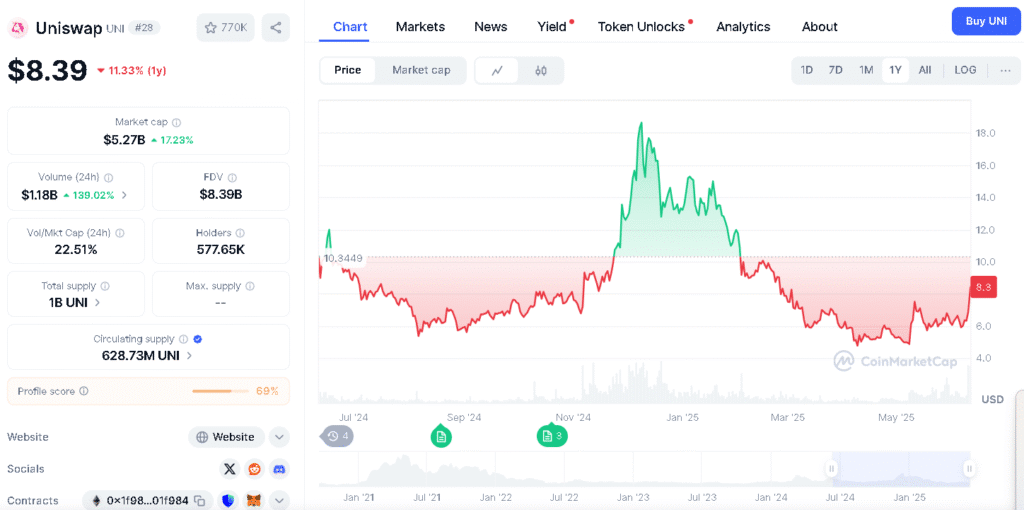

According to the sources, the Uniswap price has made an impressive comeback and rose by over 24% in recent trading. This brought renewed interest in the decentralized finance sector.

This rally comes after months of consolidation and a prolonged slump since April, with the token now trading around $8.6, its highest level in weeks.

Renewed trading strength and easing regulatory pressure have brought Uniswap back into the spotlight, which may be the start of a new strong phase for DeFi.

Technical analysts note that Uniswap has broken out of its long-term downtrend, clearing key resistance levels and setting sights on $9 and $11.6 next. Few analysts are now eyeing a breakout past $12.

Record Trading Volume Reinforces UNI’s Bullish Trajectory

The recent surge in Uniswap price has happened at the same time as a big jump in monthly trading activity. Data shows that Uniswap reached $88 billion in trading volume during May.

It surpassed the previous high that was set during the 2021 bull market. This is a big achievement for Uniswap as well as for the entire DeFi space. A big part of this trading activity came from the Ethereum Layer-2 networks like Arbitrum and Optimism.

Analysts see this Layer-2 growth as a structural strength for Uniswap, particularly because it lowers the transaction costs and makes the platform easier to use.

According to on-chain strategist Emilia Grant, this is not just a short-term price jump, but it’s a strong rally that is backed by real trading volume. She says that this gives strong support to the Uniswap price.

Regulatory Shift Boosts DeFi Optimism and Uniswap Price

Adding to this momentum is a recent announcement from the U.S. Securities and Exchange Commission (SEC), which suggests that some DeFi projects might get regulatory exemption.

This regulatory change has increased investors’ confidence, and some analysts are calling it the beginning of a new “DeFi Summer 2.0.”This positive news has helped to push the Uniswap price up.

Currently, it is trading around $8.37. Analysts now believe that the short-term outlook is looking promising. Crypto trader Marcus Lin said that DeFi tokens like UNI usually react quickly when rules become clearer.

| Metrics | Value | Sources |

| Current Price | $8.44 | CoinMarketCap |

| 24 Hour Trading Volume | $1.18B | CoinMarketCap |

| 24 Hour High Price | $8.65 | CoinMarketCap |

| All time High (May 2021) | $44.97 | CoinMarketCap |

| Resistance Levels | $9.00, $11.6, $15.5 | CoinGape |

UNI Escapes Multi-Year Wedge Pattern

Technical charts confirm the narrative. Uniswap recently broke out of a three-year-long Right-Angled Ascending Broadening Wedge pattern.

This type of breakout is usually seen as a bullish reversal and has often led to big upward moves in the past. Breakouts that are supported by strong volume like this are hard to ignore.

According to TradingView data, the current Uniswap price trend is supported by a bullish MACD crossover and an increase in daily trading volume, which recently reached $1.44 billion.

The analyst group Bitcoinsensus expects the Uniswap price to keep on rising towards $12, and possibly reach $15 or even $18, but only if it stays above the key resistance levels.

UNI’s Strong Fundamentals Back Current Valuation

As the second-biggest DEX by volume after PancakeSwap, it still holds a lot of liquidity. It is also becoming more connected with the Layer-2 chains, which makes it faster, cheaper, and easier to use.

The Uniswap price has also reclaimed its position in the top 30 crypto assets by market cap, by surpassing competitors like Aave and Jupiter. Market experts see this as a sign that investors’ confidence is returning.

Conclusion

The recent rise in Uniswap price shows that investors’ confidence and market momentum are making a strong comeback. Big trading volumes, lower fees, and positive news from regulators are helping Uniswap move up. Experts say that he token must stay above important price levels if it wants to reach $12.

FAQs

1. What is the current price of Uniswap as per the latest data?

It is around $8.37 after a 24% jump.

2. How did Uniswap’s price surge recently?

Due to a record $88B trading volume and renewed DeFi interest.

3. What price are analysts targeting next for UNI?

Analysts are eyeing a move toward $12.

4. How did Uniswap’s trading volume boost?

Ethereum Layer-2 networks like Arbitrum and Optimism played a key role.

5. How significant is the $88B volume for Uniswap?

It’s a new monthly record, beating the 2021 bull run peak.

Glossary

Wedge Pattern– A chart pattern used by traders to predict a breakout in price direction.

DeFi Summer 2.0- A nickname for a possible new boom in decentralized finance activity.

Regulatory Exemption– A rule that allows some crypto projects to skip strict regulations.

On-Chain Data– Information recorded directly on a blockchain is used to track real activity.

Layer-2 Networks – Secondary chains built on Ethereum that help speed up transactions and cut down costs.