Based on the latest reports, US President Donald Trump has announced 25% tariffs on Canadian and Mexican imports, effective March 4, 2025. The news spooked global markets and in crypto, Bitcoin fell to an intraday low of $91,362 following the announcement. As of the time of this publication, however, BTC just traded at $86,879. The tariffs were first announced on February 4, 2025, but were delayed 30 days after talks with Canadian PM Justin Trudeau and Mexican President Claudia Sheinbaum. With the deadline looming, both Canada and Mexico have allegedly threatened to retaliate if the tariffs go ahead.

Trump Tariff Effect: Market Chaos

Around 6 pm ET on Monday, as the tariff news spread, Bitcoin tanked. Market participants reacted fast to the Trump tariff effect, which not only hit crypto but also rocked US stock indices. Key players like Nvidia were down and the overall market was getting nutty.

Trump said during the announcement

“It will be very good for our country. Our country will be very rich again. The tariffs are going forward on time, on schedule. This has been an abuse that has been going on for many, many years. And I’m not even blaming the other countries that did this. I blame our leadership for allowing it to happen.”

This is Trump’s play to re-write US trade policy and it’s now spilling over into crypto. The Trump tariff effect is being watched closely to see if this is a long term correction or just short term volatility.

Bitcoin’s Price Drop Amid Tariffs

After Trump’s announcement, Bitcoin’s price dropped to $91,362 by 6:58 pm ET. Currently,i t’s down 7.2% in the last 24 hours at a price of $$86,879. Despite the bearishness, some notable voices in the crypto space like Michael Saylor of Strategy are buying the dip. He tweeted “Bitcoin is on sale” after his firm reportedly bought 20,356 BTC for $1.99 billion.

The derivatives market also reacted strongly to the Trump tariff effect. According to Coinglass data, $140 million in long positions were liquidated in 4 hours. This shows how the tariff news is forcing investors to rebalance their risk exposure in uncertain times.

Market Wide Reaction: Beyond Bitcoin

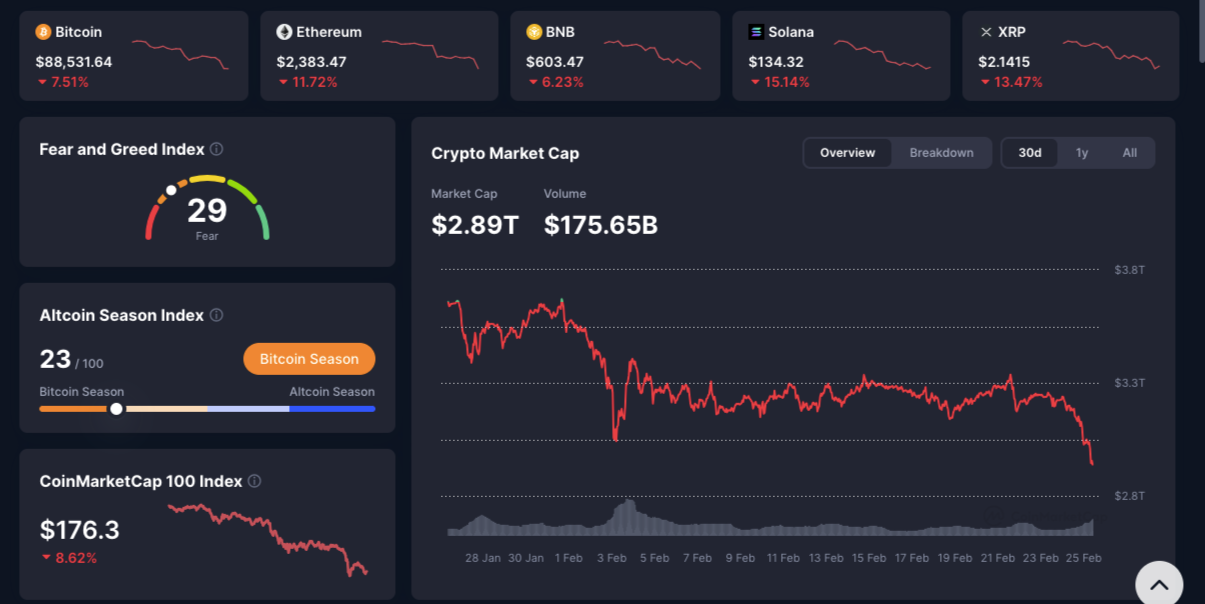

The Trump tariff effect is not limited to Bitcoin. The entire digital asset market saw its total market cap decline by over 6% and drop below $3 trillion to around $2.99 trillion.

Other cryptos were down too:

Ethereum (ETH): 11.72% down to $2,383.47

XRP: 13.47% down to $2.14

Solana (SOL): 15.14% down to $134.32

Market Data: Key Metrics

Here are the main metrics immediately after the tariff announcement:

| Metric | Value/Observation | Implication |

| Bitcoin Intraday Low | $91,362 | Reflects sharp sell-off due to tariff uncertainty |

| 24h Bitcoin Price Change | -4.8% | Indicates immediate market reaction |

| Monthly Bitcoin Price Change | -12.7% | Signals sustained bearish sentiment |

| Crypto Market Capitalization | ~$2.99 Trillion (down >6%) | Broad market contraction amid economic uncertainty |

| Derivatives Loss | $140M in long positions evaporated (within 4 hours) | Suggests rapid shift in investor sentiment |

| Trading Velocity | $126.66 Billion (up 85% from previous session) | Demonstrates heightened market activity |

| Bitcoin Market Share | 61% | Paradoxical rise as investors shift to perceived safety |

The Broader Impact of the Trump Tariff

The Trump tariff has implications beyond the short-term price action. A 25% tariff on Canadian and Mexican imports could trigger:

- Global Trade Impact: These tariffs will disrupt global trade flows and affect not only traditional markets but also digital asset markets that are increasingly tied to global economic policies.

- Supply Chains: Increased import costs will disrupt supply chains and affect industries that rely on cross-border trade.

- Inflation: Consumers will pay more for goods, inflation will rise.

- Investor Caution:The volatility in both crypto and stock markets means investors are more cautious now. This will lead to a temporary flight to safety and Bitcoin will be the less volatile option in a chaotic market.

- Regulatory Reassessment: Trump’s tariff may prompt regulators worldwide to reevaluate their stance on digital assets and create more robust long-term regulatory frameworks. As governments adjust to these changes, the crypto industry will see more clarity and stability in the long term.

Analysts warn of economic slowdowns in the affected countries and global spillover.

Deep Dive: Is This a Short-Term Blip or a Long-Term Shift?

The Trump tariff asks the question: Is this just a short-term setback or a long-term change in behavior? Analysts are split:

– Short-Term Volatility:

The immediate reaction—price drop, derivatives unwinding, increased trading velocity—shows investors are reacting to uncertainty. This will subside once investors digest the news and adjust their portfolios.

– Long-Term

Trump’s tariff strategy will force a re-set of risk across global markets. If trade gets more protectionist, investors will go to safer, more established assets like Bitcoin, even as altcoins get more volatile. And regulatory changes will bring more transparency and stability in the future.

Not all analysts agree. Michael Saylor sees this as a buying opportunity, others say the broader economic implications of the tariffs will mean a longer period of uncertainty.

Conclusion

Trump’s tariff has spooked the crypto market, Bitcoin is at intraday low as the broader market falls. This and the massive unwinding of derivatives and increased trading velocity shows the power of geopolitics on crypto markets.

Short-term is volatility and caution, long-term is uncertain. As trade gets tighter and regulators re-evaluate digital assets, the market could stabilize. Investors should monitor trading volume, market cap, technicals to see if this is a temporary blip or a fundamental change in the market.

Ultimately, Trump’s tariff reminds us of the interconnectedness of global economic policies and crypto markets. As investors navigate these choppy waters, stay informed and alert to capitalize on opportunities and mitigate risks.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What caused the drop?

Trump’s announcement of 25% tariff on Canadian and Mexican imports effective March 4, 2025 triggered investor panic and Bitcoin fell.

2. How did the tariff impact derivatives?

Within 4 hours of the announcement longs in Bitcoin derivatives were unwound, $140 million of positions were liquidated.

3.What are the implications of this tariff?

Trade will be disrupted, economic uncertainty will rise and investors will seek safe assets. This will also prompt regulators to re-evaluate digital asset markets.

4. Why is Bitcoin’s market share going up despite the price drop?

As investors become more risk averse due to geopolitics, Bitcoin is seen as a relatively safer asset than altcoins so its market share rises to 61%.

5. Is this Temporary or long-term?

Short-term is volatile, long-term is uncertain. The market is expected stabilize once investors adjust to the new trade policies and regulatory landscape.

Glossary

Derivatives Trading: Buying and selling financial contracts that are based on an underlying asset (BTC).

DEX Volume: Total volume on decentralized exchanges. A measure of market activity.

Market Capitalization: The total value of all cryptos. Calculated by price x supply.

Trading Velocity: How fast is trading happening? A measure of market sentiment and liquidity.

Institutional Investment: Big investors that move the markets.

References

Legal Disclaimer

This is not financial, investment or legal advice. Do your own research and consult with professionals before making any investment decisions.