In early February 2025, President Donald Trump reignited global trade tensions by imposing significant tariffs: 25% on imports from Canada and Mexico, and 10% on goods from China. These measures, aimed at protecting domestic industries, have introduced substantial volatility into the cryptocurrency markets, underscoring the intricate relationship between macroeconomic policies and digital asset valuations.

Immediate Market Reactions

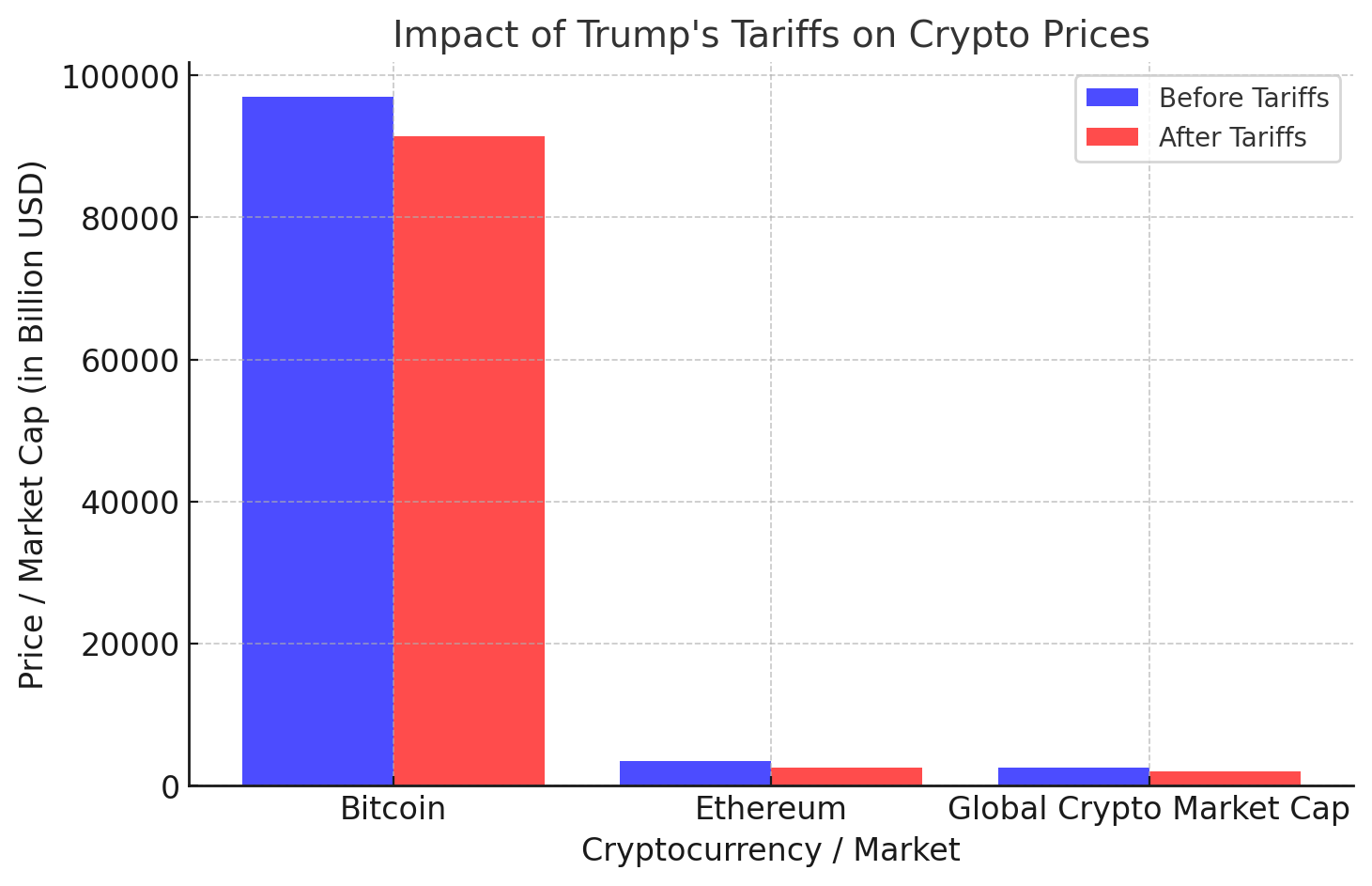

The announcement of these tariffs had a swift and pronounced impact on the crypto market. On the announcement day, the market experienced a sharp sell-off, with Bitcoin’s price dropping to a three-week low of $91,441.89 before stabilizing around $95,730.35, marking a 6.2% decline for the day.

Ethereum, the second-largest cryptocurrency by market capitalization, saw a more severe downturn, losing nearly 25% of its value since the previous Friday, settling at $2,592.14. This sell-off erased over $500 billion from the global crypto market capitalization, highlighting the susceptibility of digital assets to geopolitical events.

Mechanisms of Impact

Tariffs function as taxes on imported goods, making them more expensive for consumers and businesses. This increase in costs can lead to higher consumer prices, contributing to inflationary pressures. In response to rising inflation, central banks may adopt tighter monetary policies, such as increasing interest rates, to curb spending.

Higher interest rates can strengthen a nation’s currency as investors seek better returns on investments denominated in that currency. For the cryptocurrency market, particularly Bitcoin, which is often viewed as a hedge against currency devaluation, a stronger U.S. dollar can reduce its appeal, leading to price declines.

Investor Sentiment and Cypto Market Dynamics

The imposition of tariffs also fosters uncertainty in global markets. Investors, wary of potential trade wars and their economic repercussions, may shift away from riskier assets, including cryptocurrencies, in favor of traditional safe havens like gold or government bonds. This flight to safety can exacerbate sell-offs in the crypto market. Additionally, the interconnectedness of global supply chains means that tariffs can disrupt business operations, leading to broader economic slowdowns. Such slowdowns can dampen speculative investments, further pressuring cryptocurrency prices.

Long-Term Implications

While the immediate effects of tariffs have introduced volatility, some analysts posit that prolonged trade disputes could enhance the attractiveness of decentralized financial systems. As traditional markets grapple with policy-induced uncertainties, cryptocurrencies might emerge as alternative assets insulated from centralized economic policies. However, this potential shift is contingent on various factors, including regulatory responses, technological advancements, and broader adoption of digital assets.

Conclusion

President Trump’s recent tariff implementations have underscored the sensitivity of cryptocurrency markets to macroeconomic policies. As global trade dynamics evolve, digital asset participation must remain vigilant, recognizing that geopolitical events can have profound and immediate impacts on market valuations. Balancing short-term volatility with long-term potential requires a nuanced understanding of both global economic policies and the intrinsic characteristics of cryptocurrencies.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. How do Trump’s tariffs impact the cryptocurrency market?

Trump’s tariffs create economic uncertainty, leading to market volatility. Investors may sell riskier assets like cryptocurrencies, causing price swings in Bitcoin and altcoins.

2. Why did Bitcoin and Ethereum drop after the tariff announcement?

The tariffs triggered fears of a global economic slowdown. Investors shifted funds to safer assets, weakening demand for crypto and leading to a sell-off.

3. Could a trade war push more people toward Bitcoin?

Possibly. If tariffs weaken fiat currencies or cause inflation, Bitcoin could become more attractive as a decentralized hedge against traditional financial instability.

4. What is the relationship between tariffs, inflation, and crypto?

Tariffs can raise prices on goods, leading to inflation. In response, central banks may hike interest rates, strengthening fiat currencies and reducing Bitcoin’s appeal as an alternative investment.

5. Is this market dip a buying opportunity for crypto investors?

It depends on individual risk tolerance. Some investors see volatility as a chance to buy Bitcoin at lower prices, while others prefer to wait for market stabilization.

Glossary of Key Terms

Tariffs – Taxes imposed on imported goods, often used to protect domestic industries or influence trade balances.

Trade War – Economic conflict between nations where they impose tariffs and trade barriers against each other.

Market Volatility – Rapid and significant price movements in financial markets, often triggered by economic or geopolitical events.

Safe Haven Asset – An investment that retains or increases in value during market turbulence (e.g., gold, U.S. bonds, Bitcoin in some cases).

Inflation – The rate at which the price of goods and services rises, reducing the purchasing power of money.

Fiat Currency – Government-issued money (like USD, EUR) that isn’t backed by a physical commodity but relies on trust in the government.

Hedge – An investment made to reduce risk, often used to protect against inflation or market downturns.

Sell-Off – A rapid sale of assets, leading to a price drop due to panic or strategic market movements.

Interest Rates – The cost of borrowing money, controlled by central banks to influence economic growth and inflation.

Macroeconomic Policy – Government or central bank strategies that impact an economy’s performance, including trade tariffs, interest rates, and inflation control.

Sources