The crypto market is bracing for turbulence as traders await U.S. President Donald Trump’s White House Crypto Summit on Friday. With speculation mounting that Trump may formally announce a U.S. Bitcoin Strategic Reserve, the stakes for digital assets have never been higher.

According to analysis from STS Digital, options data from Deribit suggests that Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are in for a volatile weekend, with traders preparing for major price swings. The latest figures indicate that BTC could move as much as $5K in either direction, while ETH and SOL are expected to see fluctuations of $135 and $13, respectively.

Market sentiment remains mixed as traders assess the potential impact of Trump’s crypto policies. Could this summit solidify Bitcoin’s status as a reserve asset, or will uncertainty drive a new wave of sell-offs?

Options Markets Flash High Volatility Warnings for BTC, ETH, and SOL

Options pricing provides a valuable insight into market expectations, and current data suggests that crypto traders are positioning for heightened volatility post-summit.

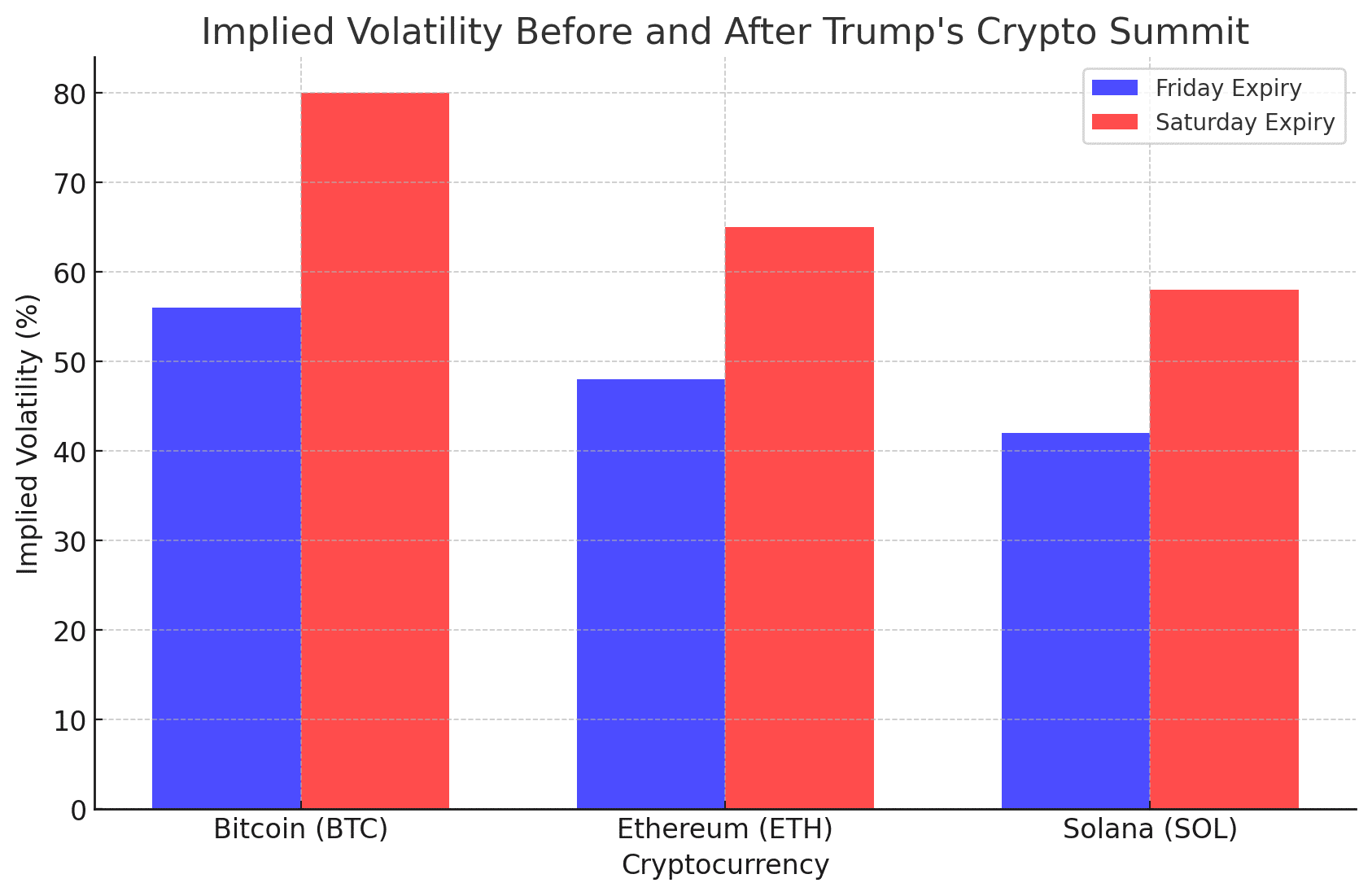

As of early Thursday, Bitcoin options expiring Friday were trading at 56% implied volatility, while Saturday expirations surged to 80%. The 24-point gap between Friday and Saturday reflects elevated expectations for price turbulence, particularly in the hours following the White House event.

A similar trend can be seen in Ethereum and Solana, with traders on Deribit pricing in increased forward volatility. These metrics, derived from options pricing, predict the size of expected price fluctuations over a given time period.

STS Digital’s Jeff Anderson, head of Asia, highlighted this sharp divergence in implied volatility, explaining:

“Options markets are showing the nerves (and illiquidity) going into the weekend and the raft of potentials. The Friday vs Saturday IV spread is nearly 25 vols wide across the board, with Friday expiries missing the expected variance.”

This means that while traders are expecting high volatility, there is uncertainty around how significant the actual price movement will be.

Implied Volatility & Expected Price Swings Post-Trump’s Crypto Summit

The following table highlights the implied volatility for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) before and after Trump’s White House Crypto Summit, as well as the expected price movement for each asset based on options market data.

| Cryptocurrency | Implied Volatility (Friday Expiry) | Implied Volatility (Saturday Expiry) | Expected Price Swing ($) |

| Bitcoin (BTC) | 56% | 80% | $5,000 |

| Ethereum (ETH) | 48% | 65% | $135 |

| Solana (SOL) | 42% | 58% | $13 |

This data suggests that Bitcoin is set for the most dramatic price movement, with a potential swing of $5,000 in either direction. Ethereum and Solana are also expected to experience heightened volatility, though their projected price fluctuations are significantly smaller compared to BTC.

These volatility spikes indicate that traders are preparing for major market reactions following the summit, as uncertainty surrounding Trump’s crypto policies remains high.

Bitcoin’s Strategic Reserve Rumors Add to Market Speculation

One of the biggest catalysts for this anticipated volatility is growing speculation that Trump will formally announce a Bitcoin Strategic Reserve at the summit.

This follows earlier reports suggesting that the administration was exploring a basket of crypto assets, including Bitcoin, Ethereum, XRP, Solana, and Cardano. However, recent rumors indicate that the focus may shift exclusively to Bitcoin, potentially marking a historic shift in U.S. financial policy.

If Trump does confirm plans for a Bitcoin reserve, it could fuel institutional demand and drive prices higher. On the flip side, if expectations are not met, markets could react negatively, leading to a sharp sell-off.

Expert Insights: How Traders Are Positioning for the Summit’s Fallout

As anticipation builds, crypto analysts are weighing in on the likely market response. Some believe that the hype surrounding Trump’s summit will lead to a short-term rally, while others warn that options data could be overstating the expected volatility.

Jeff Anderson, Head of Asia at STS Digital:

“Quite often, large expected volatility like this is a disappointment in crypto as expectations > reality. That said, the breakevens do not feel large, and options are by far the safest play for directional views in this environment.”

Elaine Murphy, Crypto Market Analyst:

“If Trump’s announcement is as impactful as expected, we could see BTC testing new highs quickly. However, if the market overestimates the significance of the summit, expect a retracement shortly after the hype fades.”

Paul Matthews, Derivatives Expert:

“Options data suggests traders are betting on a major BTC move this weekend. Whether it breaks bullish or bearish depends on Trump’s messaging and how institutions react.”

Final Verdict: Will Bitcoin and Crypto Markets React as Expected?

With Bitcoin set for a potential $5K swing, the crypto community is on high alert as the White House summit approaches. While options data signals massive implied volatility, historical trends show that the reality often falls short of expectations.

The key question remains: Will Trump’s crypto announcement deliver a bullish catalyst, or will traders sell the news?

For now, investors should prepare for a weekend of uncertainty, keeping a close watch on key resistance and support levels. With the summit likely to shape market sentiment in the weeks ahead, this event could be a defining moment for Bitcoin’s role in the global financial system.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is Bitcoin expected to swing $5K after Trump’s crypto summit?

Options pricing data suggests high implied volatility, meaning traders expect major price movement post-summit. If Trump announces a Bitcoin Strategic Reserve, BTC could rally, but uncertainty could also trigger a sell-off.

2. What role do options play in predicting Bitcoin price moves?

Options markets provide forward-looking insights into volatility expectations. A sharp increase in implied volatility often signals that traders anticipate large price swings, though actual moves may be smaller than expected.

3. How will Ethereum and Solana react to the White House summit?

Like Bitcoin, ETH and SOL options indicate elevated volatility. ETH could see a $135 price movement, while SOL may fluctuate by $13. These assets often follow BTC’s lead.

4. Should traders expect a major market reaction post-summit?

While historical trends show that hype often exceeds reality, the potential announcement of a U.S. Bitcoin reserve could be a game-changer. Traders should watch for Trump’s official statements and institutional responses.

Glossary

Implied Volatility (IV): A metric derived from options pricing that reflects the market’s expectations for future price fluctuations.

Forward Volatility: A measure comparing the implied volatility of options with different expiration dates to forecast price swings.

Bitcoin Strategic Reserve: A rumored initiative where the U.S. government would hold Bitcoin as part of its national reserves.

Straddle Breakeven: A pricing model that estimates the price movement needed for an options trade to break even.