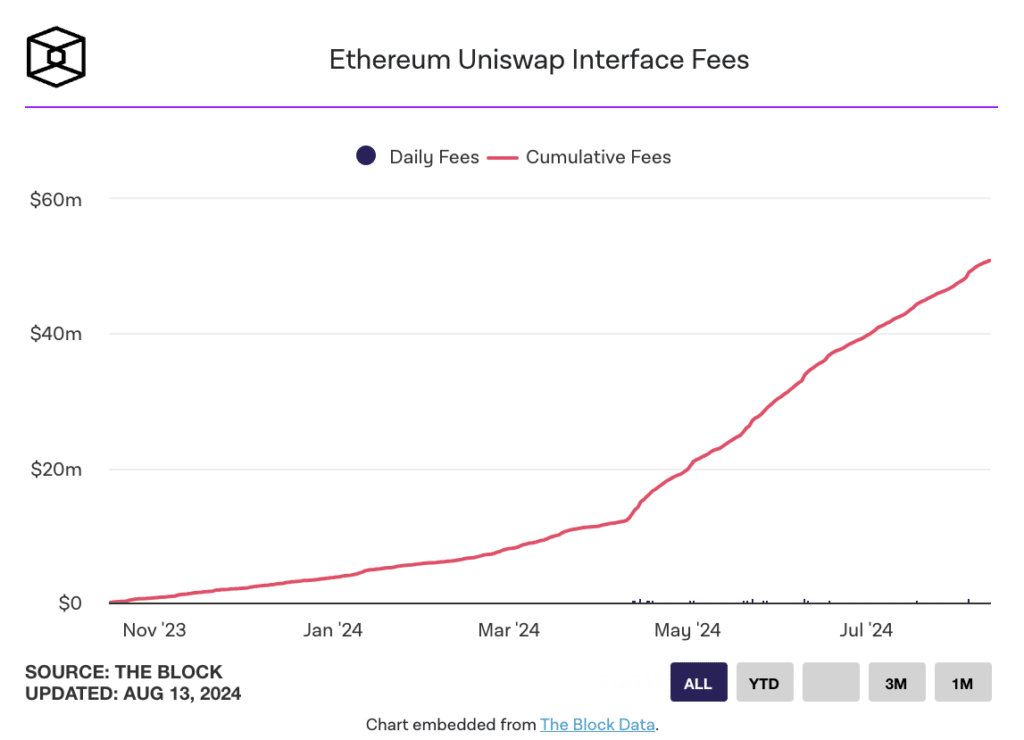

Uniswap Labs, the organization behind the popular Uniswap protocol, has recently hit a remarkable milestone, with its cumulative front-end fees exceeding $50 million. This accomplishment underscores Uniswap’s significant role in the world of decentralized exchanges (DEXs) as it continues to lead in on-chain swap volumes. While this success story is a clear indicator of Uniswap’s growth, it also prompts a discussion about the future of DEXs and the options available for users navigating these platforms.

The Journey to $50 Million in Fees

In October of the previous year, Uniswap Labs introduced a 0.15% fee on transactions conducted through its web interface and wallet application. This move was a significant step for Uniswap, as it established a new revenue stream for the company. Then, in mid-April of this year, Uniswap Labs decided to increase this fee from 0.15% to 0.25%, further enhancing its income from user transactions.

The result of these fees has been nothing short of impressive. Since the start of the year, Uniswap’s cumulative front-end fees have grown exponentially, rising from $3.7 million on January 1st to over $50.6 million today. This dramatic increase not only highlights the growing popularity of Uniswap but also emphasizes the crucial role these fees have played in the company’s revenue generation strategy.

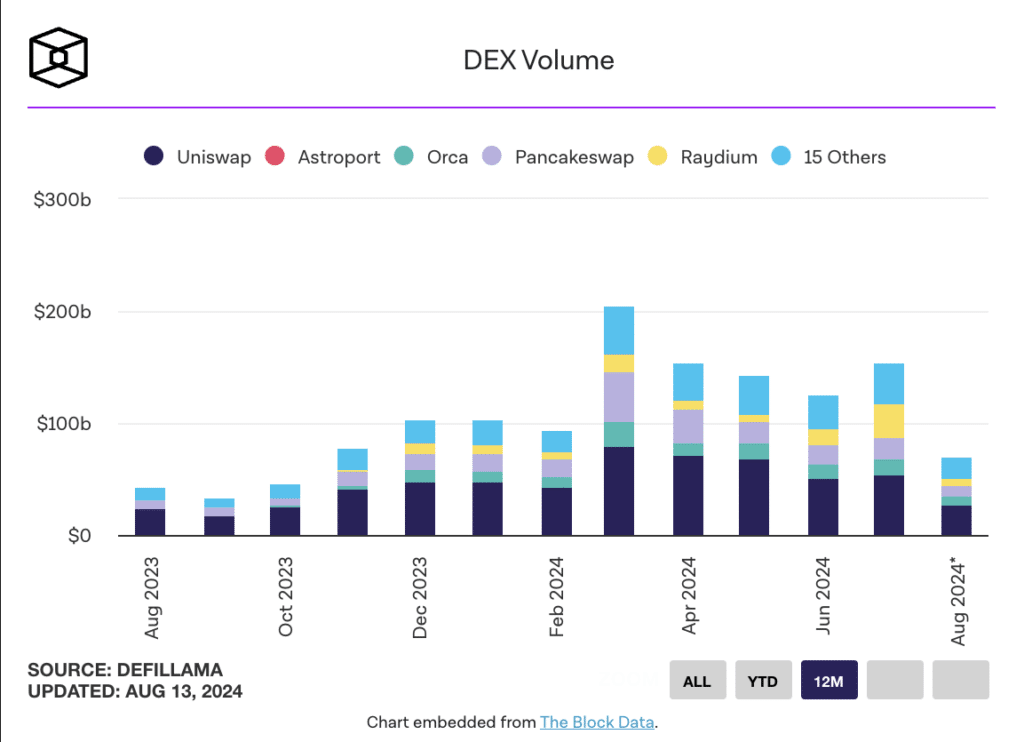

Uniswap Dominates On-Chain Swap Activity

Despite the implementation and subsequent rise of front-end fees, Uniswap has successfully maintained its position as the leading DEX in terms of on-chain swap volume. Data from The Block’s dashboard reveals that Uniswap facilitated an impressive $54 billion out of a total $154 billion in swap volume during the month. This indicates that a significant portion of all DEX activity is still happening on Uniswap, even with the additional costs imposed on users.

Uniswap’s sustained dominance in the DEX market speaks volumes about its strong infrastructure and user-friendly interface. The platform’s ability to maintain its lead, despite the introduction of fees, suggests that users continue to find value in what Uniswap offers, even if it comes with a slightly higher price tag. However, this dominance also raises questions about the choices available to users who wish to avoid these fees.

Alternatives for Avoiding Front-End Fees

For those users looking to bypass the front-end fees charged by Uniswap, there are several alternative options. DEX aggregators like 1inch, Cowswap, and Paraswap provide users with a way to execute transactions without incurring these extra costs. These platforms work by aggregating liquidity from various DEXs, allowing users to secure the best possible rates for their trades without being tied to a single platform.

In July, Uniswap’s front-end was responsible for 25.7% of DEX activity, while 1inch, the most popular DEX aggregator, accounted for 19.8%. This data suggests that although Uniswap remains a dominant player, a substantial portion of DEX activity is still being conducted on platforms that do not charge similar front-end fees.

As users become more aware of these alternatives, it will be interesting to observe how these market dynamics evolve. The rise of DEX aggregators represents a shift in user behaviour, with many seeking to optimise their returns by avoiding unnecessary fees. This shift could potentially influence the future landscape of decentralised exchanges.

Looking Ahead: The Future of Uniswap and DEXs

As Uniswap Labs continues to grow and innovate, the future of decentralised exchanges appears both promising and uncertain. The firm’s success in generating over $50 million in front-end fees is a clear indicator of its market influence. However, it also highlights the delicate balance that needs to be maintained between profitability and user satisfaction.

The introduction and subsequent increase of front-end fees have undoubtedly boosted Uniswap’s revenue, but they also present an opportunity for competitors to attract users seeking lower-cost alternatives. DEX aggregators like 1inch are already capitalising on this opportunity by offering fee-free options, and their growing market share is a trend that Uniswap will need to keep a close eye on.

In summary, Uniswap Labs has demonstrated its ability to lead the DEX market, but the journey is far from complete. As the decentralised finance landscape continues to evolve, Uniswap’s future strategies will be critical in determining its long-term success. Whether it continues to dominate the market or faces increased competition from fee-free alternatives, one thing is certain: the world of DEXs is rapidly changing, and Uniswap is at the forefront of this exciting transformation.