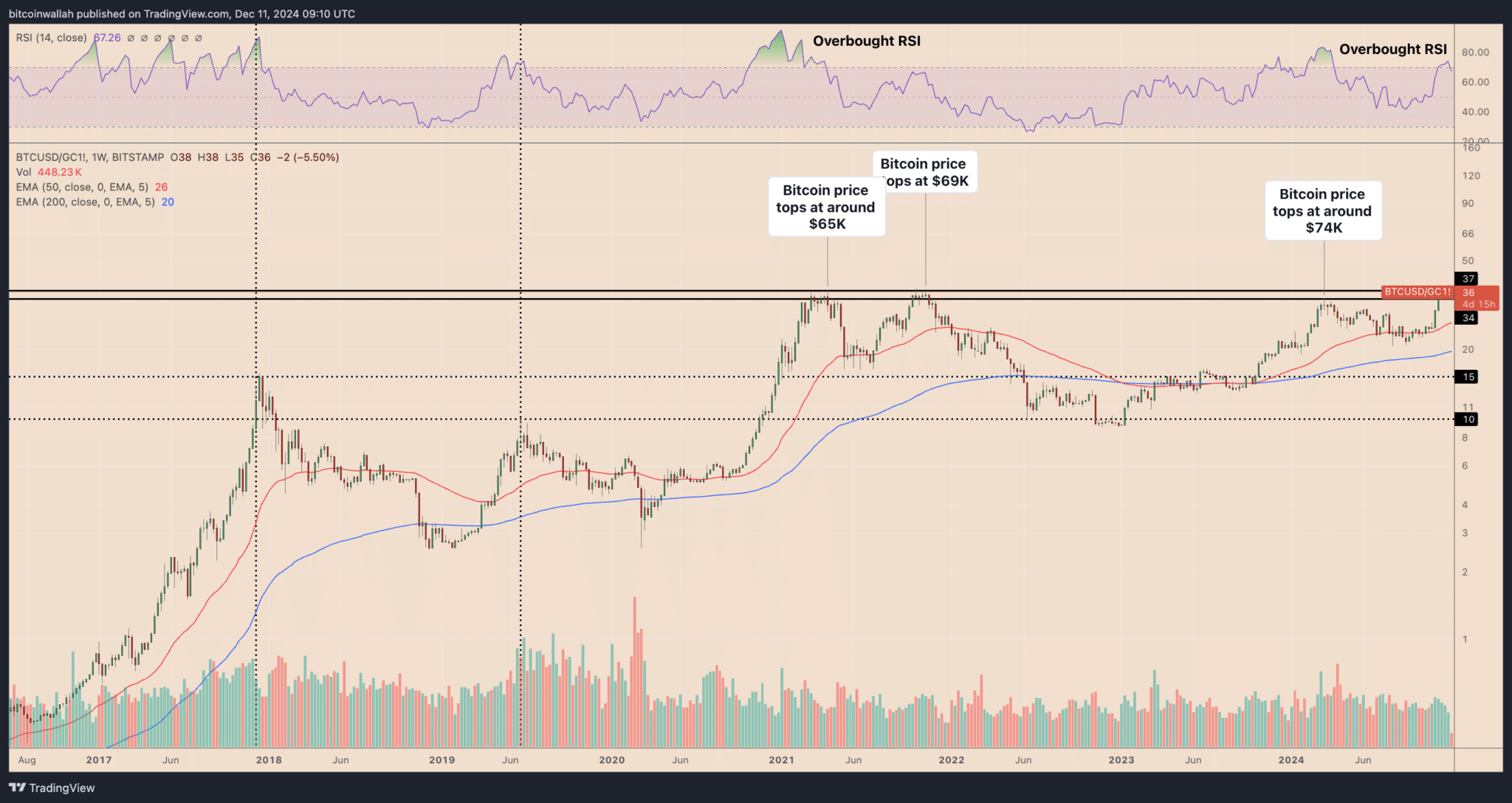

Bitcoin’s performance against gold is signaling a potential downturn, according to historical resistance levels observed during previous bear markets. A recurring fractal pattern indicates a sharp price correction may be imminent for the leading cryptocurrency.

Bitcoin-Gold Ratio Points to Possible 35% Correction

Bitcoin, which has risen 132% in 2024, recently saw a 47% boost following Donald Trump’s election win in November. However, veteran analyst Peter Brandt highlights that Bitcoin’s price may face a steep drop based on its performance relative to gold futures.

The Bitcoin-Gold ratio has reached a critical resistance zone between 34 and 37, historically associated with market peaks. This level coincides with the weekly RSI crossing above 70 into the overbought region, signaling potential overvaluation.

Historical Trends and Potential Implications

Historically, the Bitcoin-Gold ratio’s resistance levels have aligned with significant corrections in BTC/USD. For instance:

- In March 2024, Bitcoin peaked at $74,000 when the ratio hit the 34-37 zone, followed by a 33% price drop.

- During the 2021-2022 bear market, BTC/USD fell by up to 75%, starting after Bitcoin reached its all-time high of $69,000 in November 2021, which coincided with the ratio hitting the resistance zone.

- Similar patterns were observed during market peaks in December 2017 and June 2019, when Bitcoin’s RSI entered the overbought territory, leading to corrections of 85% and 72%, respectively.

Key Insights from the Fractal

This fractal reflects a common investor perception: Bitcoin is viewed as a speculative asset during bull markets, while gold serves as a safe haven in bear markets. When Bitcoin becomes overvalued relative to gold, investors tend to reduce their BTC positions, triggering significant price declines.

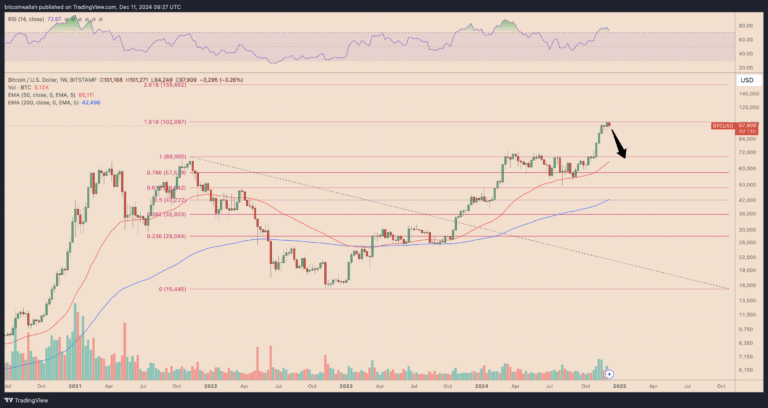

How Low Could Bitcoin Go?

Historically, Bitcoin’s corrections from local peaks have often tested the 50-week EMA. In the current scenario, this suggests a potential drop to the $65,000-$69,000 range, representing a 30-35% decline from current levels. This scenario could unfold by early 2025.

However, a breakout above $102,000—a key Fibonacci retracement level—could negate the bearish outlook and propel Bitcoin toward $150,000, aligning with bullish predictions.

Conclusion

While Bitcoin has shown strong performance in 2024, its rising valuation against gold raises caution. Investors should closely monitor the Bitcoin-Gold ratio and other technical indicators to assess potential risks. For the latest updates and expert insights, follow The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!