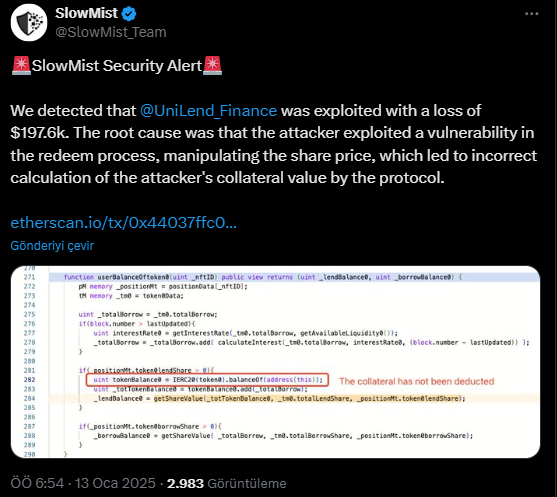

Crypto platform UniLend recently experienced a security breach that resulted in a loss of $197,600, according to a report by cybersecurity firm SlowMist. The attack exploited a vulnerability during the redemption process, allowing the attacker to manipulate stock prices and deceive the protocol into miscalculating collateral value. Here’s what we know so far.

UniLend Hack: Details and Impact

UniLend, a blockchain-based platform merging AI and Web3 technologies, faced a significant setback as a hacker exploited a flaw in its system. The attack enabled the manipulation of asset prices during redemption, leading to an incorrect assessment of the attacker’s collateral. This vulnerability caused the protocol to incur losses amounting to $197,600.

SlowMist confirmed the breach on social media, shedding light on the method used by the attacker. This event has not only impacted the platform’s operations but also caused a ripple effect on the market, including a decline in the value of UniLend’s native token, UFT.

UFT Token: Market Reaction and Core Features

In the wake of the hack, the price of UFT dropped by 3%, reflecting investor concerns. Although the drop wasn’t substantial, the sudden dip created a significant shock, as evident from market charts. Despite this, UFT retains its importance within the UniLend ecosystem due to its unique features:

- Governance: UFT holders play a vital role in shaping the platform’s future by voting on critical decisions, ensuring decentralized and community-driven growth.

- AI Capabilities: UFT is the key to accessing the platform’s AI Agent Hub, which facilitates interaction with advanced AI modules and tools.

- Universal Gas Token: UniLend aims to position UFT as a universal gas token, eliminating the need for multiple gas tokens across blockchains. This simplifies cross-chain transactions and enhances user experience.

Current Market Position

Current Market Position

As of now, UFT is priced at $0.296692 with a 24-hour trading volume of approximately $2.22 million. Ranked 879th on CoinMarketCap, it has a market capitalization of $25.23 million. While the hack has introduced short-term volatility, the long-term prospects of the platform remain uncertain.

What’s Next for UniLend?

Despite the setback, UniLend continues to innovate, combining blockchain and AI to provide decentralized financial tools. The platform’s commitment to improving security and expanding its offerings will be crucial in regaining market confidence. Investors and the broader crypto community are now watching closely to see how UniLend rebounds from this incident.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Current Market Position

Current Market Position