Over 50% of the top US hedge funds have now reported significant investments in Bitcoin, in a striking display of confidence in digital assets. This shift towards cryptocurrency investment is particularly exemplified by Millennium Management, which holds 27,263 BTC, valued at approximately $1.69 billion. This substantial allocation represents about 2.5% of Millennium’s total assets under management, which amounts to $67.7 billion.

The trend of investing in Bitcoin extends well beyond just Millennium Management. Recent information from investment company River shows that a sizable portion of major US hedge funds had entered the cryptocurrency market at the end of the first quarter of 2024. Particularly 13 of the top 25 hedge funds claimed to have bought Bitcoin ETFs, indicating an increasing tendency in bringing digital assets into traditional investment portfolios.

Among these, Schonfeld Strategic Advisors and Point72 Asset Management stand out because of their significant Bitcoin holdings. Point72 Asset Management has invested 1,089 BTC; Schonfeld Strategic Advisors holds 6,734 BTC. Despite these investments, other major US hedge funds—including Bridgewater Associates and AQR Capital Management—have chosen to stay on the sidelines, displaying caution to welcome Bitcoin ETFs at this point.

US Hedge Funds: Bitcoin’s Performance Outshines Major Stocks

In the financial markets, Bitcoin showed amazing resilience in 2024, outperforming conventional investment assets and heavyweight stocks such as Apple and Tesla. With a rise of 94% in only the first half of the year, the cryptocurrency profits were especially remarkable. This result lagged far below major indices; the S&P 500 index rose 23%, while the Dow Jones Industrial Average gained a more meagre 14%. This amazing expansion of Bitcoin emphasizes its growing importance and appeal as a possible investment choice.

Examining specific stock performance makes the comparative analysis even more interesting. Apple, a perennial favourite among investors, barely grew by 10% in the same period. Conversely, Tesla was in a major downturn; its stock value dropped by 29%. This performance difference highlights Bitcoin’s potential as a high-yield asset in a scene of different returns in traditional stock markets.

The surge in Bitcoin’s value and investment appeal contrasts sharply with the broader financial landscape, particularly the performance of tech giants. For example, despite Nvidia’s great success—more than 150% of which resulted from the artificial intelligence boom—Bitcoin has firmly established itself as a formidable player in the investment scene.

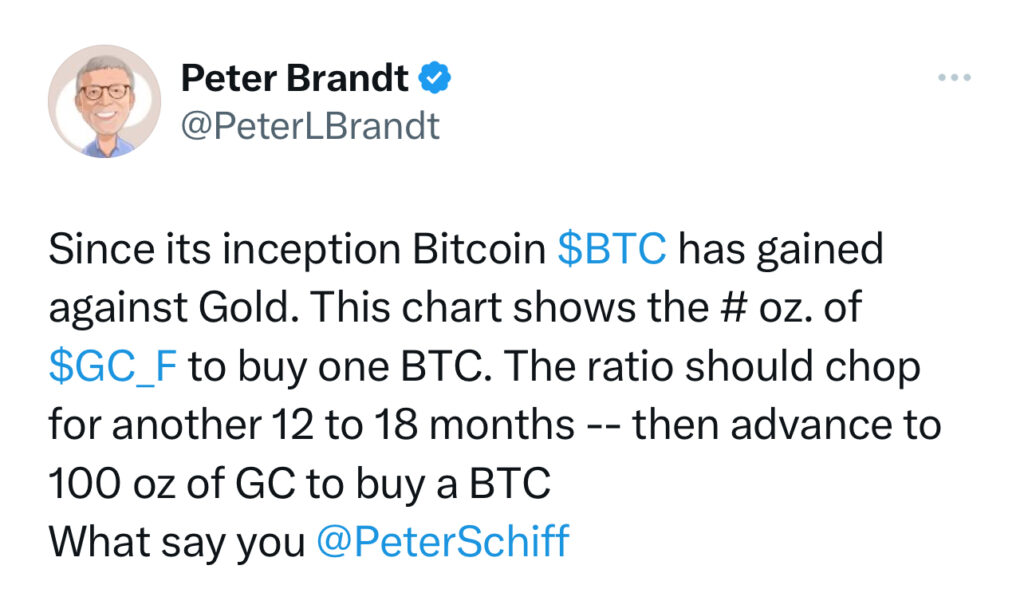

Veteran trader Peter Brandt tweeted on X FKA Twitter that Bitcoin’s growing relevance as a hedging asset might soon challenge traditional safe havens like gold. Brandt anticipates that Bitcoin’s market capitalization could surge 230% compared to gold post-2025. This prediction aligns with ARK Invest’s annual research report, which recommended a 19.4% allocation to Bitcoin in institutional portfolios for 2023 to optimize risk-adjusted returns. “Since its inception, Bitcoin $BTC has gained against Gold.” Peter Brandt stated.

US Hedge Funds Embrace Bitcoin Amid Growing Corporate Liquidity

The broader financial landscape also illuminates this trend. According to a Carfang Group analysis, U.S. corporate cash reserves reached a record $4.11 trillion in Q1 2024. This significant liquidity indicates that more businesses are considering diverse investment avenues, including cryptocurrencies like Bitcoin.

As firms look to diversify their portfolios and mitigate traditional market volatility, substantial funds are increasingly directed towards digital currencies. This movement highlights a shift in strategy, suggesting a growing confidence in the potential and stability of assets like Bitcoin (BTC).

This deepening commitment by US hedge funds to Bitcoin highlights the asset’s robust performance and underscores a broader acceptance and integration of cryptocurrency into mainstream financial strategies.

US Hedge Funds: Further Reading and Resources

Staying updated is essential as the investment landscape continually evolves. For the latest in crypto news, updates on BTC and ETH, and insightful analysis, The BIT Journal is a reliable source. This publication offers timely, well-researched information, helping seasoned investors and newcomers navigate the dynamic world of digital currencies.