After President Donald Trump signed the Strategic Bitcoin Reserve Executive Order (EO), the nation’s new Crypto Czar David Sacks clarifies the key aspects of the directive in an X posting. The announcement creates a new path for U.S. cryptocurrency management especially through how official digital asset storage works.

Sacks explained that under this new EO a specific Bitcoin reserve will be developed and the U.S. government must keep its seized Bitcoin holdings permanently. Under this new program the US Digital Asset Stockpile requires confiscation of digital assets before they can be put into the controlled holding facility. Sacks continued:

“The government will not acquire additional assets for the Stockpile beyond those obtained through forfeiture proceedings.”

U.S. Government’s Bitcoin Reserve: A Sign of Trust in Crypto?

Sack’s announcement brings up worries about the U.S. government’s future control of Cardano (ADA), XRP, and Solana (SOL). Despite no proven facts, many people believe the U.S. government stores such digital assets with its federal institutions.

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it…

— David Sacks (@davidsacks47) March 7, 2025

Research through blockchain analytics has failed to find any government wallets that hold listed cryptocurrencies. The government public record shows that they have been owners of seized Bitcoin for a long time.

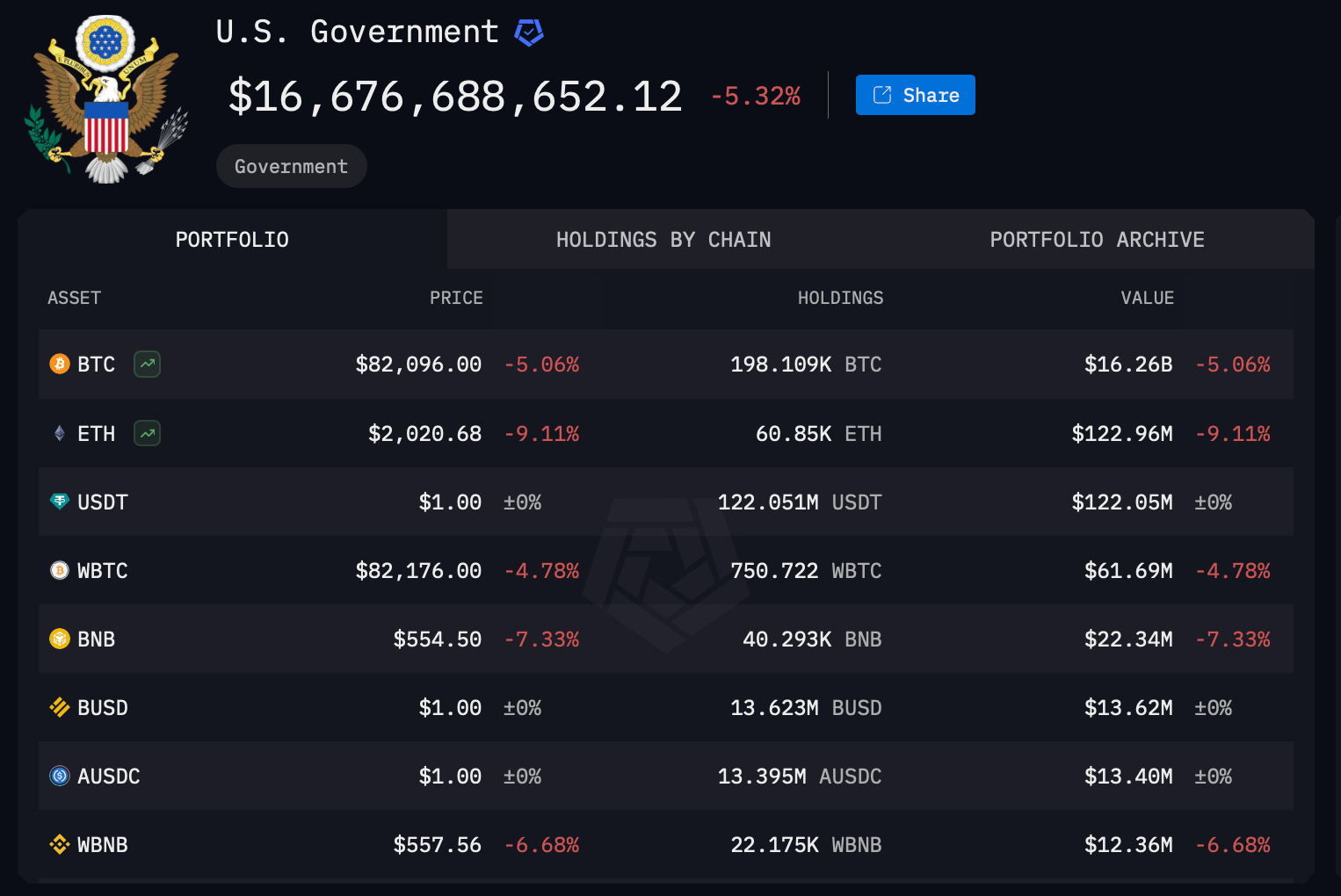

Current records show that U.S. authorities maintain possession of 198,000 Bitcoin tokens worth $16.26 billion according to current trading rates on cryptocurrency exchanges. The sizeable Bitcoin reserve shows the United States government trusts and depends on it like other governments do with their assets.

Ethereum and Wrapped Bitcoin: Key Assets in Federal Holdings

Federal agencies own Ethereum alongside Bitcoin and other stablecoins and manage these assets under their control. The government owned 60,850 ETH whose market value stood at $122.96 million according to present BTC exchange rates.

The available Bitcoin assets could produce 1,522.86 BTC through sale transactions. The authorities maintain about 122 million USDT on their balances which they can convert into 1,500 more bitcoins.

The government maintains wrapped bitcoin (WBTC) alongside its other digital assets. The government maintains 750.722 WBTC that presently holds $61.69 million. Since WBTC operates as digital Bitcoin representation experts cannot predict if the government will maintain its wrapped position or exchange it for original BTC.

Federal Agencies Manage Millions in BNB and Stablecoins

Official US authorities keep large amounts of Binance Coin (BNB) tokens in addition to several stablecoins and Binance Coin (BNB) in their reserves. The US government holds 40,293 BNB tokens in its managed wallets which have a value at $22.34 million. The government reserves would receive 276.86 BTC when the agencies sell their assets.

The federal agencies manage $13.62 million in Binance USD (BUSD), which, although phased out, can still be redeemed. When converted, the available funds generate 168.76 BTC.

The government maintains $13.40 million worth of AUSDC stablecoins which could be converted to generate 166.08 bitcoins. Based on their holdings above $1 million except AUSDC the government controls a digital money reserve of $49.97 million. Based on BTC exchange price the government holdings would create 619.27 Bitcoin ownership.

U.S. Crypto Policy Shifts Toward Bitcoin Accumulation

The government could collect 5,004.55 Bitcoin by converting all available assets except Bitcoin. The Strategic Bitcoin Reserve concept gives David Sacks the option to move some digital assets from their current portfolio into Bitcoin for better management.

This presidential directive creates a major milestone in how the US government handles cryptocurrencies. The government seems to want to gather more Bitcoin into its digital assets pool at this time with its new strategy not yet defined. Trump now sees Bitcoin as part of national financial reserves and wants to control government investments in other cryptocurrencies.

Conclusion

The Strategic Bitcoin Reserve Executive Order changed how the U.S. government handles crypto policies, especially because it now focuses on getting more Bitcoin supplies rather than other types of digital currency. The government now holds 198,000 BTC plus ETH assets, while steady coins along with these crypto assets further demonstrate its faith in Bitcoin as a national financial market investment.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. What is the Strategic Bitcoin Reserve EO?

It creates a U.S. Bitcoin reserve and prevents selling confiscated BTC while establishing a stockpile for other seized digital assets.

2. What crypto does the U.S. government hold?

It holds 198,000 BTC, ETH, USDT, WBTC, BNB, and stablecoins, some of which may be converted to BTC.

3. Will the government sell its crypto?

BTC won’t be sold, but other assets like ETH and BNB may be liquidated or converted to BTC.

Glossary of Key Terms

- Strategic Bitcoin Reserve EO – Trump’s order to establish a U.S. Bitcoin reserve.

- Bitcoin Reserve – The U.S. government’s stockpile of Bitcoin.

- U.S. Digital Asset Stockpile – Seized digital assets excluding Bitcoin.

- Forfeiture Proceedings – Legal process of seizing assets.

- Portfolio Management – Adjusting crypto holdings, like swapping altcoins for Bitcoin.