In a significant legal twist, a US appeals court has partially overturned a previous dismissal of a class-action lawsuit against Binance.US and CoinMarketCap. The lawsuit alleges that the two entities unlawfully manipulated the price of the HEX token, a controversial cryptocurrency created by Richard Heart. This decision by the US Court of Appeals for the Ninth Circuit marks a pivotal moment in the ongoing legal battle, potentially setting a precedent for future cases involving cryptocurrency exchanges and allegations of market manipulation.

Appeals Court Challenges Previous Ruling

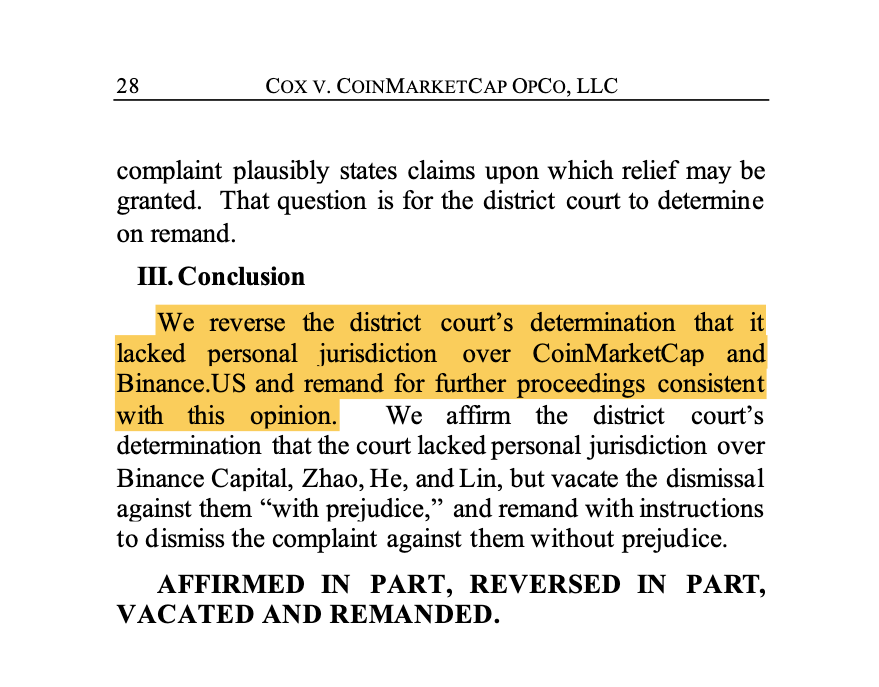

On August 12th, a three-judge panel from the Ninth Circuit Court of Appeals reversed the earlier dismissal of the HEX manipulation case. The district court had previously ruled in February 2023 that there was insufficient evidence to link Binance.US’s actions directly to the alleged price manipulation of HEX in Arizona. However, the appeals court found this ruling to be flawed, particularly in its interpretation of the requirement for “sufficient minimum contacts” between Binance.US and the state of Arizona.

The appeals court reversed a district court decision that it lacked personal jurisdiction over the case. Source: CourtListener

The appeals court clarified that the district court did have jurisdiction over Binance.US and CoinMarketCap, given their significant connections with the United States as a whole. This ruling is crucial as it broadens the scope of jurisdiction, making it clear that US-based companies can be held accountable for their actions nationwide, not just in individual states. For Binance.US and CoinMarketCap, this means that the legal battle is far from over, and they will have to face the allegations in court.

The Allegations Against Binance.US and CoinMarketCap

The class-action lawsuit, originally filed by Ryan Cox in 2021, accuses Binance.US and its parent company, Binance Capital Management, of artificially suppressing the ranking of HEX on CoinMarketCap. The lawsuit claims that this deliberate ranking suppression led to HEX trading at a lower price, while cryptocurrencies associated with Binance were allegedly given preferential treatment on the platform. This, Cox argues, constituted an unlawful manipulation of the HEX token’s market value, ultimately harming investors.

HEX, launched in December 2019 by Richard Heart, experienced a meteoric rise in its early days, reaching an all-time high of $0.51 in September 2021. However, the token has since plummeted in value, currently trading at just $0.004, a staggering decline of over 99%. The timing of this lawsuit adds another layer of complexity to the situation, especially given the SEC’s ongoing legal actions against Richard Heart, accusing him of violating federal securities laws and defrauding investors out of millions.

Implications of the Court’s Decision

The decision by the US Court of Appeals to revive the HEX manipulation case carries significant implications for the cryptocurrency industry. Firstly, it signals that courts may be more willing to entertain allegations of market manipulation within the crypto space, especially when large exchanges like Binance.US are involved. This could lead to increased scrutiny of exchange practices, particularly those related to how cryptocurrencies are ranked and traded on platforms like CoinMarketCap.

For Binance.US and CoinMarketCap, the ruling means that they will have to defend themselves against these serious allegations in court. The outcome of this case could have far-reaching consequences, not just for the defendants but for the entire cryptocurrency industry. A ruling against Binance.US could lead to more stringent regulations and oversight of crypto exchanges, particularly in how they handle and present data to the public.

Moreover, this case could serve as a blueprint for other class-action lawsuits, encouraging more plaintiffs to come forward with allegations of market manipulation. As the cryptocurrency market continues to grow and evolve, legal battles like this one could become more common, forcing exchanges to operate with greater transparency and accountability.

Looking Ahead: What’s Next for HEX and Binance.US?

As the HEX manipulation case heads back to court, all eyes will be on the proceedings and the potential outcomes. For HEX investors, the case offers a glimmer of hope that justice might be served, particularly if the allegations of manipulation are proven true. However, the broader implications for the cryptocurrency market cannot be overlooked.

The current value of HEX, trading at just $0.004, reflects the ongoing turmoil surrounding the token. With its founder, Richard Heart, under fire from the SEC and now facing this revived lawsuit, the future of HEX remains uncertain. Investors and industry watchers alike will be closely monitoring the developments in this case, as its outcome could have a significant impact on the perception and regulation of cryptocurrencies moving forward.

In conclusion, the US Court of Appeals’ decision to partially reverse the dismissal of the HEX manipulation case against Binance.US is a landmark moment in the ongoing battle between regulators, investors, and cryptocurrency exchanges. As the case unfolds, it will likely set important precedents for how similar cases are handled in the future, shaping the legal landscape of the cryptocurrency industry for years to come.