What Is “Crypto Week”?

The U.S. House leadership has carved out July 14–18 for a five-day sprint branded “Crypto Week,” a rare instance where the floor agenda is devoted almost entirely to digital-asset legislation. During that window lawmakers expect to debate and vote on three high-profile bills: the Digital Asset Market CLARITY Act, the Senate-approved GENIUS Act for stablecoins, and the Anti-CBDC Surveillance State Act.

Organizers, including Speaker Mike Johnson and Digital Assets Subcommittee chair French Hill, argue the dedicated calendar will give members the time needed to resolve lingering questions around token classification, stablecoin reserves, and whether the Federal Reserve should ever issue a retail central-bank digital currency.

Bill-by-Bill Breakdown

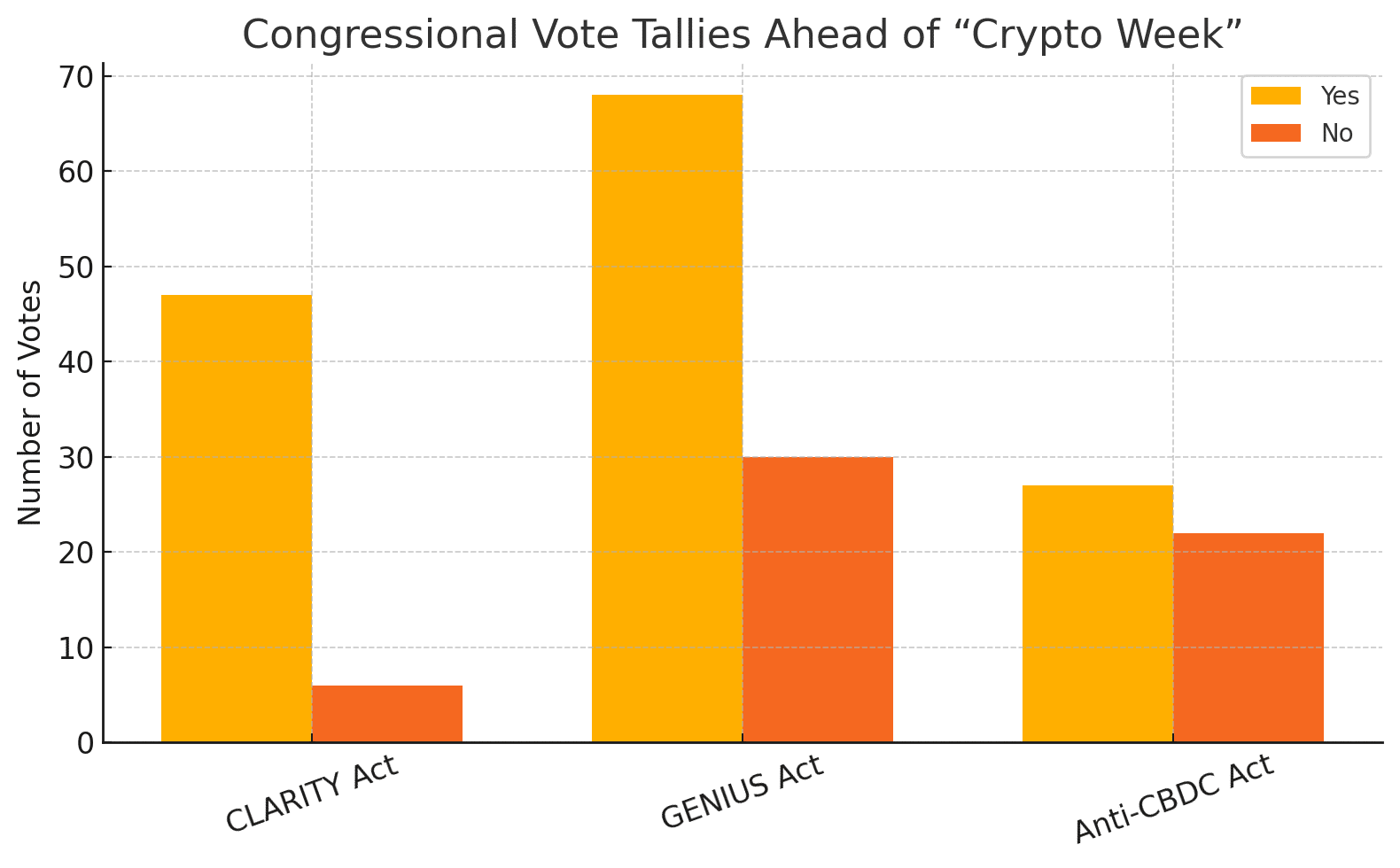

The CLARITY Act emerged from the Financial Services and Agriculture Committees with a 47-6 bipartisan vote in June. It would split primary oversight of the spot crypto market between the Commodity Futures Trading Commission and the Securities and Exchange Commission, establish issuer-disclosure rules, and create a pathway for networks to transition from securities status to commodities once sufficiently decentralized.

House sponsors say the measure mirrors many provisions in last year’s FIT21 draft yet adds stronger consumer-protection language.

Across the Capitol, the Senate cleared the GENIUS Act in mid-June on a 68-30 vote. Framed as the government’s first attempt at a comprehensive stablecoin charter, the bill would require dollar-backed reserves held at insured banks or in short-term Treasuries, impose monthly attestation rules, and grant the Federal Reserve veto power over any state-licensed issuer deemed risky to financial stability.

Supporters believe the framework could unlock mainstream payments adoption, while critics say it could crowd out smaller projects that cannot meet capital thresholds.

The Anti-CBDC Surveillance State Act seeks to bar the Federal Reserve from launching a retail CBDC or offering direct accounts to citizens, reflecting privacy concerns among many Republicans. Although narrower than the other two measures, its backers argue it is essential to ensure any public digital dollar would require explicit congressional authorization.

Political Context and Perspectives

House Republican leaders have pitched Crypto Week as part of a broader pro-innovation plank they hope to pass before the August recess, aligning the agenda with former President Trump’s vocal support for looser crypto rules.

Yet several Democrats warn that coupling a market-structure bill with a stablecoin bill and an anti-CBDC measure risks overloading the calendar and forcing members to take bundled votes that could stall in the Senate if altered.

Industry associations, meanwhile, are split: exchanges largely back CLARITY, payments companies push for tweaks to GENIUS, and civil-liberties groups lobby against any absolute CBDC ban, arguing it could hamstring future monetary-technology experiments.

Broader Implications

If enacted, the three bills could give the United States its first comprehensive statutory framework for digital assets, something analysts say might draw large institutional investors who have remained on the sidelines amid regulatory ambiguity. Clearer asset-class definitions could reduce litigation between the SEC and token issuers, while a federally recognised stablecoin regime might accelerate banks’ entry into on-chain settlement.

What to Watch This Week

Between now and July 14, House leadership will decide whether to bring each bill under a single rule or schedule separate debates to allow more amendments. Lobbying is intense: large exchanges want a de minimis exemption for retail transfers added to CLARITY, regional banks are pressing to loosen GENIUS’s Fed-oversight triggers, and privacy advocates plan to push a floor amendment narrowing the Anti-CBDC ban to a five-year moratorium.

Should any bill receive substantial changes, Senate sponsors have signalled a willingness to conference, but that could delay final passage into the fall. Regulatory agencies are already drafting contingency guidance in case only one or two measures clear both chambers.

Summary

Taken together, Crypto Week offers Congress an opportunity to answer three foundational questions in digital-asset policy: what makes a token a security or a commodity, how dollar-pegged stablecoins should be supervised, and whether a U.S. retail CBDC belongs in the monetary toolkit. CLARITY is positioned as the market-structure cornerstone, GENIUS as the payments pillar, and the Anti-CBDC Act as a privacy safeguard. Their progress failure will set the tone for American crypto regulation for years to come.

FAQs:

1. What is Crypto Week in the U.S. Congress?

Crypto Week is a scheduled period where the U.S. House debates and votes on major crypto-related bills.

2. What are the key bills in Crypto Week?

The three main bills are the CLARITY Act, GENIUS Act, and the Anti-CBDC Surveillance State Act.

3. Why is Crypto Week important for the crypto market?

It could define future U.S. crypto regulations, affecting stablecoins, token classification, and digital dollar development.

Glossary of Key Terms:

CLARITY Act: A proposed law to define whether crypto tokens are securities or commodities and assign clear oversight roles to U.S. agencies.

GENIUS Act: A bill focused on regulating stablecoins, including reserve requirements and federal oversight.

Anti-CBDC Act: Legislation aimed at blocking the development of a U.S. Central Bank Digital Currency (CBDC).

Stablecoin: A cryptocurrency pegged to a stable asset like the U.S. dollar to minimize price volatility.

CBDC (Central Bank Digital Currency): A digital currency issued by a central bank, functioning as legal tender in digital form.

Token Classification: The process of determining whether a digital asset is a security, commodity, or other financial instrument under U.S. law.