President Trump’s recent decision to impose major import tariffs has reverberated around the world. Aiming to tackle problems like unlawful border crossings and narcotics smuggling, the contentious steps target goods from Canada, China, and Mexico.

According to the source, for better or worse, the cryptocurrency mining sector now faces uncertain times ahead as downstream effects begin to emerge. Some operations may see expenses rise or international partnerships strained. Others could benefit if production shifts stateside. Only time will tell how political winds continue to reshape entire industries and global trade relations in profound and unpredictable ways.

Tariffs Take Center Stage

Effective February 1st, 2025, the United States has enacted a complex web of tariffs that will have surprising repercussions throughout the cryptocurrency sector. A 25% duty now burdens imports from Canada and Mexico, while 10% tariffs target a wide array of Chinese goods. On their face, these protectionist policies aim to shield traditional industries from foreign competition. However, subtle knock-on effects will roil the mining industry and challenge even its largest global players.

American miners, deeply reliant on imported hardware, stare down an uncertain future. Soaring costs for essential ASIC mining rigs and GPUs threaten to swell operational expenses for all but the hardiest domestic operations. Currently, behemoths like Bitmain and feisty Canaan, both based in China, lord over the specialized integrated circuit and graphics card markets.

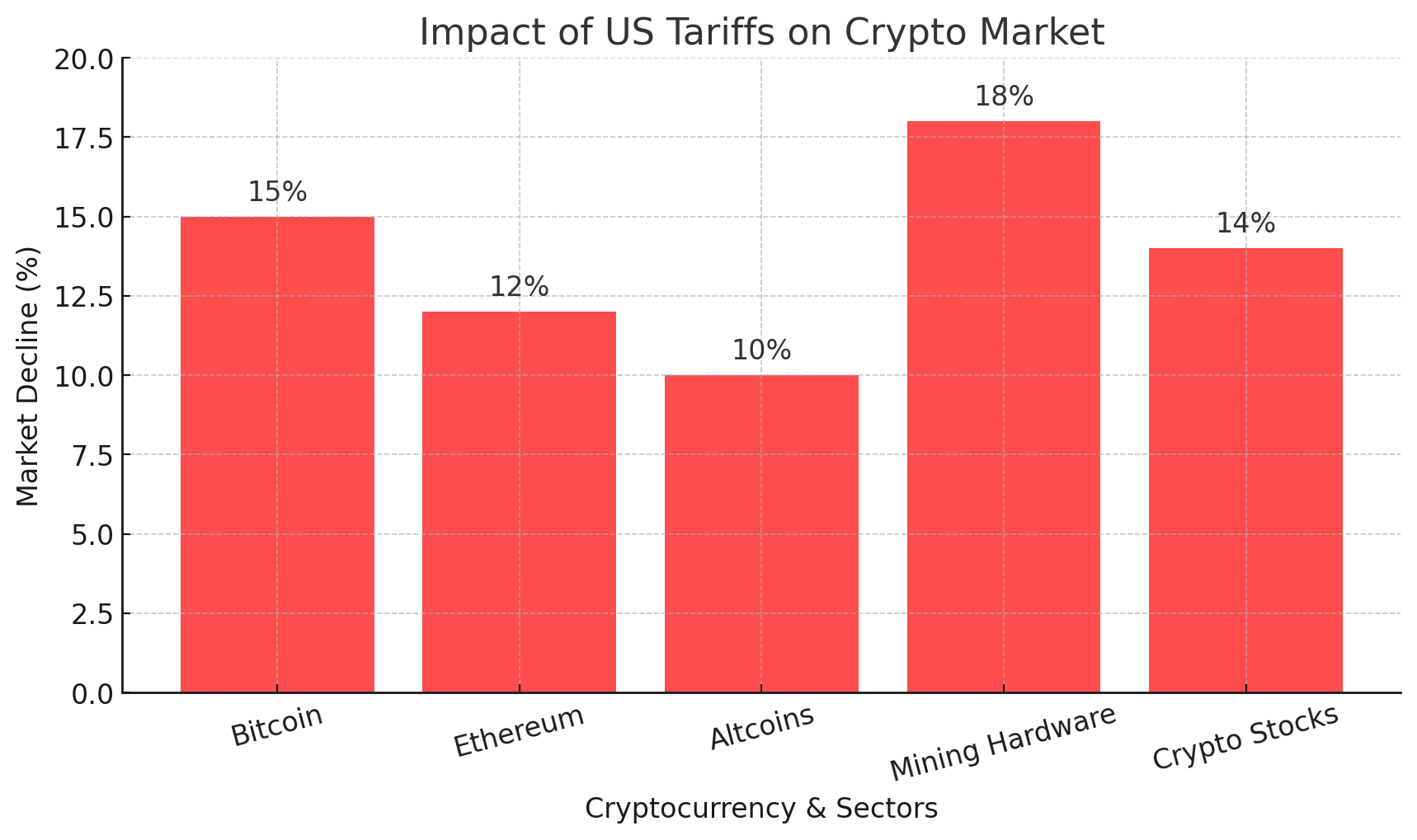

Market Turbulence: Cryptocurrencies React

The cryptocurrency sphere has not remained unaffected. Bitcoin, the pioneering digital money, underwent a noteworthy decline, plummeting below $100,000 to a three-week bottom of $91,441.89. Ether, another top cryptocurrency, fell to $2,494.33, marking its lowest point since early September. Experts attribute these downward trends to trader unease over a possible worldwide trade feud sparked by the new tariffs. The intrinsic volatility of cryptocurrencies renders them particularly vulnerable to such macroeconomic shifts. As one marketplace analyst observed,

“Investors are on edge, and the specter of a trade war pours fuel on the flames.”

Retaliation on the Horizon: Canada and Mexico Respond

In a swift response, both Canada and Mexico announced retaliatory measures against the United States. Prime Minister Justin Trudeau declared a 25% tariff on goods worth $155 billion from America, emphasizing that

“We will not back down from defending Canada.”

Mexico’s President Claudia Sheinbaum echoed this view, enacting comparable tariffs on US products. She stated

“I directed my economy minister to carry out the contingency plan we’ve been developing, which involves tariff and non-tariff countermeasures to safeguard Mexico’s interests.”

These actions underscore the escalating tensions and onset of a commercial dispute among neighboring nations.

Broader Economic Implications

Beyond the direct impact on cryptocurrency mining operations, the broader economic implications are substantial. Increased costs of imported hardware could discourage new entrants to the mining industry and squeeze profit margins for existing players. Moreover, the retaliatory tariffs from Canada and Mexico risk interrupting supply chains, affecting a range of industries beyond crypto. Economists warn that protracted trade conflicts could lead to higher consumer prices and strained international ties. As one analyst noted,

“The full extent of these impacts will depend on how long the trade dispute lasts and whether it gets resolved.”

Exploring the Uncertainty Ahead

As the situation unfolds and uncertainty looms large, stakeholders across industries must strategize responses nimbly. Cryptocurrency companies may explore shifting supply chains or considering domestic manufacturing to counterbalance tariffs’ impacts. Investors should gird for ongoing volatility and appraise risk exposure with acuity. In these cloudy times, foresight and proactive maneuvering will prove pivotal to weathering challenges ahead.

In closing, President Trump’s recent tariffs have set reactions in motion with far-flung implications. While aimed at addressing pressing national matters, these actions have woven novel complexities into the global economic fabric. The cryptocurrency mining sector and beyond must now wrestle with these changes and chart a course ahead through the evolving landscape. Adaptability and contingency planning will serve firms well as dynamics shift under their feet.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. How do Trump’s tariffs impact cryptocurrency mining?

The tariffs increase the cost of importing mining hardware, making operations more expensive for US-based miners who rely on Chinese-made ASICs and GPUs.

2. Why are Canada and Mexico retaliating against the US tariffs?

Both countries imposed counter-tariffs to protect their economies, escalating trade tensions and potentially affecting global supply chains, including crypto hardware distribution.

3. Will these tariffs cause Bitcoin and other cryptocurrencies to crash?

While Bitcoin and Ether have already dropped in value, long-term effects depend on how prolonged the trade war is and how investors react to market uncertainty.

4. Can US crypto miners avoid these increased costs?

Some miners may switch to domestic suppliers like MicroBT’s US segment, but overall, alternative options are limited, and higher prices are expected.