The U.S. Securities and Exchange Commission (SEC) has reportedly concluded an investigation into Uniswap Labs, which leads UNI price soars, and decided not to pursue any enforcement action against the company, in a major boost for the decentralized finance (DeFi) ecosystem. This decision represents a key moment for both Uniswap and the wider ecosystem of decentralized finance (DeFi), forecasting a possible move toward more crypto-friendly regulation in the U.S.

SEC Investigation Overview

The SEC launched an investigation of Uniswap Labs in April 2024 over allegations that the company acted as an unregistered securities broker and exchange and issued unregistered securities. Uniswap has always claimed that systems like its own are decentralized and have only been doing what current laws allow. On Feb. 25, 2025, Uniswap declared that the SEC’s investigation was officially closed without any enforcement action against the exchange, calling it a “huge win for DeFi.”

Implications for DeFi and Regulatory Landscape

The end of the SEC’s investigation into Uniswap Labs is part of a general trend toward more favorable treatment by the agency regarding cryptocurrencies and DeFi in the U.S. Since the departure of former SEC Chairman Gary Gensler in January 2025, Acting Chairman Mark Uyeda has made some considerable changes, including the creation of a new Crypto Task Force chaired by Hester Peirce, one of the most pro-crypto commissioners historically. Based on these developments, it seems that a more cooperative regulatory approach may soon replace the “regulation-by-enforcement” strategy.

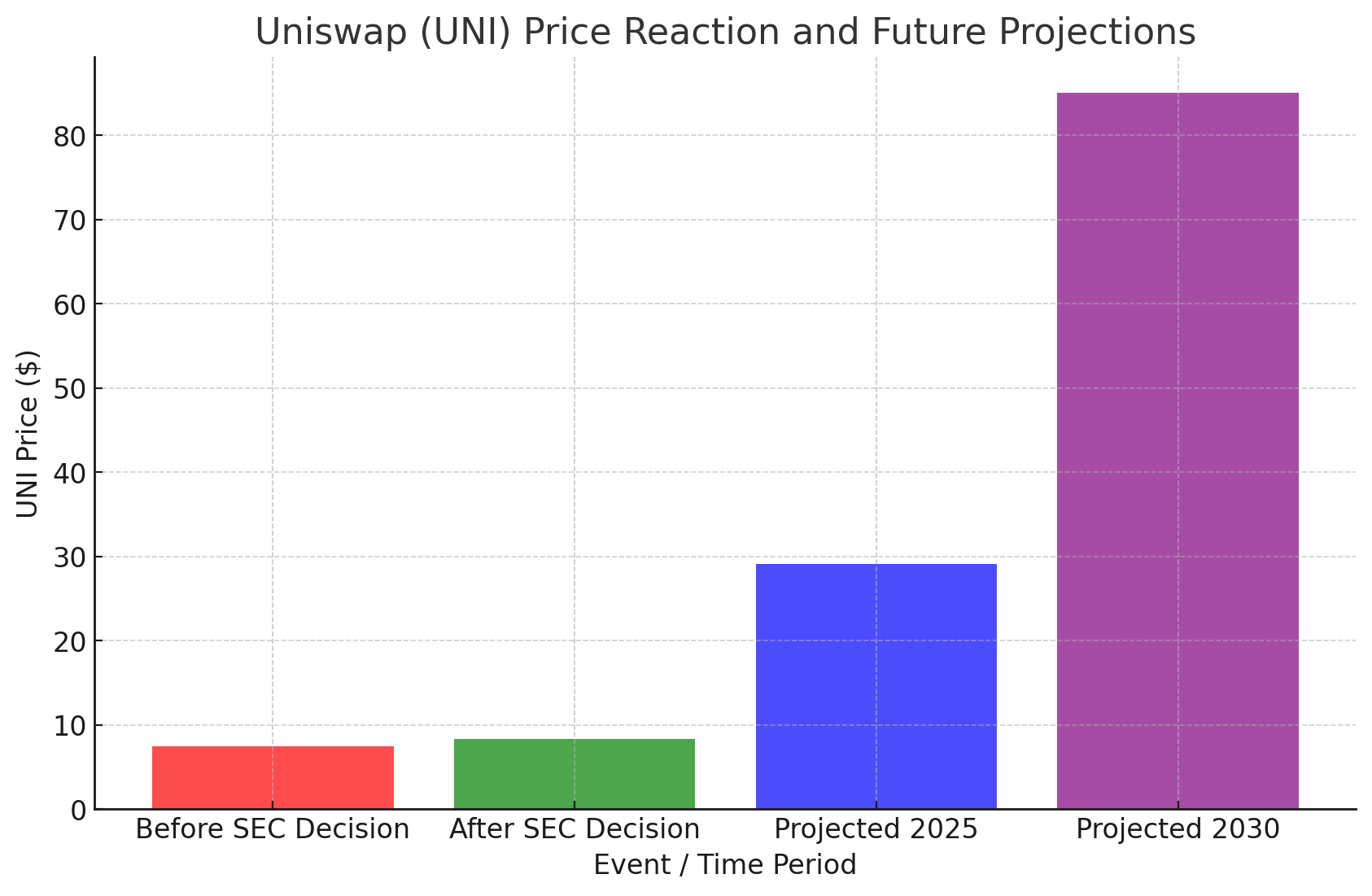

Market Response and Uniswap (UNI) Price Analysis

The SEC’s ruling can be seen to have an immediate beneficial effect on Uniswap’s governance token, UNI price. The UNI price shot up 4.6%, hitting $8.24, on the news, even as the wider market turned red, with Bitcoin falling below $90,000 for the first time in two years.

As of February 26, 2025, UNI is trading at $8.30, with an intraday high of $8.53 and a low of $7.48. This price movement reflects renewed investor confidence in Uniswap’s regulatory standing and the potential for a more supportive environment for DeFi projects.

Uniswap (UNI) Price Predictions

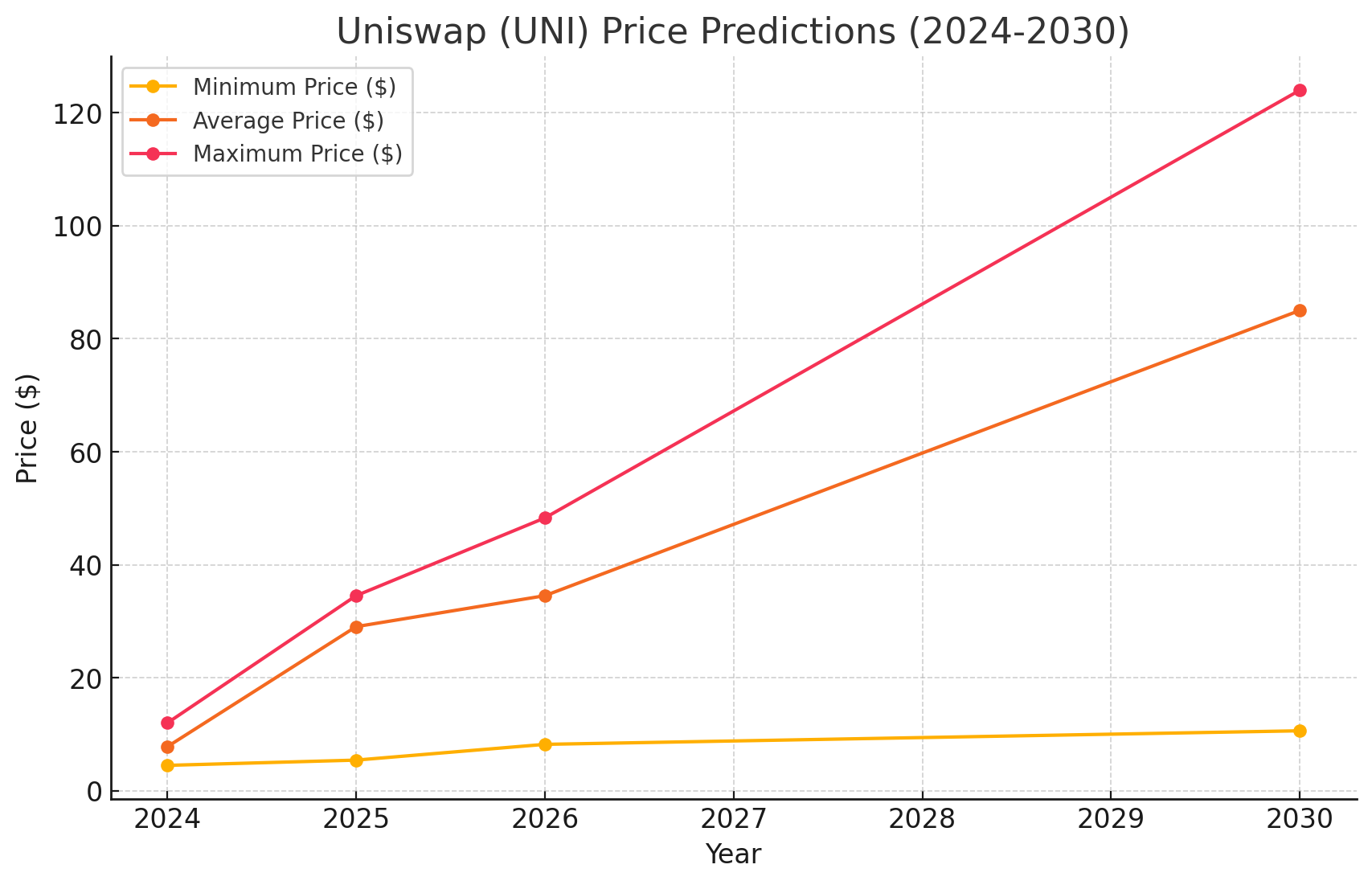

Looking ahead, various analyses offer insights into UNI’s potential price trajectory:

2025 Forecasts:

CoinCodex: Projects UNI trading between $5.43 and $11.90, suggesting a possible increase of up to 40.78%.

Changelly: Estimates an average price of $29.05, with potential highs reaching $34.53.

2030 Forecasts:

DigitalCoinPrice: The UNI price is anticipated to average $29.05 in 2025, climb to $34.53 in 2026, and reach $48.29 in 2027.

These projections underscore a generally optimistic outlook for UNI, influenced by Uniswap’s market position and the evolving regulatory landscape.

Price Prediction Table

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2025 | 5.43 | 29.05 | 34.53 |

| 2026 | 8.22 | 34.53 | 48.29 |

| 2030 | 10.62 | 85.02 | 124.00 |

Sources: CoinCodex, Changelly, DigitalCoinPrice

Conclusion

The SEC’s decision to close its investigation into Uniswap Labs without taking enforcement action is a landmark moment for the DeFi space. Not only does this decision reaffirm Uniswap’s alignment with current regulations, but it also hints at a potentially more amicable regulatory landscape for decentralized finance in the United States. With the evolving regulatory landscape, Uniswap and its UNI token look primed for potential growth in the coming years, as evidenced by bullish price predictions.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What was the SEC probing Uniswap Labs over?

The SEC probe relates to whether Uniswap Labs has acted as an unregistered broker and exchange broker, as well as whether it has issued unregistered securities.

What does the end of the SEC investigation mean for Uniswap?

Temporary closure signifies that Uniswap Labs is not under threat of any enforcement action, implies a adherence to existing norms and ideally creates a more welcoming climate for DeFi projects.

How did the market respond to the SEC’s decision?

Despite the general upward trend, the biggest price jump came after the announcement when UNI’s price surged around 4.6% as newly elevated investor confidence led to increased buying pressure.

What does the future combo of price predictions for UNI look like?

UNI might reach from $5.43 to $11.90 in 2025, according to analysts, with the possibility of growing to $85.02 at 2030 and they would rely on market and regulations

Glossary

Decentralized Finance (DeFi): A financial system built on blockchain technology that operates without centralized intermediaries.

Uniswap Labs: The development team behind Uniswap, a leading decentralized exchange on the Ethereum blockchain.

Wells Notice: A formal notification from the SEC indicating that it is considering enforcement action against a company or individual.

Governance Token: A token that enables holders to participate in the decision-making processes of a blockchain project.

DigitalCoinPrice: A cryptocurrency price tracking platform that provides market data and forecasts.

Sources