The U.S. Department of Housing and Urban Development (HUD) is exploring the integration of blockchain technology and stablecoins to enhance its operations. This initiative aims to improve transparency and efficiency in tracking grants and financial disbursements. While some officials are optimistic about the potential benefits, others express concerns regarding the implementation and associated risks.

Understanding Blockchain and Stablecoins

Blockchain is a decentralized digital ledger that securely records transactions across a network of computers. Its transparency and immutability make it appealing for applications requiring trust and verification. Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging them to a reserve asset, such as a fiat currency like the U.S. dollar. This stability makes them suitable for transactions where volatility is a concern.

HUD’s Proposed Pilot Project

HUD’s Community Planning and Development (CPD) office, responsible for funding affordable housing and homeless shelters, is considering a pilot project to utilize blockchain technology. The project would involve tracking financial disbursements to a single grantee using blockchain, aiming to enhance transparency and efficiency in grant monitoring.

Internal Reactions and Concerns

Within HUD, reactions to the proposed integration are mixed. Proponents believe that adopting blockchain could streamline operations and provide clearer oversight of fund allocation. However, critics argue that the plan could be “dangerous and inefficient,” highlighting potential complications and the volatility associated with stablecoin payments.

Official Stance and Clarifications

Despite internal discussions, a HUD spokesperson clarified that the department currently has no plans to implement blockchain or stablecoin technologies, stating, “Education is not implementation.”

Broader Federal Interest in Digital Assets

HUD’s exploration aligns with a broader federal interest in digital assets. The current administration has shown openness to cryptocurrency adoption, with policy advisors advocating for blockchain as a cost-cutting tool. Additionally, the U.S. Treasury Department is evaluating a regulatory framework for stablecoins to ensure the U.S. dollar’s dominance as the world’s reserve currency.

Global Examples of Digital Currency Integration

Other countries are also exploring digital currencies and blockchain integration. For instance, India launched the Digital Rupee (e₹), a central bank digital currency (CBDC), to promote a cashless economy and enhance payment systems. The Digital Rupee aims to reduce the costs associated with physical currency management and improve financial inclusion.

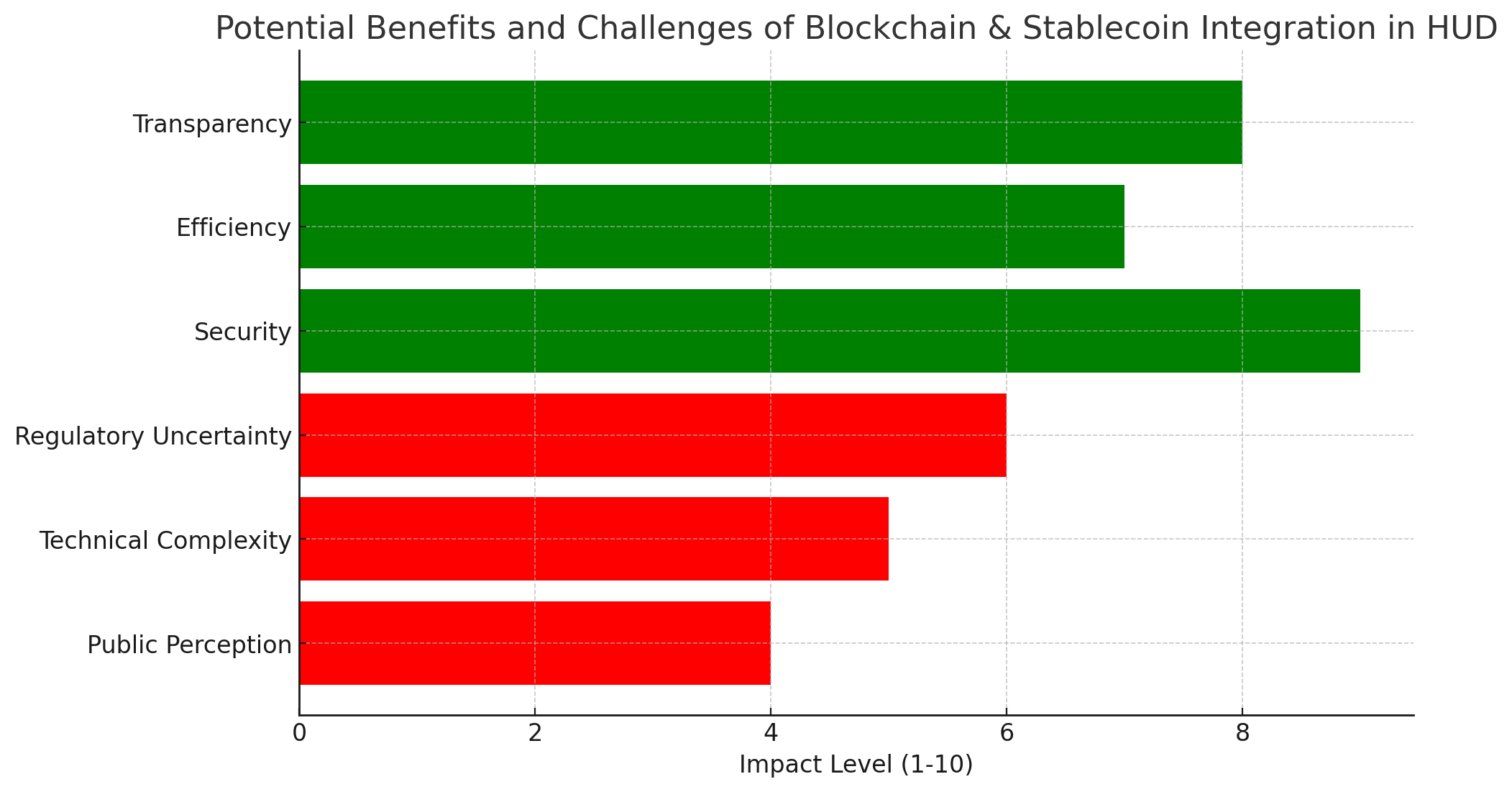

Potential Benefits of Blockchain in Government Operations

Integrating blockchain technology into government operations can offer several benefits:

Transparency: All transactions are recorded on a public ledger, reducing opportunities for fraud and corruption.

Efficiency: Automating processes can reduce administrative overhead and expedite transactions.

Security: The decentralized nature of blockchain makes it resistant to tampering and cyberattacks.

Challenges and Considerations

Despite its potential, integrating blockchain and stablecoins into government operations presents challenges:

Regulatory Uncertainty: The evolving nature of cryptocurrency regulations can create compliance challenges.

Technical Complexity: Implementing new technologies requires significant infrastructure changes and staff training.

Public Perception: Concerns about privacy and the misuse of digital currencies can affect public trust.

Conclusion on the U.S.’ Move

HUD’s consideration of blockchain and stablecoins reflects a growing interest in leveraging emerging technologies to improve government operations. While the potential benefits are significant, careful consideration of the associated risks and challenges is essential. As discussions continue, the experiences of other countries and agencies can provide valuable insights into best practices and potential pitfalls.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is blockchain technology?

Blockchain is a decentralized digital ledger that securely records transactions across a network of computers, ensuring transparency and immutability.

What are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve asset, such as a fiat currency like the U.S. dollar.

Why is HUD considering blockchain and stablecoins?

HUD is exploring these technologies to enhance transparency and efficiency in tracking grants and financial disbursements.

Are there concerns about integrating these technologies?

Yes, some officials express concerns about potential complications, volatility associated with stablecoins, and the overall efficiency of such integration.

Is HUD currently implementing blockchain and stablecoins?

No, HUD has clarified that there are no current plans to implement these technologies; discussions are in the exploratory stage.

Glossary of Key Terms

Blockchain: A decentralized digital ledger that records transactions across a network of computers.

Stablecoin: A type of cryptocurrency designed to maintain a stable value by pegging it to a reserve asset.

Central Bank Digital Currency (CBDC): A digital form of a country’s fiat currency issued by its central bank.

Cryptocurrency: A digital or virtual currency that uses cryptography for security.

Fiat Currency: Government-issued currency that is not backed by a physical commodity but rather by the government that issued it.

References

ft.com