The impact of a recent $2.17 million whale dump of Mantra (OM) tokens is gaining significant attention. This substantial transaction, releasing 10.42 million OM into Binance, followed a large acquisition valued at $24.29 million from FalconX between December 2024 and April 2025. On‑chain data shows this sale crystallized an $8.34 million realized loss, hinting at a potential capitulation event tied to changing sentiment.

Analysis suggests that such a large-scale liquidation tends to fuel short‑term bearish momentum, reinforcing caution as market participants brace for possible volatility and resistance in the days ahead. Data reveals that an overwhelming 95.46% of token holders are currently underwater, with only 4.47% in profitable positions. This extreme imbalance weighs heavily on recovery hopes.

Further intensifying the bearish outlook, the 90‑day Futures Taker CVD demonstrates persistent sell‑side dominance, indicating that takers, aggressive market players, continue to offload on strength rather than buy the dip.

Market Sentiment: Whales vs. Retail in a Fragile Balance

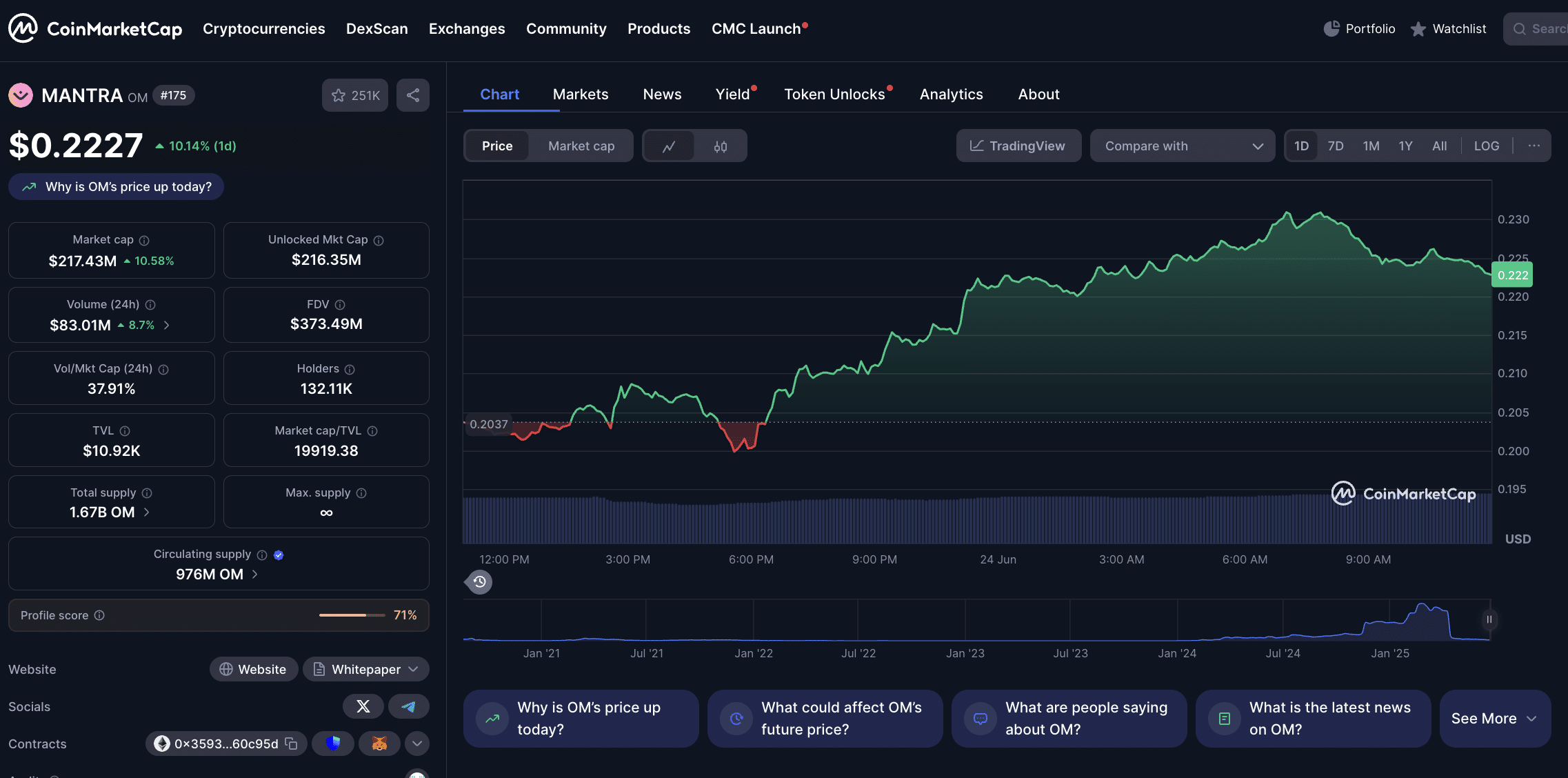

Currently trading at $0.222, OM analysis reveals a fragile tug-of‑war in sentiment. The whale dump versus visible oversold RSI signals highlight this tension. Large holders appear to have capitulated, while broader retail interest remains tepid. This dynamic could play out in choppy price action, characterized by sharp spikes followed by retracement. The core question remains whether fresh buying, possibly driven by improved conditions or policy moves, can re-balance market sentiment.

A key takeaway from this OM analysis is that price action alone may not suffice to draw in new backers. For the token to rebound, a compelling narrative, such as platform upgrades, partnerships, or ecosystem expansion, will be essential. Otherwise, the current technical condition and oversold sentiment may result in consolidation or even a prolonged sideways range.

Technical Indicators: RSI Oversold but Weak MACD Signal

The Relative Strength Index (RSI) sits at a deeply oversold level of 20.48, which typically signals a possible bounce. However, the Moving Average Convergence Divergence (MACD) crossover lacks follow‑through, dampening confidence. This technical divergence suggests that sentiment remains entrenched on the downside. Despite oversold conditions, Mantra (OM) analysis confirms that without meaningful increases in buying volume, momentum is likely to persist with downside bias rather than ignite a powerful rally.

Another contradiction noted is the divergence between rising address growth and falling engagement metrics. On‑chain figures indicate a 15.79% increase in new wallet creation over the past week, yet active daily addresses dropped by 4.89%. This pattern suggests speculative interest rather than sustained adoption.

Without honest growth in on‑chain interaction, Mantra (OM) analysis indicates that the token may struggle to build momentum, risking further stagnation.

Putting OM Analysis into Perspective

Looking at the Mantra (OM) analysis, it points to a short‑term outlook centered on caution rather than optimism. The whale dump was a significant red flag, the large unrealized holder losses suggest selling pressure may persist, and technical signals lack conviction. Even though an oversold RSI hints at potential rebounds, the weak MACD implies that these are likely to be shallow.

The divergence between new wallets and declining engagement further dampens expectations. Unless a powerful catalyst emerges, downside pressure will probably persist, and any upside will face heavy resistance.

Conclusion: Bearish Bias Prevails Until Catalyst Arrives

Wrapping up, Mantra (OM) analysis paints a complex picture of caution and fragility. With whales unloading into realized losses, retail sentiment sapped, and key on‑chain and technical signals signaling weakness, the short‑term outlook remains bearish. A sustained rebound appears unlikely without a structural shift or revitalizing catalyst. Until such trigger arrives, recovery attempts may flounder early, and traders should remain alert to volatility risk.

Summary

A recent whale dump of 10.42 million OM tokens worth $2.17 million has triggered renewed bearish sentiment around Mantra (OM), resulting in a realized loss of $8.34 million. On-chain data shows 95% of OM holders are underwater, reinforcing a weak recovery outlook.

Despite oversold RSI levels and a rise in new wallets, falling daily activity and persistent taker sell dominance indicate continued market pressure. The MACD lacks strong bullish momentum, and speculative interest appears shallow. Without a major narrative shift or market rebound, OM’s near-term price action remains bearish and vulnerable to further downside.

FAQ

What does the whale dump mean for OM’s price recovery?

The whale dump reflects a large holder taking realized losses, increasing short‑term bearish sentiment as OM analysis shows high potential for further selling.

Why is holder loss data important in OM analysis?

OM analysis uses unrealized loss data to assess selling pressure: when most holders are underwater, potential for profit-taking on rebounds increases.

Can technical indicators justify a bounce?

Though the RSI is oversold, the weak MACD signal suggests limited conviction. OM analysis emphasizes caution despite oversold conditions.

Is new wallet growth a positive sign?

Rising wallet creation looks promising, but OM analysis notes the simultaneous drop in active addresses suggests lack of meaningful on‑chain usage.

What could trigger a breakout from this downtrend?

According to our OM analysis, only a strong catalyst, like ecosystem upgrades or renewed investor interest, can overcome current bearish dominance and unlock recovery potential.

Glossary

Capitulation: The act of selling at a loss after holding through a decline, often seen as a surrender to downward pressure; usually occurs during market bottoms or trend reversals.

RSI (Relative Strength Index): A momentum oscillator used in technical analysis that ranges from 0 to 100. A reading below 30 typically indicates oversold conditions; above 70 suggests overbought territory.

MACD (Moving Average Convergence Divergence): A trend-following indicator used in technical analysis to detect changes in momentum by comparing two moving averages (usually 12-day and 26-day EMAs).

Taker Sell Dominance: Occurs when aggressive sellers dominate trading activity, placing market sell orders that drive prices down. Often signals prevailing bearish sentiment.

CVD (Cumulative Volume Delta): A technical metric in futures trading that tracks the difference between buying and selling volume over time. Positive CVD indicates buyer dominance; negative indicates seller strength.