According to the report, Ukraine is gearing up to legalize crypto by the first quarter of 2025. This initiative, led by Danylo Hetmantsev, head of the Ukrainian Parliament’s Committee on Finance, Tax, and Customs Policy, aims to regulate digital assets while ensuring fiscal responsibility.

“We aim to pass this law and legalize cryptocurrency in the first quarter,”

Hetmantsev announced during the Domestic Investment Opportunities forum.

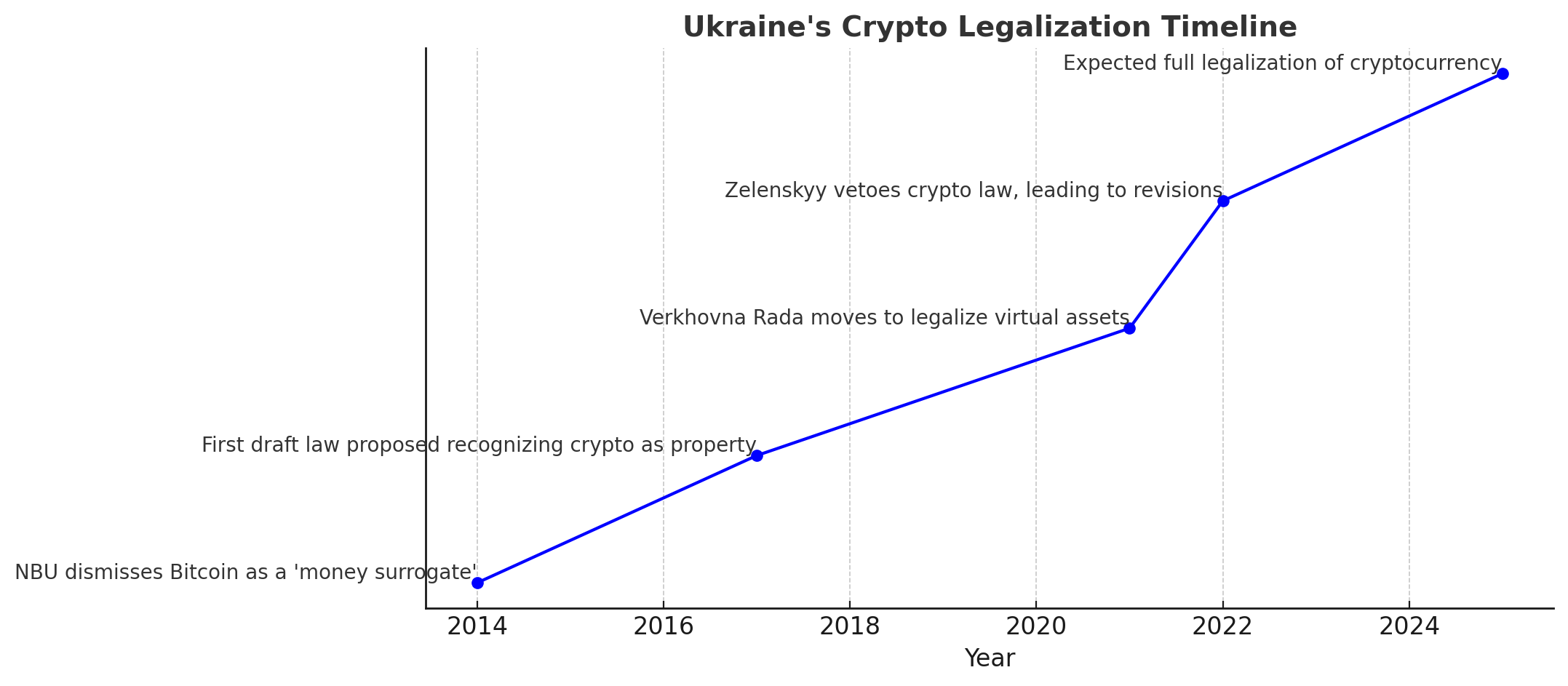

A Decade-Long Journey Toward Crypto Acceptance

Ukraine’s relationship with cryptocurrency has evolved over the past decade. In 2014, the National Bank of Ukraine dismissed Bitcoin as a “money surrogate,” citing concerns over anonymity and lack of regulation. By 2017, the country had proposed its first draft law to recognize crypto as property, but it had stalled. Progress continued, and in 2021, the Verkhovna Rada moved to legalize virtual assets. However, President Volodymyr Zelenskyy vetoed a subsequent law in 2022, prompting further revisions. Now, with a new draft law expected in early 2025, Ukraine is on the cusp of fully integrating cryptocurrencies into its economy.

Taxation Without Exemptions: A Cautious Approach

Unlike some nations that offer tax incentives to crypto users, Ukraine plans to implement a taxation model similar to that of securities. Profits from crypto assets will be taxed upon conversion to fiat currency. Hetmantsev emphasized,

“In consultations with European experts and the IMF, we are taking a very cautious approach to using cryptocurrencies for tax exemptions, as it could potentially facilitate tax evasion in traditional markets.”

Cryptocurrency as a Financial Lifeline Amid Conflict

The ongoing conflict with Russia has underscored the potential benefits of cryptocurrencies for Ukraine. Digital assets have provided Ukrainians with alternatives for cross-border transactions, asset protection from inflation, and access to financial support without relying on traditional banking systems. Notably, cryptocurrencies have played a pivotal role in humanitarian aid, raising nearly $70 million in early 2023 to support Ukraine’s defense and relief efforts.

Aligning with Global Trends

Ukraine’s move mirrors a global shift toward regulated crypto adoption. For instance, Russia recently banned crypto mining in occupied Ukrainian regions but eased domestic crypto tax policies, exempting transactions from VAT and capping income tax on crypto earnings at 15%. Similarly, Morocco is drafting regulations to replace its 2017 crypto ban, and Argentina is exploring Bitcoin payments by 2025 to enhance currency freedom.

Conclusion

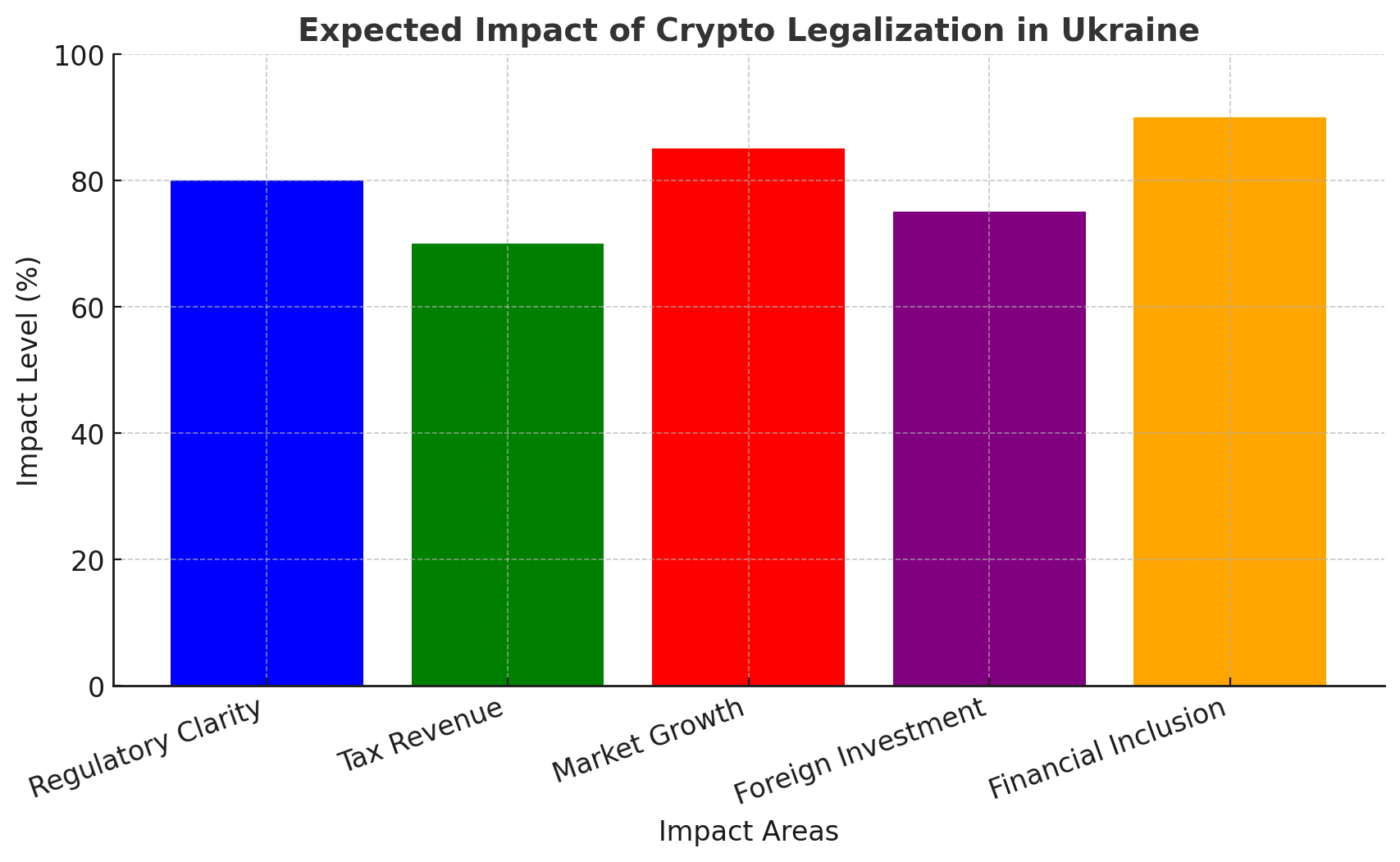

Ukraine’s plan to legalize cryptocurrencies by early 2025 marks a significant step toward integrating digital assets into its financial system. The country aims to create a transparent and legally secure framework for businesses and investors by focusing on regulation, standard taxation, and financial stability. As the global landscape of digital finance continues to evolve, Ukraine’s cautious yet progressive approach positions it as a potential leader in the Eastern European crypto market.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

When will Ukraine legalize cryptocurrencies?

Ukraine plans to legalize cryptocurrencies by the first quarter of 2025.

Will there be tax exemptions for crypto transactions in Ukraine?

No, profits from crypto assets will be taxed upon conversion to fiat currency, similar to the taxation of securities.

How has cryptocurrency been used in Ukraine during the conflict with Russia?

Cryptocurrencies have facilitated cross-border transactions, protected assets from inflation, and supported humanitarian aid efforts, raising nearly $70 million in early 2023.

Is Ukraine’s approach to crypto regulation unique?

Ukraine’s approach aligns with global trends, focusing on regulation and standard taxation without offering tax incentives, similar to recent policies in countries like Russia and Morocco.

What are the next steps for Ukraine’s crypto legislation?

A dedicated working group is finalizing the draft legislation, with the first parliamentary reading expected in the first quarter of 2025.

Glossary of Key Terms

Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of a central authority.

Fiat Currency: Government-issued currency that is not backed by a physical commodity but rather by the government that issued it.

Securities: Financial instruments that represent ownership positions in publicly traded corporations, creditor relationships, or rights to ownership.

Tax Exemption: A monetary exemption that reduces taxable income.

International Monetary Fund (IMF): An international organization working to foster global monetary cooperation and financial stability.