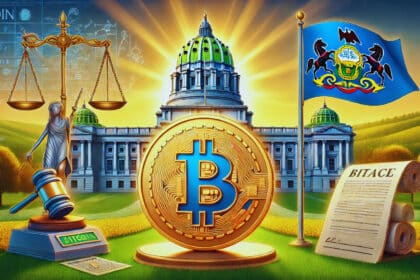

The US Spot Bitcoin ETFs reached a record high in August, with $252 million flowing in on Friday, according to The BIT Journal. Over seven consecutive days, these positive inflows have increased the total value of spot Bitcoin ETFs to $58.4 billion, the highest this month.

This inflow highlights the growing interest and confidence in Bitcoin ETFs. The consistent rise in value underscores the strong demand for spot Bitcoin ETFs, reflecting their increasing role in the market.

According to data from SoSoValue, Friday’s $252 million influx is the largest since July 22, breaking a 32-day record. BlackRock’s IBIT, the largest spot Bitcoin ETF by asset value, led the charge with an $87 million inflow, maintaining its dominance in the market. Fidelity’s FBTC followed closely, securing a $64 million inflow, further solidifying its position as a key player.

Despite this positive trend, not all ETFs experienced growth. Grayscale’s GBTC, the second-largest ETF by asset value, recorded a $35 million outflow, yet it managed to attract $50 million into its Bitcoin Mini Trust (BTC).

Spot Bitcoin ETFs Attract Diverse Investments

The latest surge in spot BTC ETFs has attracted investments from a wide range of funds. Bitwise’s BITB received $42 million, while Ark and 21Shares’ ARKB brought in $24 million. VanEck’s HODL ETF, known for its robust performance, saw a $14 million inflow. Among the smaller players, Invesco’s BTCO and Valkyrie’s BRRR reported inflows of $3 million and $2 million, respectively.

This influx of capital into spot Bitcoin ETFs reflects a broader trend of increased interest in Bitcoin as a secure and valuable asset. The market’s response to these ETFs demonstrates the growing confidence in Bitcoin’s long-term potential, especially as traditional financial institutions like BlackRock and Fidelity continue to lead the charge.

Spot Bitcoin ETFs Outperform Ether ETFs

While spot BTC ETFs have been on a winning streak, spot Ether ETFs have struggled to keep up. On Friday, another $5.7 million was withdrawn from Ether funds, bringing the total outflow since August 15th to nearly $99 million. Grayscale’s ETHE, in particular, experienced a significant outflow of $9.8 million, despite minor inflows into VanEck’s ETHV and Bitwise’s ETHW, which saw $2.0 million and $1.4 million in inflows, respectively.

The contrasting performance of spot Bitcoin ETFs and Ether ETFs underscores the shifting dynamics within the cryptocurrency market. Investors seem to be gravitating more towards Bitcoin, as it continues to assert its dominance over other digital assets.

Spot Bitcoin ETFs Continue to Surge

As the market continues to evolve, spot Bitcoin ETFs are clearly leading the way. The $252 million inflow on Friday not only marks the largest single-day inflow in over a month but also cements the position of spot Bitcoin ETFs as a dominant force in the cryptocurrency investment landscape. With a total value of $58.4 billion, these ETFs are proving to be a crucial vehicle for investors seeking exposure to Bitcoin.

The BIT Journal notes that the sustained interest in spot Bitcoin ETFs is a clear sign of Bitcoin’s enduring appeal. As these funds continue to attract significant capital, they are likely to play a major role in shaping the future of cryptocurrency investments.

Spot Bitcoin ETFs are showing remarkable resilience and growth, attracting substantial investments and reaching new heights. As more investors turn to these funds, the cryptocurrency market is poised for continued expansion and innovation. Stay tuned to The BIT Journal for more updates on this evolving story.