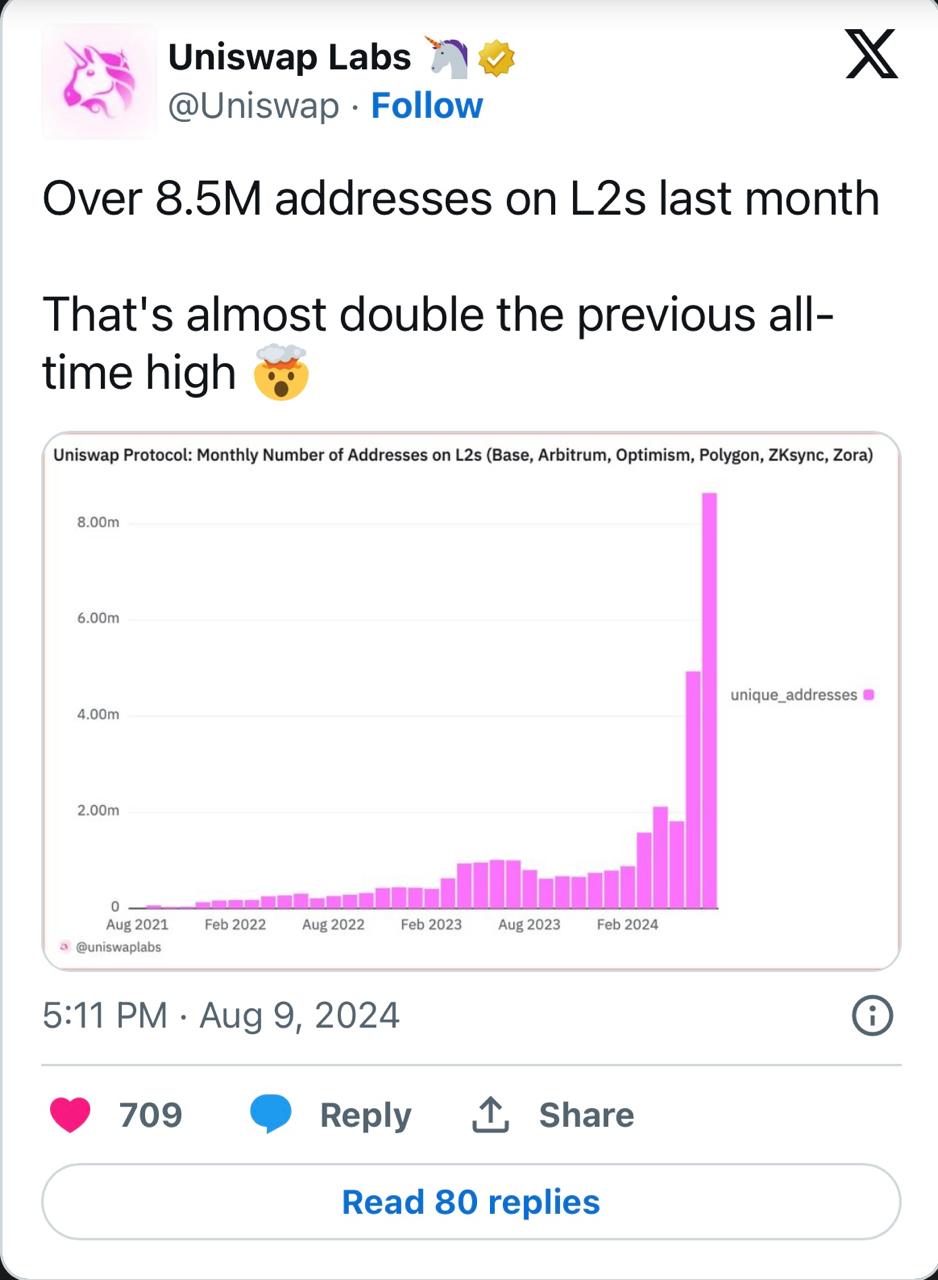

Uniswap Ethereum L2 wallet addresses reached a new peak of 8.5 million in July, marking a significant increase from June. This growth highlights the ongoing expansion of decentralized finance (DeFi) on Ethereum’s layer-2 (L2) networks, even as total value locked (TVL) across these platforms has seen a decline.

Surge in Uniswap Ethereum L2 Addresses

Ethereum layer-2 wallet addresses using Uniswap, the largest decentralized exchange (DEX) by trading volume, nearly doubled last month compared to numbers recorded in June. Data from Dune Analytics revealed that 8.5 million Ethereum addresses traded on Uniswap through L2 networks such as Arbitrum, Base, Optimism, Polygon, and ZKSync. This surge in activity set a new all-time high for Uniswap Ethereum L2 addresses.

The dramatic increase in L2 addresses has been attributed to the lower transaction costs on these networks. Ethereum’s mainnet, known for its secure and permission less transactions, often faces congestion, leading to higher transaction fees. Layer-2 networks, designed to alleviate these bottlenecks, offer a more cost-effective solution for users looking to trade on Uniswap and other DeFi platforms.

According to L2Fees, it currently costs less than $1 to send Ether on layer-2 networks and under $3 to swap digital assets. This affordability is likely a key driver behind the rising number of Uniswap Ethereum L2 addresses.

TVL Decline Despite Address Growth

While Uniswap Ethereum L2 addresses have seen significant growth, the total value locked (TVL) across DeFi platforms has experienced a decline. TVL refers to the total amount of assets deposited into DeFi protocols, and it is often used as a measure of the overall health and activity of the DeFi ecosystem.

According to data from DefiLlama, the total TVL across DeFi chains, including Ethereum and its layer-2 networks, has decreased by up to 25% in the last 30 days. This decline reflects broader market corrections and a downswing in the value of altcoins, which make up a significant portion of the assets locked in DeFi protocols.

The drop in TVL, despite the increase in Uniswap Ethereum L2 addresses, suggests that while more users are engaging with DeFi through layer-2 networks, they may be doing so with smaller amounts of capital. This could be due to a combination of factors, including market volatility and cautious investor sentiment.

A spokesperson from Uniswap Labs commented on the trend, stating, “The growth in L2 addresses highlights the increasing adoption of layer-2 solutions, even as market conditions remain challenging. This trend underscores the importance of scalable and affordable infrastructure for the future of decentralized finance.”

Impact of Recent Upgrades

One of the key factors driving the growth in Uniswap Ethereum L2 addresses is the recent Dencun upgrade to Ethereum’s mainnet, which was implemented in March. This upgrade has further reduced transaction costs on layer-2 networks, making them an even more attractive option for users looking to trade on Uniswap and other DeFi platforms.

The Dencun upgrade improved the scalability and efficiency of Ethereum’s primary chain, allowing for faster and cheaper transactions on layer-2 networks. This, in turn, has made it easier for users to access decentralized finance services without having to worry about the high fees that have plagued Ethereum’s mainnet in the past.

In addition to the Dencun upgrade, the introduction of new layer-2 networks like Base has also contributed to the growth in Uniswap Ethereum L2 addresses. These networks offer even lower transaction costs and faster processing times, making them an appealing choice for DeFi users.

A recent report from Dune Analytics highlighted the impact of these upgrades, stating, “The introduction of new layer-2 solutions and the ongoing improvements to Ethereum’s mainnet have been key drivers of growth in the DeFi space. As more users migrate to layer-2 networks, we expect to see continued expansion in the number of Uniswap Ethereum L2 addresses.”

Major Takeaway

The surge in Uniswap Ethereum L2 wallet addresses to 8.5 million in July underscores the growing importance of layer-2 networks in the DeFi ecosystem. While the decline in total value locked (TVL) across these platforms suggests some caution among investors, the overall trend points to a strong future for decentralized finance on Ethereum’s layer-2 networks.

As more users continue to adopt layer-2 solutions for their lower transaction costs and improved scalability, the number of Uniswap Ethereum L2 addresses is likely to continue its upward trajectory. However, the long-term success of these networks will depend on their ability to maintain affordability and efficiency while navigating the challenges of a volatile market. Keep following TheBITJournal for latest updates on cryptocurrency.