The “Cryptoqueen” has not been seen since 2017, as investigative authorities worldwide continue to seek information on her whereabouts. In an Aug. 7 ruling, the United Kingdom’s High Court of Justice issued a Worldwide Freezing Order against Ruja Ignatova, popularly known as the “Cryptoqueen,” and several of her alleged accomplices in the OneCoin schem

Victims Unite for Justice

More than 400 victims of the OneCoin collapse came together to petition the court to freeze the assets of Ignatova, OneCoin co-founder Sebastian Greenwood, Christopher Hamilton, and Robert MacDonald. These individuals are alleged to have helped launder funds on behalf of OneCoin, along with four influencers who advertised OneCoin to the public. Additionally, business entities Ignatova allegedly used to launder funds from OneCoin and purchase assets have also been subjected to the worldwide asset freeze.

The Saga of the Cryptoqueen

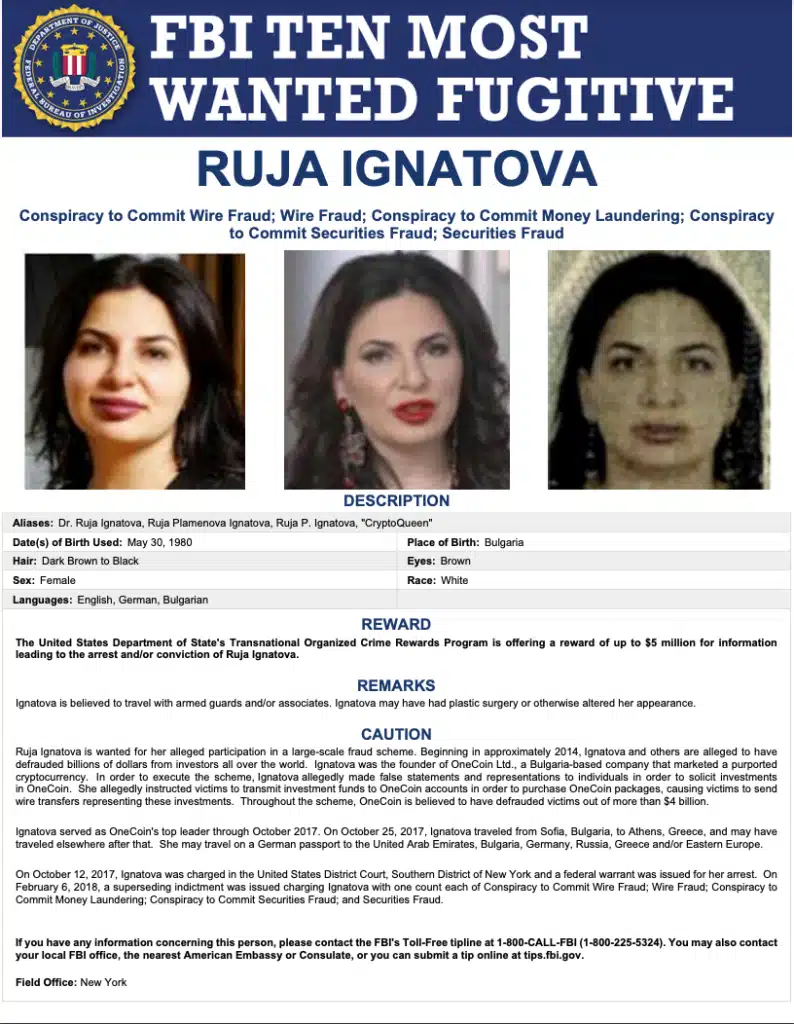

Ruja Ignatova is alleged to have defrauded investors in an apparent $4 billion Ponzi scheme from the inception of OneCoin in 2014 until the 2017 collapse of the fraudulent project and the disappearance of Ignatova. The Cryptoqueen was last seen in Athens, Greece in 2017 and has not been seen since, prompting the Federal Bureau of Investigation (FBI) to place her on their Ten Most Wanted list.

In January 2024, the United States State Department offered a $5 million reward for information leading to the capture and conviction of Ignatova, though alleged sightings of Ignatova remain elusive, and the whereabouts of the Cryptoqueen likewise remain unknown.

Konstantin Ignatov, Ruja’s brother, pleaded guilty to money laundering and fraud in 2019. The OneCoin accomplice faced a maximum sentence of 90 years behind bars for his role in the Ponzi scheme. However, he was freed after three years and sentenced to time served after cooperating with US investigators and testifying against OneCoin lawyer Mark Scott in court.

In 2019, Scott was found guilty on charges related to bank fraud and money laundering. He received a much lighter sentence than the 17 years US prosecutors argued was appropriate. OneCoin co-founder Karl Greenwood was also found guilty in 2023 and received a 20-year sentence for his role in the scheme. Greenwood was also forced to surrender the $300 million in payments he received from facilitating the OneCoin fraud.

Nexera Burns Stolen Tokens Following Hack

In another significant development in the crypto world, Nexera, a decentralized finance (DeFi) protocol, has burned 32.5 million of its native NXRA tokens involved in a recent hack as part of efforts to address the incident and enhance security. According to an X post by blockchain security firm PeckShieldAlert, these 32.5 million NXRA tokens have been permanently removed from circulation.

Nexera’s official X account announced several steps taken to address the hack, concluding their technical investigation and determining that their smart contracts were not compromised. However, to mitigate the damage caused by the exploit, the Nexera team quickly froze the remaining 32.5 million NXRA tokens in the attacker’s wallet after concluding that only $440,000 of the total NXRA tokens transferred were effectively compromised. Burning 32.5 million NXRA tokens was an important action aimed at supporting the stability of the Nexera ecosystem.

The Nexera Hack

On Aug. 7, Nexera was exploited in a smart contract security incident, resulting in the theft of $1.5 million worth of digital assets, including NXRA tokens. The protocol, which aims to bridge DeFi with traditional finance, was the target of a coordinated attack that affected multiple projects and protocols.

The hacker stole 47 million NXRA tokens, valued at approximately $1.76 million, and began selling a portion of them for Ether (ETH). They also transferred some funds to the BNB Chain. The total estimated loss was around $1.5 million.

According to updates provided by Nexera, the exploit was part of a broader coordinated attack targeting multiple projects and protocols. The protocol said there was no need to issue a new NXRA token, and the existing token address would remain the same. Users were strongly advised to refrain from trading. Given that the attacker had already engaged with exploit-related addresses on KuCoin and MEXC, these exchanges suspended their services, including deposits, withdrawals, and trading. Additional exchanges were also notified and urged to take similar action.

Conclusion

The Ruja Ignatova asset freeze marks a significant step towards justice for the victims of the OneCoin scheme. As investigations continue and legal actions unfold, the cryptocurrency world remains vigilant against fraud and security breaches, exemplified by the swift actions taken by Nexera to mitigate their recent hack. The search for the elusive Cryptoqueen continues, with authorities and the public eagerly awaiting any new developments in her case. Stay tuned for more updates on this evolving story on The Bit Journal