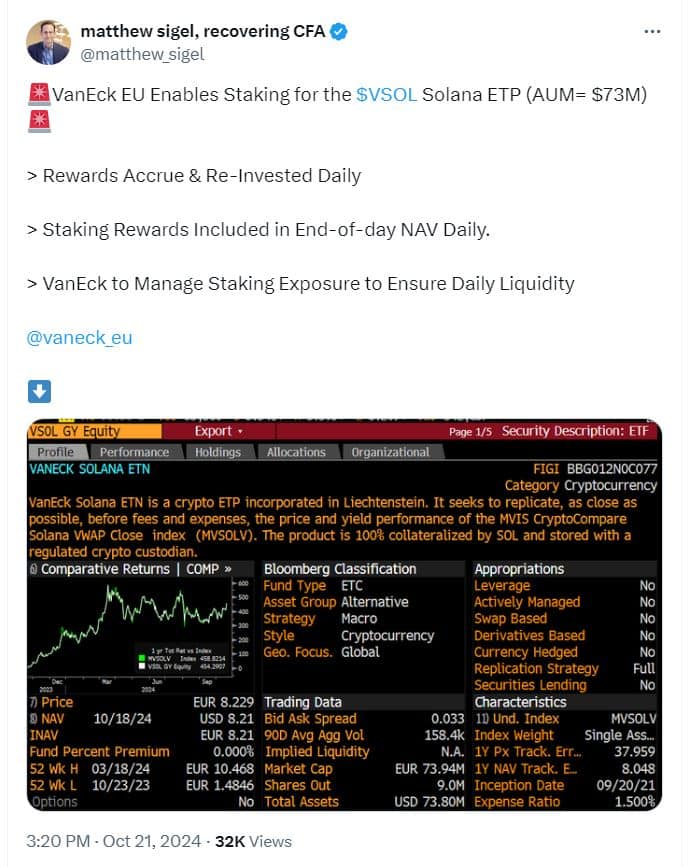

On October 21st, 2024, the prominent asset management firm VanEck took an innovative step by enabling staking capabilities for their Solana Exchange-Traded Note (ETN) available to investors in Europe. This marked a revolutionary move in the financial sector, providing European holders of Solana the novel ability to earn daily rewards from their stakes effortlessly. The newly added auto-staking function promises heightened financial benefits without the demand for active participation.

Through an entirely automated process, the earnings generate further value each day as they automatically augment the ETN’s net asset value. Complexities in sentence structure showcase the variation in technological and economic intricacies, as staking proliferation bridges investment opportunities with newfound passive profit potential.

VanEck: Simplifying Crypto Investment with Solana ETN

VanEck’s Solana ETN, launched in 2021, captured significant investor interest for its innovative approach to gaining exposure to one of the fastest-growing blockchain platforms. By integrating staking directly into the fund structure, VanEck has crafted a compelling proposition – offering participants the dual benefits of maintaining liquid exposure while passively generating additional yield. The asset manager diligently calculates staking rewards earned daily and credits back proportions to the fund’s net asset value, automating an otherwise technical process.

For those intrigued by Solana’s technological progress yet wary of engaging directly in proof-of-stake governance, the VanEck vehicle removes barriers to participation. Through its management of the underlying staking process, the fund assumes responsibility for delegating tokens to validators and collecting associated rewards on behalf of unit holders. With staking proceeds factored promptly into the net asset value, investors gain transparent exposure to the project’s advances without demanding specialized knowledge or persistent involvement in the network itself.

The Appeal of Staking for Investors

Key Features of VanEck’s Solana ETN

While simplicity and reliability attracted many investors to VanEck’s Solana ETN, allowing effortless purchase like any other stock, others voiced valid concerns regarding its opaqueness. Though fully collateralized with real Solana assets securely stored, daily updates to coin entitlement left some wondering precisely what performance their investment reflected. Moreover, the steep 25% staking fee deducted before distributing the remaining rewards shifted the focus to covering hidden costs rather than fully informing stakeholders.

As assets in regulated cold storage guaranteed backing for each euro invested, transparency remained an issue. While simplicity appealed to those wishing to avoid private keys and manage digital assets directly, others saw this as precluding vital oversight. The daily liquidity and operational infrastructure that fees maintain cannot come without tradeoffs to disclosure. As investments entwine traditional markets with emerging technologies, balancing protection, participation, and preparedness proves an ongoing challenge.

VanEck’s Role in Crypto and Blockchain Innovation

VanEck’s forward-thinking nature when it comes to digital assets has been evident for years. The company’s decision to weave staking into its Solana ETN stems from a wider philosophy to give traditional investors access to cryptocurrencies. By simplifying the process of staking and packaging it within an ETN, VanEck aims to construct a bridge linking conventional finance with the burgeoning realm of decentralized finance (DeFi).

In addition to its stake-oriented Solana ETN, VanEck has taken steps to promote other blockchain-tied products, such as ETFs for Bitcoin and Ethereum in America. Furthermore, it has submitted an application for a Solana ETF to the SEC. As regulatory clarity continues evolving at a promising pace, VanEck is positioning itself as a pioneer in providing innovative, compliant investment vehicles for blockchain assets that satisfy an assortment of investor risk profiles and preferences.

The Final Thoughts

The introduction of staking capabilities for VanEck’s Solana exchange-traded note marks a transformative development, paving the way for European investors to enjoy the rewards of blockchain validation. By establishing an easy, liquid, and secure mechanism for capitalizing on staking yields, VanEck has expanded the appeal of its Solana ETN in a manner that streamlines participation in decentralized technology for those seeking blockchain exposure without typical complexities. As digital asset markets continue burgeoning in size and significance, VanEck’s innovative spirit and ability to craft accessible investment vehicles will likely cement its reputation as a pioneering leader accommodating mainstream adoption of emerging technologies.

Stay tuned to TheBITJournal and keep an eye on updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!