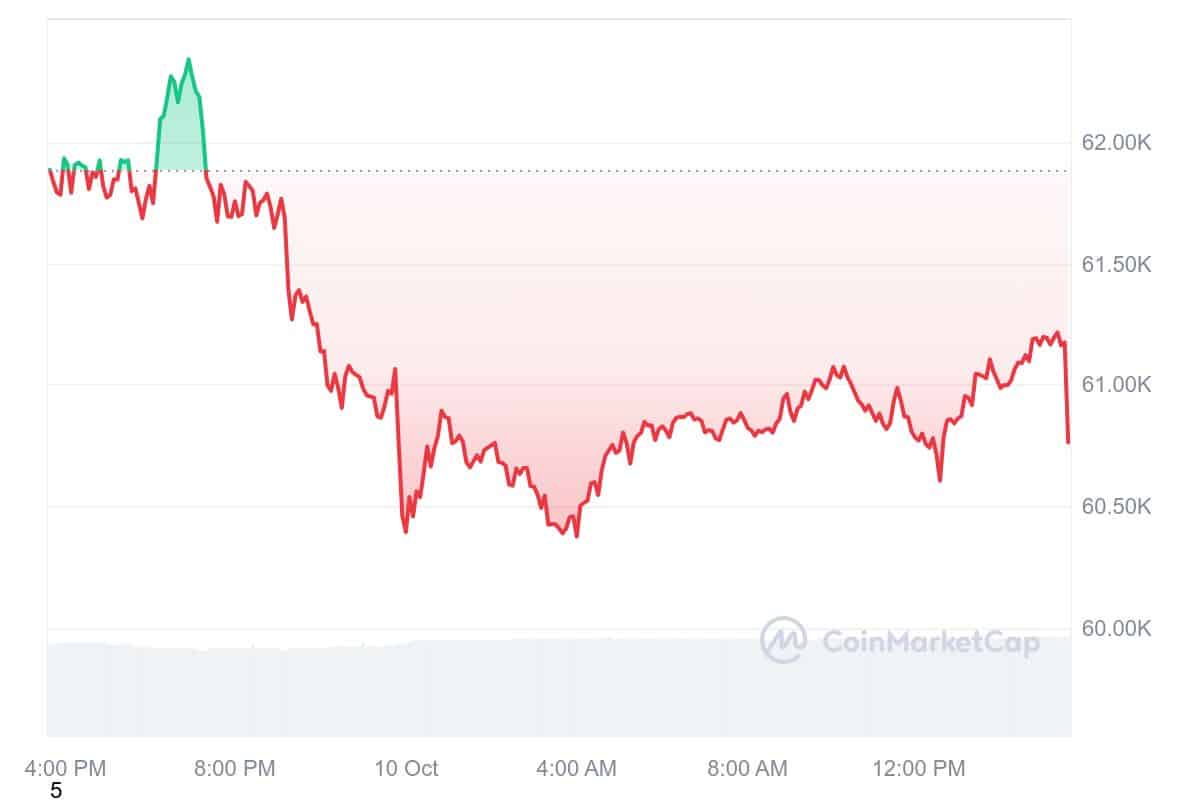

As Bitcoin (BTC) continues to experience volatility, it faces a battle to maintain the $60,000 level. The crypto markets remain highly sensitive to U.S. economic data, particularly the Federal Reserve’s interest rate decisions. Today’s release of U.S. inflation data was one of the key factors that experts were watching closely for clues about Bitcoin’s future movements. Analysts emphasize that the U.S. Consumer Price Index (CPI) and Core CPI data are critical for predicting future market trends. Additionally, the Federal Reserve’s interest rate decision in November is being viewed as a potential game-changer for Bitcoin.

U.S. Inflation Data in Focus

Today, the U.S. inflation data was released, providing a crucial snapshot of the country’s economic health. The annual CPI came in at 2.4%, close to the expectation of 2.3%, down from the previous reading of 2.5%. The monthly CPI was 0.2%, meeting expectations. More striking was the Core CPI—a key inflation indicator closely monitored by central banks. On an annual basis, the Core CPI was 3.3%, slightly higher than the expectation of 3.2%. This data suggests inflation remains persistent, which could complicate forecasts for potential rate cuts.

QCP: Yesterday’s Fed meeting minutes revealed a less dovish tone. Combined with last Friday’s strong payroll data, market has increased their bets of a 25bps rate cut in November to 83.7% chance from 67.9% last week. While US equities indices rallied last night with the S&P 500…

— Wu Blockchain (@WuBlockchain) October 10, 2024

The Federal Reserve’s interest rate decisions have a profound impact on crypto markets. Recent data, along with the Fed’s statements, have directly influenced Bitcoin and other cryptocurrencies. The next Fed meeting in November is being closely watched, as it could set the tone for the remainder of the year. The strong employment data and higher-than-expected inflation have dampened expectations for a rate cut. Currently, the probability of a 25 basis point rate cut stands at 83.7%, up from 67.9% last week.

However, following recent economic reports, this likelihood could increase even further. While the S&P 500 continues to rise, reaching a new high, the crypto market is not sharing the same optimism. The renewed selling pressure on Bitcoin and Ethereum (ETH) is driven by news of Silk Road-related BTC sales and PlusToken-linked ETH liquidations.

Despite the pressure, analysts still believe that if Bitcoin holds above the $60,000 support, an anticipated “Uptober” rally could still happen.

Key Data and Year-End Projections

This week’s most significant risk factors for the market are the upcoming U.S. CPI and PPI data, alongside major banks’ earnings reports. These will play a crucial role in determining the direction of the Fed’s next interest rate decision. As markets anticipate more rate cuts, investors are positioning to lock in returns at these low levels and prepare for a potential year-end rally. However, analysts warn that a more hawkish tone from the Fed could lead to further market volatility.

According to QCP Capital, the combination of easing inflation and a strong U.S. labor market may lead investors to adopt a more cautious approach in the coming months. The outcome of these critical data points will likely shape the market’s direction.

For more in-depth crypto market analysis, stay tuned to The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!