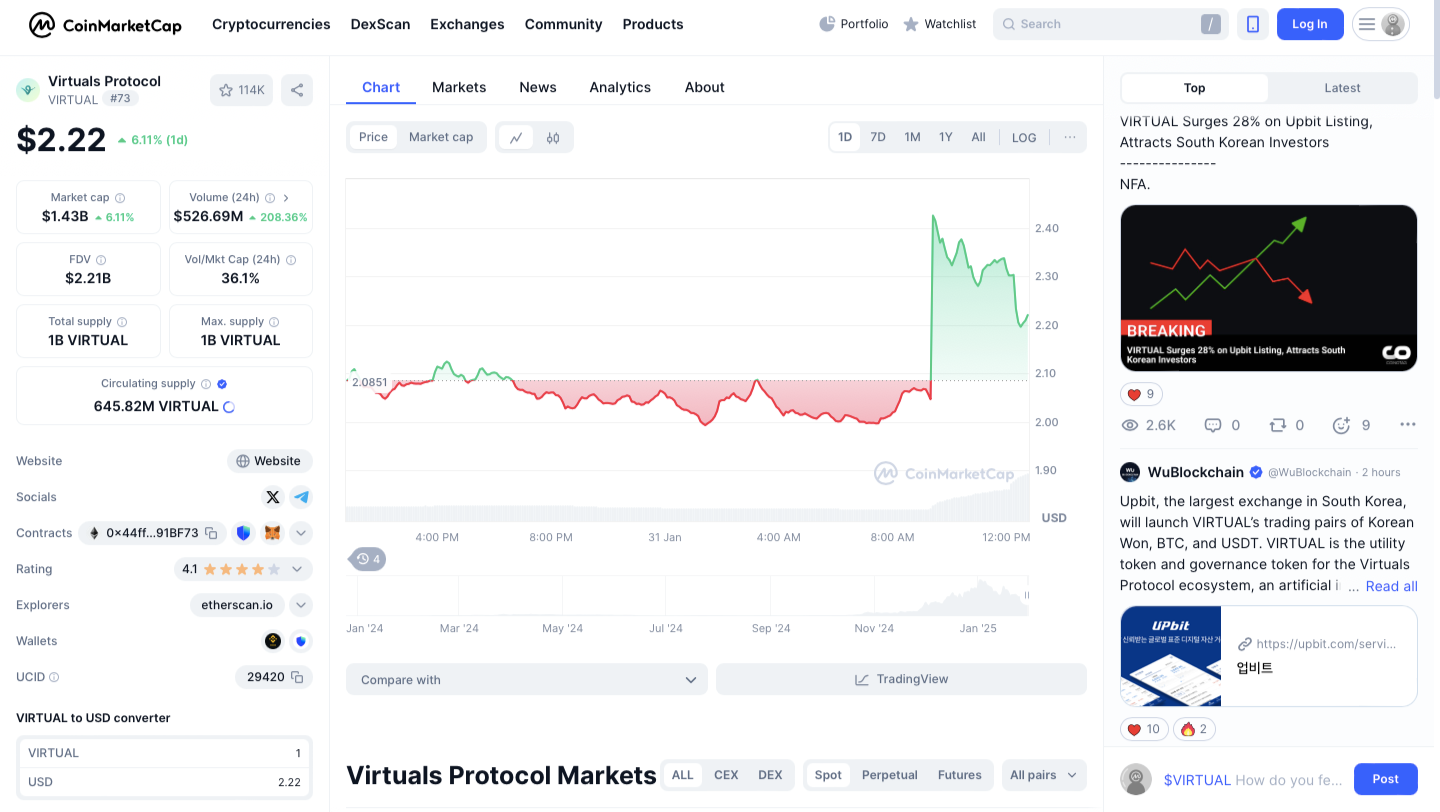

The VIRTUAL token increased by 28% to reach the value of $2.65 following its latest exposure to the biggest crypto exchange in South Korea, Upbit. The rally comes amidst growing exposure and interest in the token, representing the native coin of the AI-driven launchpad platform Virtuals Protocol. The listing on Upbit, a well-known exchange with a token-wise South Korean market, sees VIRTUAL greeted by an increased trading volume and a new wave of investors.

What are VIRTUAL and virtual Protocols?

VIRTUAL is the native token of Virtuals Protocol, a decentralized platform built to fuel the development of AI agents, creating an ecosystem that supports the growth of AI-based applications and tools.

It was built on the Base Ethereum Layer 2 network that is designed for speed and scalability, though it is expanding into the Solana blockchain. The Virtuals Protocol enables developers to tap into its infrastructure in creating AI-powered agents; the VIRTUAL token serves utility and governance within the ecosystem. This event of the listing of VIRTUAL tokens on the Upbit exchange has hence been a vital moment for the protocol, in which it came into the already rapidly growing crypto market in South Korea. This listing came with three trading pairs: VIRTUAL/KRW, VIRTUAL/USDT, and VIRTUAL/BTC– allowing access to the token not being too complicated for traders ranging from local to international levels.

Upbit Listing Sparks Major Price Movement

The token’s price jumped up by 28% in just moments from the relatively low $2.06 to $2.65 during the European trading session in light of the VIRTUAL token listing announcement. This hike practically brought the token up to its previous high of $5.25, reached on January 2, 2025, although it is still well below that peak.

For a few different reasons, the VIRTUAL token listing on Upbit will be important. South Korean exchanges like Upbit occupy a unique position in the broader cryptocurrency ecosystem. Their traders have often led the way in adopting alternative tokens and have proved price movers in both local and global markets. This kind of exposure promises to bring much-needed liquidity and volatility to VIRTUAL’s markets.

Listing the token against three of the most popular trading pairs-KRW, USDT, and BTC- also makes the token readily accessible to a wide variety of international traders. It is a key moment for Virtuals Protocol, which has attained great visibility since its expansion to Solana’s ecosystem. The focus on AI and fast-moving DeFi would make VIRTUAL a likely beneficiary of broader market adoption.

The Role of AI and Virtual Protocol in the Crypto Ecosystem

The virtual protocol is not just a usual crypto project; rather, it works on the very border of artificial intelligence technologies and blockchain development. During these fast times powered by AI, Virtuals Protocol is the bedrock for building decentralized AI agents. Such AI agents would be able to act independently on interactions with different systems or networks. On that point, it fully provides the underlying infrastructure needed to develop, train, and deploy the agent.

At the heart of this ecosystem is the VIRTUAL token. It is a governance token and also a utility token, thus allowing on-chain governance of the platform while providing the gas for transactions that happen on the platform. Demand for the VIRTUAL token will increase with increased adoption of the network, thus positioning it as a very lucrative investment for both retail and institutional investors.

Expansion into Solana and LayerZero Integration

Central to Virtuals Protocol’s scale-up strategy is an expansion to the high-speed Solana blockchain, acclaimed for its scalability and low transaction fees, enabled by LayerZero. This cross-chain interoperability protocol will enable seamless asset and data flow between chains.

The introduction of the Meteora Pools into Solana’s ecosystem is part of a strategic route for offering better trading liquidity and participation by VIRTUAL holders. This has been a very important move, considering that it places VIRTUAL among the newest cross-chain tokens that will manage to bridge the gap between the Ethereum and Solana economies. Apart from this, Virtuals Protocol has reportedly created the SOL reserve for which 1% of its trading fees would be converted into SOL tokens.

This gives Virtuals Protocol a wider exposure to multiple blockchain ecosystems and creates a very solid foundation for future growth and adoption. Integration with Solana will add even more scalability to the network while developers look to leverage blockchain technology for AI-powered applications.

Virtuals Protocol’s Tokenomics and Buyback Program

Another important development that drew attention to the VIRTUAL token was the buyback program of the platform. Virtuals Protocol announced its intention of buying back and burning ecosystem tokens using the almost 13 million VIRTUAL tokens accrued from post-bonding trading income. Token buybacks and burns are one of the usual strategies adopted by projects in order to reduce supply and increase scarcity, which could have a positive impact on token prices over time.

It, therefore, depicts a determination of Virtuals Protocol for value creation in long-term investor worth, but the major motive would also mean keeping tokenomics healthy and sustainable in the process. This would result in reducing the total supply of VIRTUAL tokens, thus hiking up demand, especially as new applications get built into the still-developing ecosystem.

Potential Risks and Regulatory Considerations

While the price action of the VIRTUAL token has been very promising, one should never forget the risks that come with speculative assets of this nature. Virtuals Protocol shares the same fate with many blockchain projects: regulatory uncertainty The governments and different regulatory bodies are still trying to understand how to classify and regulate both cryptocurrencies and blockchain technologies in general.

The most persistent risks include adverse regulatory treatment against Virtuals Protocol or its token, especially in major markets such as the U.S. or South Korea, which could substantially affect the price and adoption rate of the token. However, with increasing interest from global investors and the growing intersection of AI and blockchain, VIRTUAL has positioned itself as a potentially valuable asset in the evolving crypto ecosystem.

Conclusion: Can VIRTUAL Continue Its Surge?

A spike of 28% in the VIRTUAL token following its Upbit listing shows rising demand for blockchain-based solution of AI solutions. Thus, with this strategic scaling over Solana and LayerZero and a strong model of token economics, VIRTUAL is well-set for extended growth in the year 2025.

With further expansion in both the AI and DeFi spaces, the future for Virtuals Protocol and its native token, VIRTUAL, seems bright. This could usher in the integration of AI agents with blockchain for the next generation of decentralized applications, making VIRTUAL one of the most intriguing projects to pay attention to over the next several years.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What is VIRTUAL?

VIRTUAL is the native token of the Virtuals Protocol, which researches the creation of AI-powered agents in a decentralized environment. The token has broad usage in the governance and transactional utility of the platform.

2. Why did VIRTUAL jump 28%?

VIRTUAL jumped 28% right after Upbit, one of the major South Korean crypto exchanges, announced the listing of VIRTUAL for trading versus three pairs: VIRTUAL/KRW, VIRTUAL/USDT, and VIRTUAL/BTC.

3. What is Virtuals Protocol’s buyback program?

Virtuals Protocol announced the buyback program where it is going to re-buy and burn the ecosystem token by using 13 million VIRTUAL tokens that were gathered from post-bonding trading income. A reduction in supply might drive its value upwards.

4. How does expansion on Solana help Virtuals Protocol?

By expanding to Solana, Virtuals Protocol will be able to access a highly scalable, low-cost blockchain. This expansion, supported by LayerZero, enhances cross-chain interoperability and boosts liquidity for the VIRTUAL token.