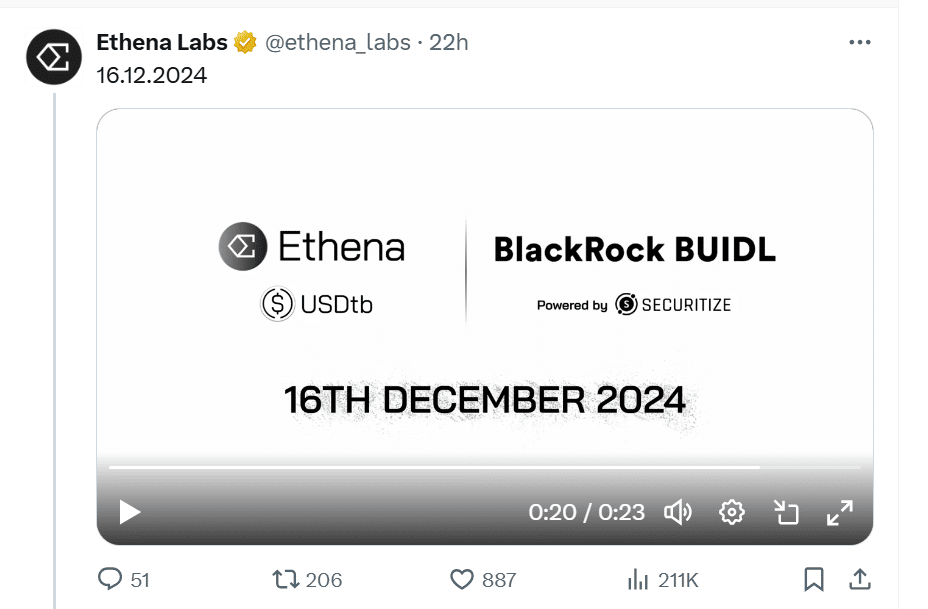

A New Era for Stablecoins: USDe’s innovative Launch Ethena Labs, a pioneer in decentralized finance (DeFi), has announced it will debut its synthetic USDe stablecoin on December 16th, 2024. The revelation, shared via a post on the former Twitter platform, has generated substantial interest across the cryptocurrency sphere.

With an immense market capitalization of $5.73 billion, USDe has surpassed DAI as the third-largest USD-pegged stablecoin. However, the enthusiasm prompts questions regarding its sustainability in a volatile marketplace.

Unlike conventional fiat-collateralized stablecoins such as Tether (USDT) or USD Coin (USDC), USDe has been engineered as a yield-generating instrument. This innovative approach promises annual percentage yields of up to 29%, rendering it a lucrative option for investors seeking stability and profit concurrently. Yet, sceptics caution that the model could experience significant difficulties during market downturns, evoking comparisons to the infamous collapse of Terra-Luna in 2022.

The Mechanics Behind USDe: A Double-Layered Yield Engine

USDe’s novel dual-layered framework leverages the rewards of Ethereum staking while shielding returns from short-term fluctuations, seeking to offer an engaging yield without forsaking stability. By balancing long positions in staked Ether with short positions on exchanges, this adaptive strategy aims to preserve consistent profitability.

“At Ethena Labs, we envision reimagining the concept of the stablecoin,” the company stated in their declaration. “USDe represents the next step in decentralized finance’s evolution—a solution for both casual and seasoned investors to optimize returns while retaining reliability.”

The initial reception was energetic, with CoinMarketCap reporting that trading activity had surged more than 24% over the past 24 hours to reach $171.09 million. These numbers underscore the growing appetite for profitable holdings amid an uncertain economic landscape.

Critics Sound the Alarm: Is USDe Too Good to Be True?

Despite soaring in value, USDe has attracted sharp rebukes from sector experts. Comparisons to Terra-Luna’s spectacular undoing are unavoidable. Terra’s algorithmic system broke down in bearish environments, unable to preserve its parity with the U.S. dollar. Naysayers fear USDe may face similar vulnerabilities.

Andre Cronje, Chief Technology Officer of Fantom Foundation, is among those promoting prudence. “USDe’s model thrives in bullish eras, but its resilience in bear markets is untested,” Cronje observed. He also underscored a possible weakness: narrowing profit margins as the crypto market becomes more sophisticated.

Ethena’s reliance on centralized exchanges for hedging introduces an extra layer of hazard. Should a centralized exchange confront insolvency or operational disruptions, USDe’s hedges could falter, exposing positions to unrealized gains and losses. These factors, critics contend, mirror the systemic flaws that led to Terra’s collapse.

A Record-Breaking Entry Amid Stablecoin Giants

USDe’s rapid ascendance showcases the pioneering spirit and lofty ambitions of Ethena Labs. With its $5.73 billion market cap, USDe now trails just USDT ($135 billion) and USDC ($40 billion) in the stablecoin hierarchy. This turning point signals a seismic shift in the decentralized finance landscape as investors increasingly look beyond traditional banking for alternatives.

Yet, even as USDe surpasses DAI, the road ahead remains treacherous. Analysts note that while USDe’s risk-neutral approach may offer ephemeral boons, maintaining long-term viability relies heavily on unpredictable market vagaries and operational safeguards being stringently upheld.

What’s Next for USDe and Ethena Labs?

The countdown to USDe’s impending launch continues, fueling both anticipation and scepticism in equal measure. Ethena Labs’ daring vision has unquestionably reshaped the discussion on stablecoins, providing a glimpse into the future of yield-bearing assets in decentralized finance.

However, lessons from Terra-Luna’s collapse loom heavily. As USDe takes centre stage, its functionality will be scrutinized not solely for returns but additionally for resilience against crypto’s volatile dynamics. If Ethena Labs addresses lingering issues surrounding sustainability and the risk of centralization, USDe could cement its role as a cornerstone of defi.

Much hangs in the balance, with the cryptosphere watching closely. Whether USDe heralds a new era for stablecoins or becomes another cautionary tale, its rollout marks a defining moment in the ongoing progression of decentralized finance. As Ethena Labs persists in innovating, its journey will undoubtedly offer valuable insights for the industry at large.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!