The national debt of the United States has now exceeded $35 trillion, a figure that has sent shockwaves through both political and economic spheres, raising urgent questions about future economic stability such as, “Is Bitcoin the solution to the US national debt problem? This milestone, recorded by the US Debt Clock on July 30, 2024, signifies a dramatic rise in the nation’s financial liabilities.

Amidst this backdrop, Bitcoin is emerging as a potential solution. At the recent Nashville Bitcoin conference, discussions centered on whether Bitcoin could address the US national debt crisis. This new angle challenges traditional debt management approaches and has sparked considerable debate.

The Growing US National Debt

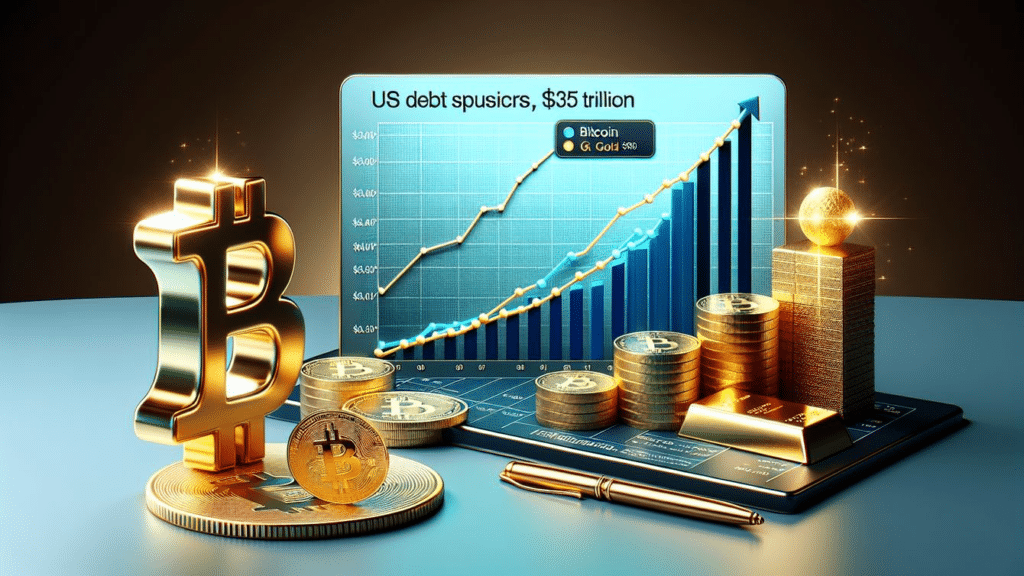

As of July 30, the US Debt Clock reveals the national debt stands at a staggering $35 trillion. This marks a sharp increase from $5.5 trillion in July 2000 and $28.5 trillion in July 2020. The Nashville Bitcoin conference highlighted these figures, with Senator Cynthia Lummis introducing the Bitcoin Reserve Bill, which proposes holding Bitcoin for at least 20 years to mitigate the national debt. This bill reignites the debate: Is Bitcoin the solution to the US national debt problem?

Interest payments on the debt now approach $906 billion, nearly matching the $912 billion defense budget. This significant expense limits funding for other critical sectors such as education. The Federal Reserve faces pressure to lower interest rates to ease debt repayment, yet persistent inflation remains above the 2% target.

Moreover, despite the Federal Reserve’s efforts to reduce quantitative tightening, the M2 money supply continues to grow. Attention is now focused on the interest rate decision expected on July 31, which could have major implications for the country’s economic strategy. A Fed funds rate pause at 5.25-5.50% is anticipated.

Is Bitcoin the Solution to the US National Debt Problem? The Bitcoin Reserve Bill

Senator Cynthia Lummis’s Bitcoin Reserve Bill presents a bold and controversial proposal aimed at addressing the national debt. By maintaining a Bitcoin reserve for 20 years, proponents believe this strategy could alleviate the debt burden. They argue that Bitcoin’s deflationary nature and potential for appreciation could protect fiat currencies from devaluation. However, this raises the question: Is Bitcoin the solution to the US national debt problem?

Critics point to Bitcoin’s volatility and regulatory uncertainties as significant concerns. They argue that relying on such an unpredictable asset might jeopardize national finances. The debate, “Is Bitcoin the solution to the US national debt problem?” illustrates the ongoing clash between traditional finance and cryptocurrency.

The Federal Reserve’s Challenge

The Federal Reserve is navigating a complex situation as it addresses both national debt and inflation. The central bank’s decision-making is influenced by the need to manage the growing national debt while controlling rising inflation rates. Lowering interest rates could help reduce the cost of servicing the national debt and free up funds for other government initiatives. However, such a move carries the risk of exacerbating inflation if not carefully controlled.

Market observers and policymakers are closely monitoring the Federal Reserve’s upcoming July 31 interest rate announcement, which is expected to provide crucial insights into the Fed’s future strategy. While a pause in rate hikes is anticipated, the persistent issue of rising national debt and the question, raising urgent questions about future economic stability such as, “Is Bitcoin the solution to the US national debt problem? remains a significant challenge. This backdrop makes the debate over Bitcoin’s potential role in addressing the national debt more pertinent.

As traditional financial mechanisms face limitations, Bitcoin is increasingly being examined as a possible solution to the debt crisis. The question, “Is Bitcoin the solution to the US national debt problem?” is becoming more relevant as the Fed’s decisions and the broader economic context continue to evolve.

Stay updated with The BIT Journal for the latest developments in the crypto world and insights into the ongoing financial discussions.