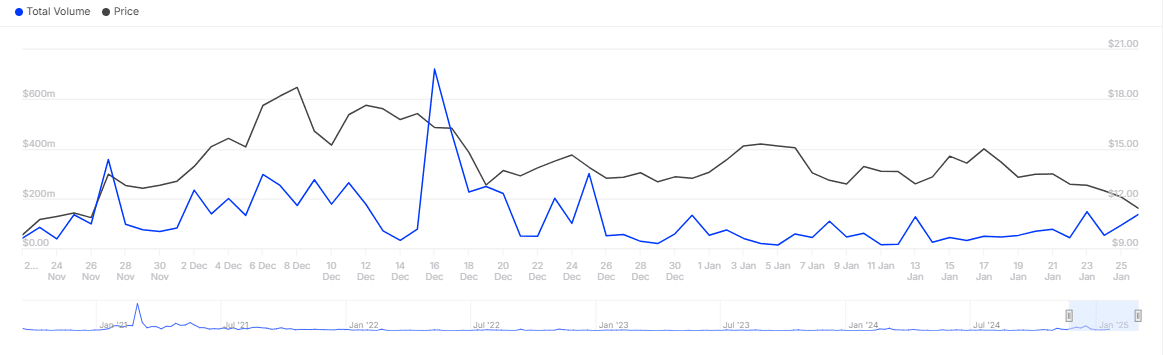

Uniswap’s native token UNI has dropped 11.95 percent in the turbulent 24 hours since, mirroring a bear trend across the cryptocurrency market. This downturn seems to be fueled by whale activity and retreated engagement from smaller market places.

As reported, it was usually large holders that are referred to as whales, who helped UNI plunge by a large extent. As per IntoTheBlock’s analysis, there’s a huge discrepancy between bulls and bears in the market, as 23 bear addresses are up against 12 bullish. Trading traffic was tipped in selling direction by these addresses, with up to 1% of Uniswap on their balances.

Uniswap’s TVL Sees $353 Million Decline Amid Market Downturn

This group traded approximately 11.98 million UNI tokens worth $136.4 million over the last day, doing so through large-scale sell-offs. Undoubtly, bearish traders have increased dominance as they continued to exert downward pressure on UNI price.

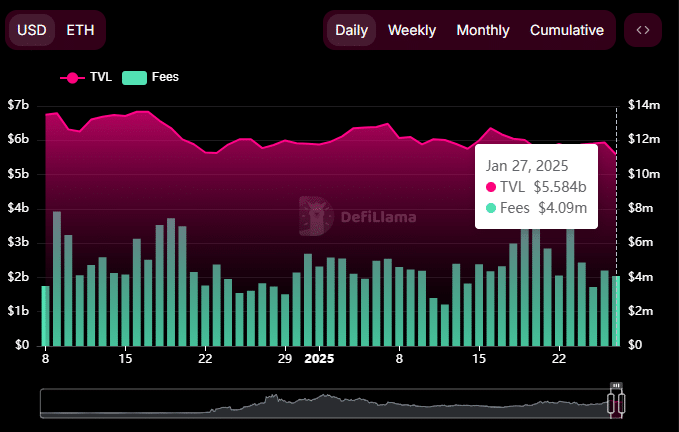

The liquidation of Uniswap’s TVL continued, even to the point of liquidity providers, as Total Value Locked (TVL) fell significantly throughout the bearish sentiment. The TVL, which is expressed in the form of the total assets deposited in liquidity pools, went down by $5.937 billion to $5.584 billion within the same period. This means that investors are selling off their Uniswap tokens by withdrawing them from the market.

Uniswap also saw transaction fees generated also drop from $9.24 million on January 20 to $4.49 million at press time. The decline in fees is further evidence of a bearish tone within the market there’s also less trading taking place, as evidenced by the reduced fees.

Consistent UNI Address Activity: A Beacon in a Bearish Market

Despite the overall bearish sentiment, one positive trend stands out: The number of unique traders involved with Uniswap transactions has not decreased. The past day has seen these active addresses hover between 88,700 and 94,700, and the engagement hasn’t shown much variation.

Such constant participation has been something of a stability, allowing UNI’s price to not crash even further down. If active addresses surpass their range, then the trend from the downtrend would then reverse, and that would then drive the number of Uniswap to upward momentum.

Large holders have a dominant influence on the price dynamics of the Uniswap market indicating a bearish tilt of UNI. The short-term volatility seen in whale activity and liquidity withdrawals seems to be part of the story, but consistent engagement of smaller traders might be the only glimmer of hope for recovering prices.

As the market heads toward these difficult dynamics, a focus will be on whether UNI can regain its momentum with increased trader involvement or if bearish forces will continue to trade for the short term.

Conclusion

The bottom line is UNI’s 11.95% sell-off presents bearish trends in market activity triggered by whales, liquidity provider withdrawal & reduced engagement. But a sharp fall had been averted by steadiness activity from so called unique traders. Active participation has the potential to surge, reinforcing the delicate balance that will govern UNI’s near-term price action.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

- Why did UNI’s price drop by 11.95%?

Large sell-offs by whales and reduced market engagement caused the decline. - How do whales impact UNI’s price?

Whales control large volumes of UNI, and their trades heavily influence price trends. - What does the TVL drop mean for UNI?

A lower TVL shows liquidity providers are selling UNI, reflecting bearish sentiment.

Can active traders stabilize UNI’s price?

Yes, steady trading activity has helped prevent a sharper price decline. Increased participation could drive recovery.