A group of senators from both parties in the United States Senate has redoubled their attempts to pass legislation prohibiting members of Congress from engaging in stock trading.

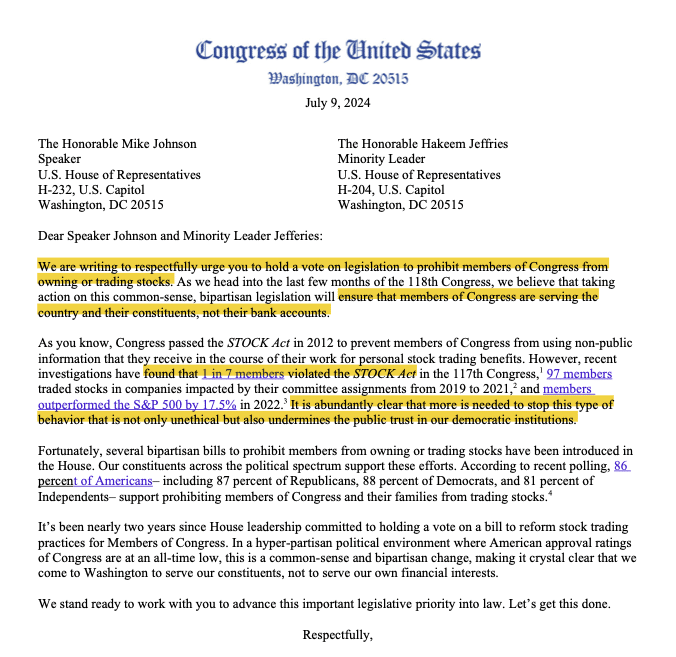

An amendment to the Stop Trading on Congressional Knowledge Act of 2012 was suggested by a group of twenty senators from both parties in a letter that was sent on July 9 to House Speaker Mike Johnson and Democratic Leader Hakeem Jeffries. The amendment was intended to prevent politicians from engaging in stock trading.

“Congress should not be here to make a buck,” said US Senator Josh Hawley at a presser. “There is no reason why members of Congress ought to be profiting off of the information that only they get, and the rest of the American people don’t get.”

Senators also mentioned that 97 members had traded equities in which the committees they controlled had a direct impact and that members of Congress had, on average, outperformed the S&P 500 by 17.5%. This was something that was brought up by the senators.

The senators referred to a recent research that discovered that between 2021 and 2023, one out of every seven members of Congress who were currently serving had violated the STOCK Act. Within ninety days of the measure being signed into law, the proposed amendment to the STOCK Act would prohibit sitting members of Congress from engaging in any form of trading.

As an additional provision, it would prohibit the trading of stocks beginning in March 2027 for the sitting president, vice president, spouses, and dependent children of all members of Congress who are currently serving in their positions. If the new regulations were to be implemented, the punishment for breaching them would be a fee equal to ten percent of the value of the item that was transferred. This is a huge increase from the current penalty, which is only $250 for each violation.

“It is abundantly clear that more is needed to stop this type of behaviour that is not only unethical but also undermines the public trust in our democratic institutions,” The senators expressed in the letter.

“Members of Congress should be working in service of their constituents, not using their positions to line their own pockets,” Senator Jared Golden stated on July 9th. “Anyone who feels the same should have no problem voting for this common sense, long overdue step.”

Members of the House submitted the first major revisions to the STOCK Act in January 2022. The letter was written to Nancy Pelosi, serving as Speaker at the time, and Kevin McCarthy, serving as Minority Leader. The public revelations that were widely published and described the highly successful trades that several key lawmakers made during the early days of the COVID-19 outbreak were a significant factor in the success of the push to prohibit members of Congress from engaging in trading.

The most noteworthy of them was Representative Nancy Pelosi, who became the focus of great public attention after it was disclosed that her successful trading activities had contributed to her net fortune expanding to almost $250 million even though she only earned an annual congressional salary of $193,000 per year. Pelosi is connected to several copy-trading and stock-picking firms that are specifically designed to replicate her trading activities to make a profit.

US Lawmaker Stock Trading Ban: Is Crypto A Better Option?

In conclusion, the renewed push by a bipartisan group of senators to prohibit stock trading among members of Congress underscores a critical effort to restore public trust in democratic institutions. This proposed amendment to the Stop Trading on Congressional Knowledge Act of 2012 aims to curb unethical behaviour and ensure that elected officials serve their constituents’ interests rather than their financial gains.

As we look towards innovative solutions to uphold transparency and integrity in governance, the world of cryptocurrency offers a compelling parallel. Just as blockchain technology promotes transparency and immutability in financial transactions, these legislative efforts seek to bring similar principles to political conduct. By embracing such measures, we can foster a more accountable and ethical environment, both in traditional markets and the emerging crypto landscape.

The intersection of regulation, ethics, and technology highlights the potential for crypto principles to influence broader systemic reforms, ultimately contributing to a fairer and more transparent society.