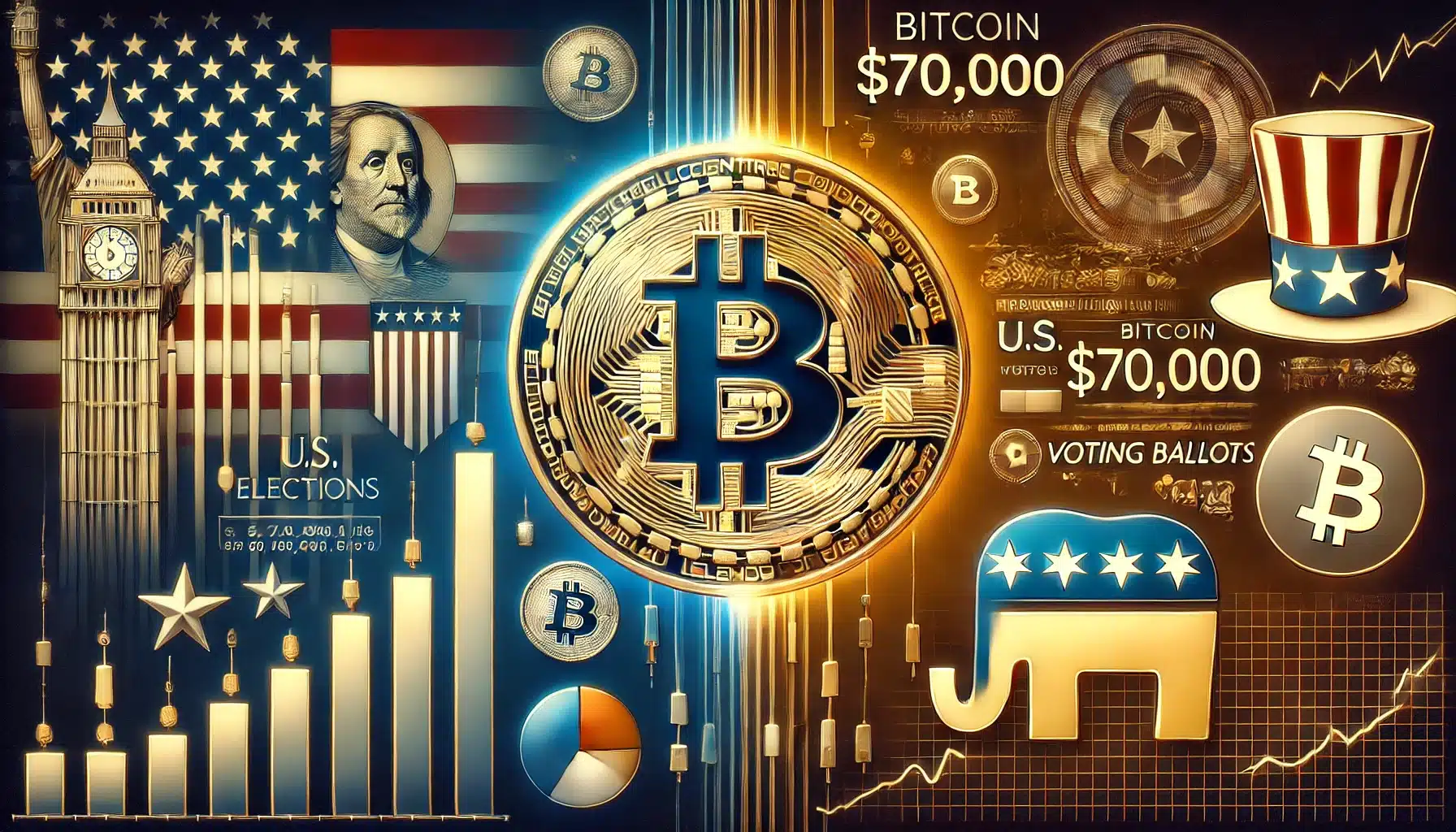

As investors focus on the upcoming U.S. presidential elections, Bitcoin continues to push toward the critical $70,000 level. Markets are closely watching how the election results and the Federal Reserve’s interest rate decisions will impact the world of crypto.

Bitcoin Nears the $70,000 Resistance

As The Bit Journal has reported, Bitcoin is once again approaching the key $70,000 mark, a level it has tested multiple times. Presto Research analyst Min Jung highlights that this level serves as an important psychological barrier. With Bitcoin’s all-time high of $73,700 in March still fresh in investors’ minds, the anticipation for a further rise is growing.

As Bitcoin approaches this crucial level, investors are turning their attention to the U.S. elections, where Bitcoin is playing a more prominent role than ever before. No longer just an investment asset, crypto has become directly tied to political outcomes.

U.S. Presidential Elections and Crypto: What’s the Connection?

The crypto world is watching the upcoming U.S. presidential elections closely. Donald Trump’s increasing chances of victory have sparked excitement in the markets. Known for his pro-crypto stance, Trump has publicly supported Bitcoin and Web3 technologies. On the other hand, his opponent Kamala Harris has shown interest in regulating crypto, though Trump’s policies resonate more with a broader group of investors.

Polymarket data shows Trump with a 60% chance of winning, while polls from FiveThirtyEight indicate a slim lead for Harris. This tight race underscores the importance of the election results for crypto investors.

What Would a Trump Victory Mean for Bitcoin and Crypto?

According to Augustine Fan of SOFA.org, a Trump victory would be the most favorable outcome for the crypto market. Fan believes Trump’s crypto-friendly policies could ease regulatory pressure on digital assets. With a Republican-controlled Congress, Trump’s digital asset reform plans would likely pass more easily.

Experts also predict that a Trump win could create greater opportunities in crypto mining and decentralized finance, developments that could positively impact Bitcoin and other digital asset prices.

Post-Election Economic Developments

Another major event following the U.S. elections is the Federal Open Market Committee’s (FOMC) interest rate decision. According to CME Group’s FedWatch tool, there is a strong chance of a 25 basis point rate cut. Analyst Min Jung suggests that if this cut materializes, Bitcoin (BTC) could gain further momentum.

As Bitcoin approaches the $70,000 level, both the election results and Fed decisions will play a critical role in shaping the price direction in the coming weeks. Investors should closely monitor these developments.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!