In recent weeks, a significant yet subtle trend has been catching the attention of seasoned crypto watchers: the declining dominance of Tether (USDT) in the broader cryptocurrency market. Tracked through the USDT Dominance index, this metric measures the share of USDT’s market cap relative to the total crypto market capitalization—a crucial signal of investor sentiment.

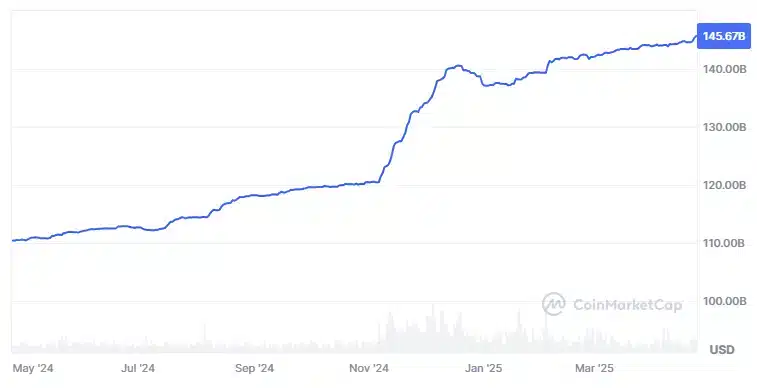

Despite Tether’s total market cap reaching an all-time high of $145.6 billion in April 2025, the shrinking dominance percentage tells a different story. Over $1.6 billion worth of USDT has been minted this month, yet its proportional power in the market is slipping. What does this mean? Liquidity is no longer sitting idle in stablecoins—it’s flowing into riskier assets like Bitcoin and altcoins.

Bitcoin’s Price Action Mirrors the USDT Dominance Trend

According to Max, founder of BecauseBitcoin, there’s a mirror-like relationship between USDT dominance and Bitcoin’s price movements. As he pointed out in a recent post on X (formerly Twitter), every significant dip in the USDT.D chart has coincided with a Bitcoin rally.

Currently, both the USDT Dominance and BTC/USD charts are breaking key support and resistance zones, suggesting a potential breakout. Historical data reinforces this pattern: declining USDT.D often precedes or accompanies Bitcoin price surges. Max speculates this could push Bitcoin toward the $100,000 milestone in the near term—a pivotal psychological and technical level.

Stablecoin Exodus Signals Altcoin Season?

It’s not just Tether under scrutiny. A similar trend is emerging with USD Coin (USDC). Crypto analyst Cryptosahintas has introduced a compelling metric: the combined dominance of USDT and USDC. This USDT.D + USDC.D index peaked at 8% in April but is now retracing. The analyst forecasts a potential fall to 3.5%, which could ignite the long-awaited altcoin season.

If capital continues shifting from stablecoins to smaller-cap assets, altcoins may see dramatic price increases in the second half of 2025. This transition reflects growing investor risk appetite and suggests confidence in broader market strength.

Sentiment Shift: From Fear to Greed

The evolving metrics are supported by a shift in market psychology. The Crypto Fear & Greed Index has climbed out of the “fear” zone into “greed” territory, a classic indicator that investors are warming up to more speculative bets.

At the same time, the total crypto market cap has surged by 6%, rising from $2.68 trillion to $2.84 trillion. This increase is a strong sign of renewed momentum and expanding participation across digital assets, reinforcing the bullish narrative.

Not Everyone Is Convinced: Caution from 10X Research

Despite bullish signals, some experts urge restraint. A recent report from 10X Research highlights a disconnect between the rising supply of stablecoins and their market dominance. While issuance is growing, dominance has yet to return to previous highs—indicating not all capital is entering the market with full conviction.

The firm emphasizes the need for increased trading volume and institutional involvement to sustain the rally. They caution that as Bitcoin approaches the $100K mark, volatility could spike, and only a solid foundation of liquidity and support will validate the next leg up.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References & Sources