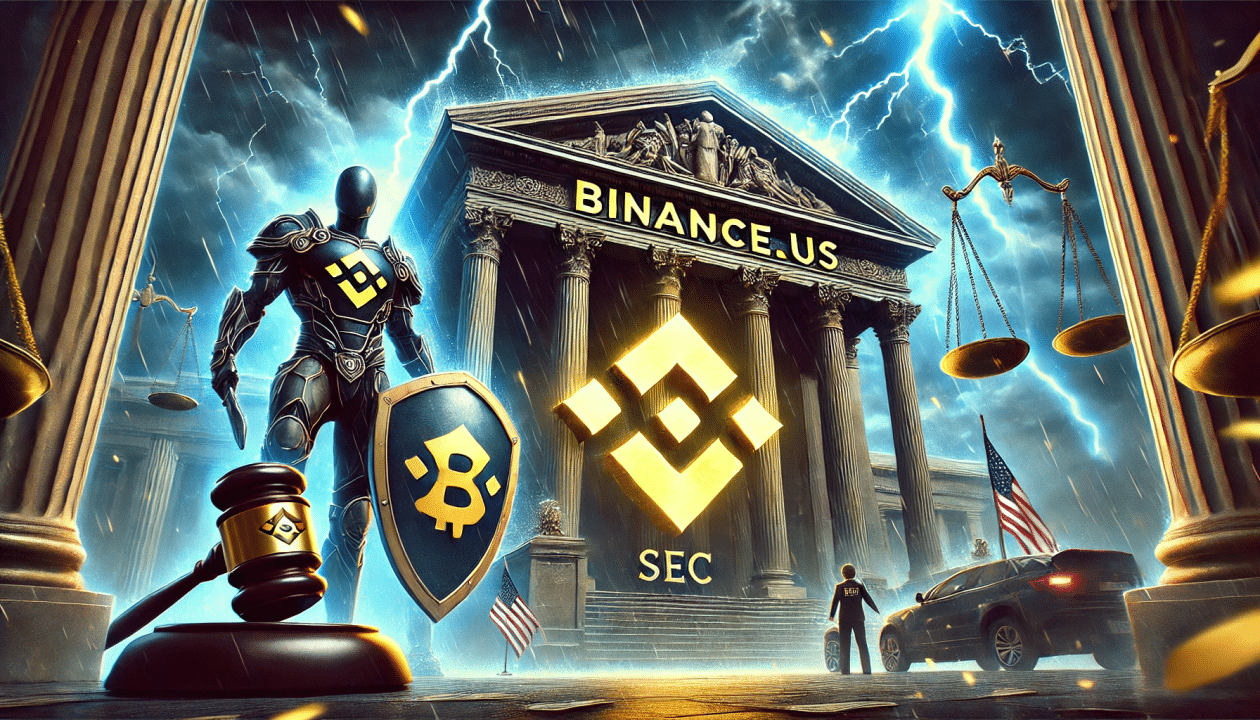

A lawsuit accusing Binance US of manipulating the price of the HEX token has been partly revived by the United States Ninth Circuit Court of Appeals. The court’s decision, handed down on August 12, breathes new life into the class-action suit initially filed by plaintiff Ryan Cox in 2021. The lawsuit, which had previously been dismissed, claims that Binance US and CoinMarketCap, a website that tracks cryptocurrency prices and is owned by Binance, engaged in illegal activities to manipulate the price of the HEX token. The case has now been sent back to the lower court for further proceedings.

A Viable Claim of Price Manipulation

The lawsuit against Binance US, which is centered on allegations of price manipulation of the HEX token, was originally dismissed by a district court. The plaintiff, Ryan Cox, argued that Binance US and CoinMarketCap had deliberately caused the HEX token to trade at lower prices compared to other cryptocurrencies listed on the Binance exchange. Cox claims that this manipulation harmed investors and that it was done with the intent to profit Binance and its affiliates.

According to the appeals court, Cox’s claims present a viable case for price manipulation. The three-judge panel found that Cox had provided sufficient evidence to suggest that the alleged acts of manipulation could be tied to activities conducted by Binance US in Arizona, where the company is incorporated and operates. This connection was deemed strong enough to establish personal jurisdiction, meaning the court has the authority to hear the case.

The ruling emphasized that the case should proceed based on the merits of the plaintiff’s claims, stating that “Cox has demonstrated a plausible claim of price manipulation.” This decision allows the lawsuit to move forward, potentially leading to a full trial where the allegations will be thoroughly examined.

Mounting Criticism of HEX Token and Richard Heart

The HEX token, which was launched by Richard Heart, has faced increasing scrutiny in recent months. Heart, a controversial figure in the cryptocurrency community, has been accused of misleading investors and violating securities laws. On July 31, 2023, the Securities and Exchange Commission (SEC) filed a separate lawsuit against Heart, alleging that he had defrauded investors out of at least $12.1 million through the sale of unregistered securities.

The SEC’s lawsuit against Heart has added to the negative sentiment surrounding the HEX token, which has been criticized for its lack of transparency and questionable business practices. The ongoing legal battles have raised concerns among investors about the legitimacy of the token and the potential risks associated with investing in it.

Despite these challenges, the HEX token has continued to attract a loyal following, with some investors remaining confident in its potential for growth. However, the revived lawsuit against Binance US could have significant implications for the future of the token and its market value.

Implications of the Court’s Decision

The decision by the United States Ninth Circuit Court of Appeals to partly revive the lawsuit against Binance US is significant for several reasons. Firstly, it sets a precedent for how courts may handle cases involving allegations of cryptocurrency price manipulation, particularly when the alleged acts are tied to specific jurisdictions within the United States.

Secondly, the ruling could have broader implications for Binance US and other cryptocurrency exchanges that operate within the country. The lawsuit’s outcome could influence how these exchanges conduct their business and whether they may face similar legal challenges in the future. If Cox’s claims are proven in court, Binance US could be held liable for damages, potentially resulting in substantial financial penalties and a loss of investor confidence.

The case also highlights the ongoing regulatory challenges facing the cryptocurrency industry as a whole. As more investors enter the market, there is growing pressure on regulators to ensure that exchanges operate fairly and transparently. The outcome of this lawsuit could serve as a litmus test for how the courts will handle similar cases in the future.

Final Take on US Court Decision Against Binance US

The United States Ninth Circuit Court of Appeals’ decision to partly revive the lawsuit against Binance US over the alleged manipulation of the HEX token price marks a critical moment in the ongoing legal battles surrounding the cryptocurrency industry. The case, which will now proceed to further judicial review, could have significant implications not only for Binance US but also for the broader cryptocurrency market. As the case unfolds, it will be closely watched by investors, regulators, and industry stakeholders alike, as it may set important precedents for how legal challenges involving digital assets are handled in the future. Keep following TheBITJournal and key and eye on the legal battle of Binance US.