The crypto market has gained strong bullish momentum following Donald Trump’s recent election win. While Bitcoin races to new highs, the altcoin market is catching up with strong rallies. Leading the surge is Ethereum, which has set the pace for other coins. Its competitor, Cardano (ADA), has surged by 25% in just three days, breaking past the $0.43 barrier for the first time since July. This impressive rally is largely attributed to increased whale activity. Crypto analyst Abiodun Oladokun weighs in on ADA’s outlook.

Strong Demand for ADA

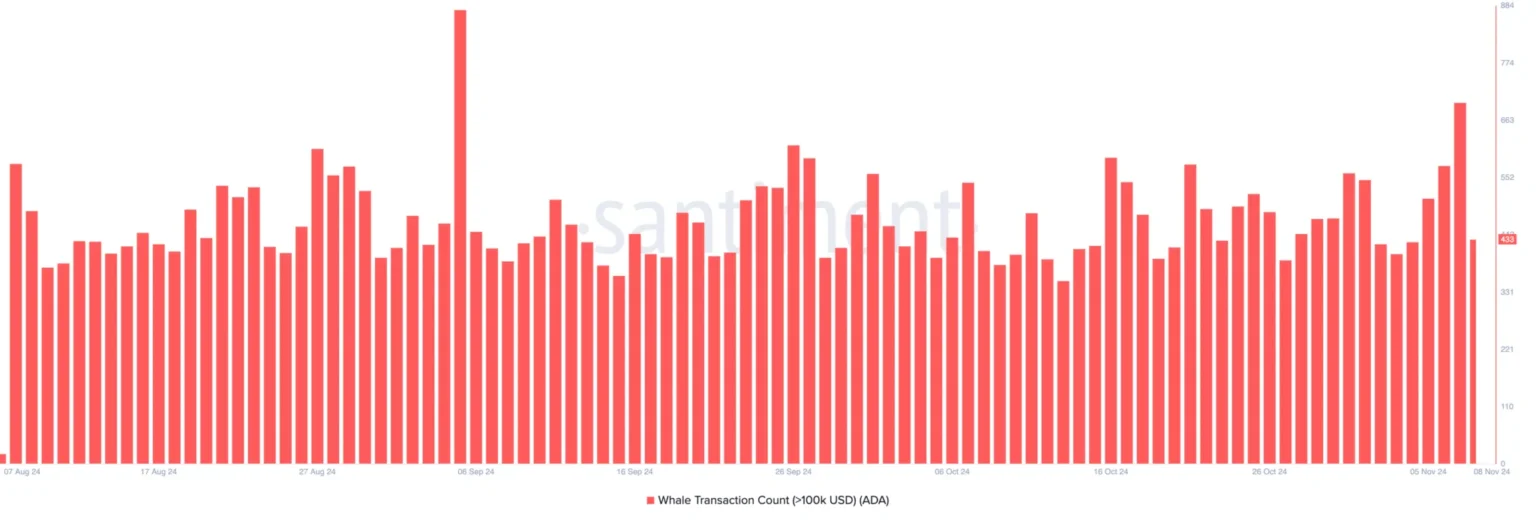

Data from Santiment reveals a recent spike in Cardano whale activity. According to the on-chain data provider, the number of transactions exceeding $100,000 has surged in recent days. On Thursday alone, 697 of these high-value transactions occurred, marking the highest single-day activity since September 5. This increase often signals heightened interest from key market players.

Large transactions suggest that major investors are gaining confidence in ADA’s potential, likely buying in anticipation of a price increase driven by broader market trends. When whales accumulate, it often triggers increased demand from other market participants. This trend aligns with a 139% weekly increase in ADA’s holding duration, which tracks the average length of time investors hold their tokens without selling or exchanging. The rising holding duration generally indicates a bullish outlook, with investors expressing confidence in ADA’s near-term growth potential.

ADA Price Forecast: Key Levels to Watch

Cardano is currently trading at $0.43, having successfully broken past the critical resistance level of $0.40—a level it had previously struggled to sustain under intense selling pressure. If the current bullish trend continues, the $0.40 level is expected to form a solid support base, potentially driving ADA to the $0.47 mark, a price last seen in June.

However, if ADA fails to hold the $0.40 support and a retest is unsuccessful, the price could drop to $0.31, which would invalidate short-term upside momentum.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

The market analysis shared here is both detailed and accurate