America Great Again” (MAGA) program.

Trump feels that regulating the cryptocurrency business is critical to retaining the US’s competitive advantage in the global digital economy.

“The GENIUS Act is a step towards ensuring that America remains at the forefront of the digital economy,” Trump said, emphasizing the need of clear standards.

The Broader Legislative Push for Crypto Regulation

The GENIUS Act is part of a bigger legislative push during “Crypto Week” in the House, alongside the CLARITY Act and the Anti-CBDC Surveillance State Act. The CLARITY Act proposes to define the SEC and CFTC’s duties in monitoring digital assets, whereas the Anti-CBDC Surveillance State Act wants to prohibit the federal government from launching a central bank digital currency (CBDC). These measures, taken together, reflect a wider plan for providing clarity and regulation to the United States’ expanding cryptocurrency sector.

Conclusion: A Turning Point for U.S. Crypto Regulation

Based on the latest research the GENIUS Act is part of a larger legislative campaign during “Crypto Week” in the House, which also includes the CLARITY Act and the Anti-CBDC Surveillance State Act. The CLARITY Act proposes defining the SEC and CFTC’s roles in overseeing digital assets, whereas the Anti-CBDC Surveillance State Act seeks to prevent the federal government from introducing a central bank digital currency (CBDC).

These initiatives, when taken collectively, indicate a broader strategy for bringing clarity and regulation to the United States’ growing cryptocurrency industry. Keep an eye on future updates of stablecoins.

FAQs

1. What is the GENIUS Act?

The GENIUS Act is a U.S. legislative proposal aimed at regulating stablecoins and ensuring transparency and security within the crypto market.

2. Why is Trump pushing for the GENIUS Act?

Trump believes the GENIUS Act is essential to keep the U.S. ahead in the global digital asset space and provide much-needed clarity for stablecoin issuers.

3. What other crypto bills are part of “Crypto Week”?

In addition to the GENIUS Act, the CLARITY Act and Anti-CBDC Surveillance State Act are also under consideration, focusing on regulatory clarity and blocking a central bank digital currency (CBDC).

4. How will the GENIUS Act affect the U.S. crypto market?

The GENIUS Act will create a regulatory framework for stablecoins, promoting transparency and trust, which could encourage wider adoption and innovation in the U.S. crypto industry.

Glossary of Key Terms

GENIUS Act: A legislative proposal to regulate stablecoins and set standards for transparency in the digital asset market.

Stablecoin: A cryptocurrency designed to maintain a stable value by being pegged to a reserve asset like the U.S. dollar.

CLARITY Act: A bill to clarify the roles of the SEC and CFTC in regulating digital assets.

Anti-CBDC Surveillance State Act: A bill preventing the U.S. government from issuing a central bank digital currency (CBDC).