Senator Elizabeth Warren has raised concerns over Howard Lutnick, Donald Trump’s pick for Commerce Secretary, citing his financial links to Tether (USDT), a controversial stablecoin issuer. As the CEO of Cantor Fitzgerald, which holds a 5% stake in Tether (USDT), Lutnick’s deep-rooted involvement in the crypto industry has prompted Warren to question his ability to remain impartial in shaping economic policies.

In a Jan. 27 letter, Warren called Tether a “known facilitator of criminal activity”, branding it “outlaws’ favorite cryptocurrency” and questioning Lutnick’s long-standing ties to the company. Although Lutnick has pledged to divest from Cantor Fitzgerald if confirmed, Warren argues that his close personal connections to Tether (USDT) and its affiliates remain problematic. She warns that his financial interests could compromise his ability to act in the best interest of the American people, making him an unsuitable choice for the position.

Lutnick’s Influence on Crypto Policy Raises Questions

According to reports, If confirmed in his Jan. 29 hearing, Lutnick could gain direct access to President Trump and key regulators, positioning him to influence U.S. crypto policy, particularly regarding Tether (USDT) and the broader cryptocurrency industry, a concern Warren has strongly voiced.

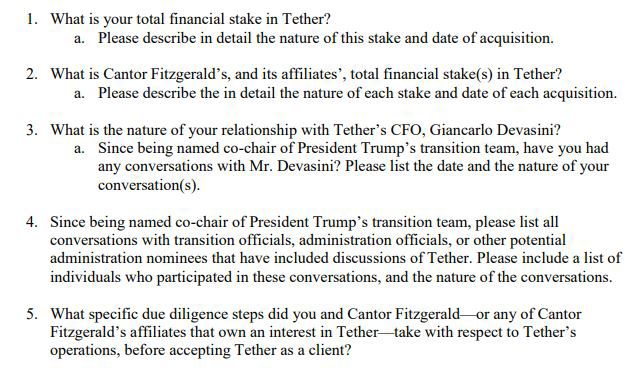

She has, however, demanded answers to 13 critical questions, including his current financial stake in Tether (USDT), any discussions with Trump administration officials about the company, and whether Cantor Fitzgerald conducted due diligence to ensure Tether’s compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations under the Bank Secrecy Act.

“While you have agreed to divest your interest in Cantor Fitzgerald, which holds a 5% stake in Tether, and serves as Tether’s asset manager, this divestment does not end the questions about your deep personal ties to the company or its affiliates,” wrote Warren, the top Democrat on the Senate Banking Committee.

Setting a Feb. 10 deadline for Lutnick’s response, Warren remains skeptical of his impartiality, though she won’t be directly involved in his confirmation hearing since she is not a member of the Senate Commerce, Science, and Transportation Committee.

Tether’s Role in Global Financial Crimes

Warren’s criticism of Tether stems from concerns that bad actors exploit its stablecoin, USDT, for illicit activities such as money laundering, sanctions evasion, and even financing North Korea’s nuclear program. Despite these allegations, Tether has also cooperated with global law enforcement agencies.

On Jan. 27, Tether reportedly worked alongside blockchain analytics firms Tron and TRM Labs to help Spanish authorities freeze $26.4 million in crypto linked to a European money-laundering operation. Similarly, in September 2023, Tether collaborated with the FBI to recover $6 million from scammers targeting U.S. citizens by freezing their wallets, based on available reports.

Warren’s Push for Stricter Crypto Regulations

A long-time crypto skeptic, Warren has repeatedly called for tougher regulations on the digital asset industry. She recently urged Trump’s Treasury Secretary nominee to crack down on crypto loopholes and push for stronger compliance measures.

In both 2022 and 2023, Warren introduced the Digital Asset Anti-Money Laundering Act, aimed at bringing the crypto sector under existing AML and Counter-Terrorism Financing (CTF) frameworks. However, the bill faced intense opposition from the Chamber of Digital Commerce and over 80 former U.S. military and national security officials, who argued that overregulation could drive crypto innovation overseas and weaken U.S. law enforcement capabilities.

Conclusion

Howard Lutnick’s nomination as Commerce Secretary has reignited the debate over crypto regulation in the U.S. With deep financial ties to Tether (USDT), his appointment could significantly shape the future of stablecoin policies and cryptocurrency oversight. Warren’s push for clarity highlights the growing political scrutiny over digital assets and their role in the global financial system. As Lutnick prepares for his confirmation hearing, all eyes are on his response to Warren’s demands—and whether his crypto connections will become a major roadblock to his appointment.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is Senator Warren questioning Howard Lutnick about Tether (USDT) ?

Warren is concerned about Lutnick’s financial ties to Tether, arguing that it could lead to conflicts of interest in shaping U.S. crypto regulations.

2. How is Tether linked to illicit activities?

Critics claim Tether (USDT) is used for money laundering, sanctions evasion, and funding criminal activities, including North Korea’s nuclear program.

3. Has Tether helped law enforcement before?

Yes. Tether worked with the FBI in 2023 to freeze funds from crypto scammers and recently helped Spanish authorities seize $26.4 million from a money-laundering operation.

4. What impact will Lutnick’s confirmation have on crypto regulations?

If confirmed, Lutnick could play a key role in shaping U.S. crypto policies, particularly regarding stablecoins and anti-money laundering regulations.