The Ethereum blockchain-based decentralized exchange Uniswap (UNI) operates as one of the major decentralized platforms which enables users to execute ERC-20 token swaps without depending on any middleman. Uniswap (UNI) reached $7.577 on March 6, 2025 because the value increased by 3.99% during the previous day. Traders seeking to make well-informed decisions should understand the Uniswap price movement in the upcoming week because the cryptocurrency market experiences frequent price volatility.

This paper conducts a Uniswap price prediction analysis for the current week by collecting data from technical study and market information and industry expertise. This analysis analyzes both short-term and long-term forecasts which will guide traders and investors who need to predict UNI/USD market movements.

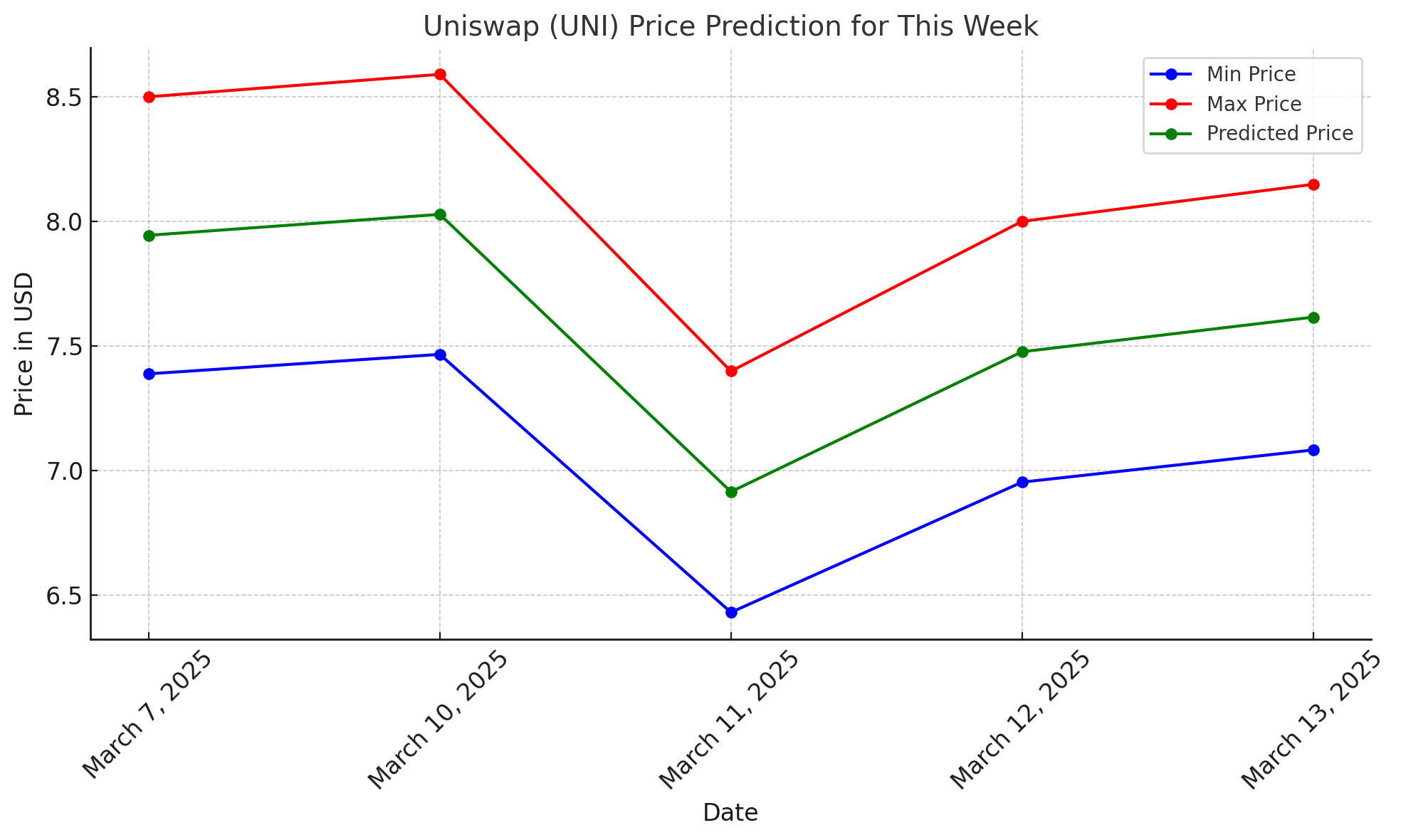

Uniswap Price Predictions for This Week

Daily Uniswap Price Predictions

The Uniswap token has demonstrated consistent price performance throughout recent days although it has shown minor market-related movements. The most recent UNI/USD price forecasts obtained from 30rates.com predict the following market values for upcoming days.

| Date | Day | Min Price | Max Price | Predicted Price |

| March 7, 2025 | Friday | $7.3883 | $8.5005 | $7.9444 |

| March 10, 2025 | Monday | $7.4664 | $8.5904 | $8.0284 |

| March 11, 2025 | Tuesday | $6.4308 | $7.3988 | $6.9148 |

| March 12, 2025 | Wednesday | $6.9535 | $8.0003 | $7.4769 |

| March 13, 2025 | Thursday | $7.0827 | $8.1489 | $7.6158 |

Friday, March 7:

Friday, March 7:

The analysts have predicted that UNI/USD will trade between $7.3883 and $8.5005 and close at $7.9444 on Friday, March 7. Based on the forecasted moderate market price increase on this day, market participants should expect some price growth.

Monday, March 10:

On Monday UNI/USD shows indications of further Uniswap price growth and it is projected to reach $8.0284. The price of UNI/USD will fall between $7.4664 and $8.5904 between March 7th to March 8th. The market atmosphere during Monday appears optimistic because of both external market dynamics and positive news developments within Uniswap along with DeFi as a whole.

Tuesday, March 11:

A temporary downward movement of UNI/USD is projected for Tuesday as the trading price approaches $6.9148. The anticipated Uniswap price movement for the day will sit between $6.4308 and $7.3988 which points to a downward shift after the market gains from earlier this week. Trading with care becomes important because market volatility might arise.

Wednesday, March 12:

The market expects recovery during Wednesday as the Uniswap price shows signs of increasing. The trading value for UNI/USD between March 11 and March 13 should stay within $6.9535 to $8.0003 yet the most likely midpoint stands at $7.4769. The positive market trend might restart its ascent since investor sentiment continues to strengthen.

Thursday, March 13:

The Thursday UNI/USD market outlook indicates prices will continue upward movement from $7.0827 to $8.1489. A potential breakout combination with an upward trend starting in the later part of the week is projected through the predicted Thursday price of $7.6158.

Weekly Price Outlook

The week’s price performance of Uniswap depends on three main factors which include larger cryptocurrency market trends along with Ethereum movement and major events in decentralized finance (DeFi). The upcoming price direction of UNI/USD will follow the data points and 30rates.com projections during this week.

| Date | Day | Min Price | Max Price | Predicted Price |

| March 7, 2025 | Friday | $7.3883 | $8.5005 | $7.9444 |

| March 10, 2025 | Monday | $7.4664 | $8.5904 | $8.0284 |

| March 11, 2025 | Tuesday | $6.4308 | $7.3988 | $6.9148 |

| March 12, 2025 | Wednesday | $6.9535 | $8.0003 | $7.4769 |

| March 13, 2025 | Thursday | $7.0827 | $8.1489 | $7.6158 |

The UNI/USD price trend points positively during this week but analysts expect market dips to occur on Tuesday. Price recovery during Wednesday and Thursday will produce an excellent week-ending performance.

Technical Indicators and Market Sentiment

Technical Indicators and Market Sentiment

Uniswap’s short-term traders may find minor bullish signals through technical analysis indicators that are producing ambiguous yet marginally positive signals for price movement predictions. The current indicators for UNI/USD display the following points:

| Indicator | Signal |

| Moving Average (5M) | Buy |

| Moving Average (30M) | Buy |

| Moving Average (1H) | Buy |

| Moving Average (1D) | Buy |

| RSI (Relative Strength Index) | Neutral |

The positive trend of moving averages from the 5M to 30M to 1H to 1D periods indicates a buy signal recommendation. The present RSI position demonstrates a neutral situation because market conditions do not indicate overbought or oversold status thus potentially stabilizing price fluctuations. The indicators require close watch because price fluctuations might take place during this week.

Key Factors Impacting UNI/USD Price Predictions

Various elements will influence the projected price path of UNI/USD this week.

Uniswap’s price performance throughout this week faces potential changes because of these elements:

- The price actions of Ethereum directly impact UNI price due to Uniswap’s operation on the Ethereum blockchain. Ethereum gains in the market could transfer upward momentum to UNI.

- Uniswap positions as one of the leading entities in the decentralized finance market. The price potential of UNI may rise if both DeFi applications and their protocols become more popular or expand their user bases.

- The value of UNI stands to be affected by widespread cryptocurrency market sentiments involving Bitcoin as well as Ethereum and other various altcoins. Price changes for UNI tokens depend on bullish and bearish market forces which both influence the token value positively and negatively respectively.

- The implementation of Uniswap Protocol upgrades which add network upgrades and new features will positively affect the value of UNI tokens. Investors should review all developments that the Uniswap team publishes.

Conclusion

The Uniswap (UNI) cryptocurrency token displays a dual price movement prediction throughout this week due to potential value boosts during Friday and Monday. A small price correction could happen on Tuesday before expectations of price growth emerge on Wednesday. The market analysts anticipate breakout values during Thursday for UNI/USD trading. Traders must stay alert about potential market volatility because the assessment for Uniswap’s performance this week shows hesitant optimism. Keep following The Bit Journaland keep an eye on Uniswap Price.

FAQs

What is the current price of Uniswap (UNI)?

Based on March 6, 2025 data Uniswap (UNI) holds a price value of $7.577. The price of Uniswap (UNI) reached $7.577 during March 6th 2025.

How much is Uniswap price expected to rise this week?

The price projection for Uniswap (UNI) during this week extends to $8.5005. The experts predict Uniswap (UNI) to build up to its peak at $8.5005 by Friday while showing possible price changes during this week.

What factors affect Uniswap’s price prediction?

Multiple elements in the market influence the future valuation of Uniswap (UNI). The market price of Ethereum combined with the expansion of DeFi platforms and general crypto market trends determine the value of UNI.

What is the RSI and how does it affect Uniswap’s price prediction?

The Relative Strength Index provides an evaluation tool which strongly influences Uniswap’s projected market values. Market analysts use the Relative Strength Index (RSI) to determine if an asset receives too many interested buyers (overbought condition) or too few with interests (oversold). A neutral RSI value of UNI indicates that market conditions maintain balance between buying and selling forces.

Glossary of Key Terms

- Uniswap: A decentralized exchange protocol Uniswap (UNI) exists on Ethereum to enable ERC-20 token swapping through its platform.

- Average moving: The technical indicator Moving Average (MA) functions by generating smoothed price information to detect market trends.

- RSI: offers investors information on asset overbought and oversold conditions through its momentum-based evaluation system.

- DeFi: Cryptocurrencies managed by blockchain technology represent DeFi (Decentralized Finance) because they function without requiring central intermediaries such as banks.

- Bullish: Bullish describes an upward price direction that represents a market trend which results in rising prices.

- Bearish: A market trend labeled bearish reveals price levels that decrease downward.

References

- 30rates.com – Uniswap Price Predictions

- Uniswap Official Website

- CoinMarketCap

- Tradingview

- CryptoCompare – Uniswap (UNI) Price

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!