According to the source, Utah’s lawmakers have successfully approved Bitcoin Bill HB230, the “Blockchain and Digital Innovation Amendments.” This decision assures the state’s further advancement in dealing with Bitcoin and other digital currencies. However, the approved bill seems to be different and altered from the earlier draft version.

However, before passing the bill, the lawmakers made sure to remove the important provision related to investment. This clause, if not removed, would have allowed Utah to become the first state of the US to hold Bitcoin as a source of its finances. This means Utah will now not be able to hold any Bitcoin reserves, which was a major part of the original proposal.

Important Elements of Bitcoin Bill

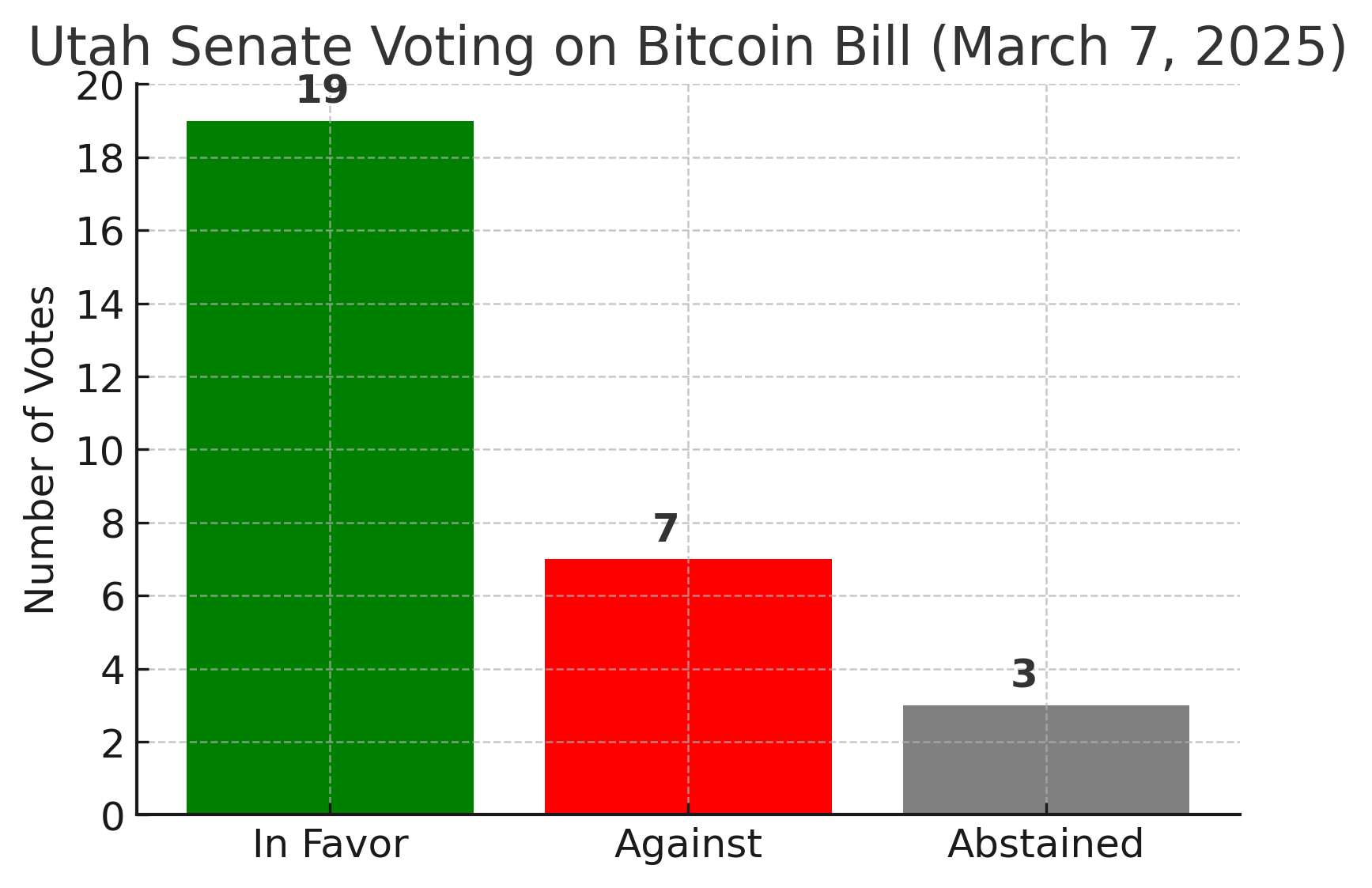

On March 7, 2025, the Utah Senate held a vote to pass the bill. According to the voting analysis, 19 votes were found in favor of the bill while 7 disagreed with it and 3 chose not to vote. Hence, the maximum number of lawmakers agreed to pass the bill which was then sent to Spencer Cox, the governor, to make the final call to decide whether to sign it into law or not.

The bill was made and passed to make the crypto regulation sound clearer to most enthusiasts. With this bill, residents will have the right to exchange crypto, mine bitcoin, or even run nodes. Moreover, the bill suggests that the state manage cryptocurrency exchange, which will help to strengthen Utah’s presence in the national and global Cryptocurrency market.

The Controversial Investment Clause

The Bitcoin bill of Utah has been approved, but there has been an important change that has allowed the state to invest in Bitcoin to be removed. There have been many arguments after removing this clause as the supporters argued that it might increase Utah’s finances and protection against inflation.

On the other hand, critics pointed out the issue of bitcoins’ explosive price. Before the change in the bill, Utah would have been able to invest up to 5% of state money in Bitcoin, but this clause has been removed. The Bitcoin bill will still help Utah residents to protect their right to mine Bitcoin, participate in staking as well as run nodes.

Senate Support and Bipartisan Backing

The Bitcoin Bills have been approved by the Republican and Democratic Senates. Curtis Bramble, an important Senator of the bill, pointed out that this bill will help to make crypto rules clearer for investors and businesses. The strong support reveals that there is increasing agreement among party lines on the importance of making the regulation clearer for digital currencies.

Now that the Bitcoin Bill has been approved by the Senate, it will be forwarded to the Utah House for more review and consideration. There will be some changes by lawmakers, but with the Senate approval, Utah will be moving forward to be an important center for the development of Blockchain and Cryptocurrency.

Conclusion

Utah’s Senate has given approval to Bitcoin Bill HB230 but made a decision to remove a clause that would have let the state invest in Bitcoin. The changes have been made due to concern over the risk of price changes. The bill will help people to protect their rights. The bill is now forwarded for review, and Utah might become an important center for crypto development.

Keep your eyes on the latest crypto new with Bit Journal

FAQ

1. What is Utah’s Bitcoin Bill HB230?

It is a bill approved by Utah’s Senate to regulate Bitcoin and digital currencies.

2. What was rejected from the Bitcoin bill?

An investment clause that would have allowed Utah to invest in Bitcoin was rejected.

3. How many Senate votes were in favor of the bill?

The 19 senate votes were in favor of the Bitcoin bill.

4. Where does the Bitcoin bill go after Senate approval?

The bill is further sent to Governor Spencer Cox for final approval.

5. Why did 7 lawmakers oppose the investment clause?

They were worried about Bitcoin’s volatile price and its risks to the state’s financial stability.

Glossary

Bitcoin Bill HB230: Utah’s Bitcoin regulation law.

Investment Clause: Provision to invest in Bitcoin.

Volatility: Price fluctuations, especially in Bitcoin.

Blockchain: Digital ledger for transactions.

Self-Custody: Controlling your own cryptocurrency.